July 31, 2025

This piece is sponsored by Prairie Family Business Association.

A 50-year career in banking leadership wraps up this week for Dave Johnson – but thanks to intentional planning, his family and his business are ready for it.

“In my opinion, managing succession – or not managing it – is the primary reason about 13,000 bank and savings and loan charters have declined during my career – from 17,618 to 4,462,” Johnson said.

“My advice is if you want your family-owned business to remain family-owned, start early, do the work and don’t minimize the contributions, feelings or opinions of your children.”

Five decades ago, Reliabank held $8 million in assets and had one location at Farmers State Bank in Estelline. It’s now a $750 million bank, with locations also in Watertown, Hayti, Hazel, Hartford, Humboldt, Colton, Sioux Falls and Tea.

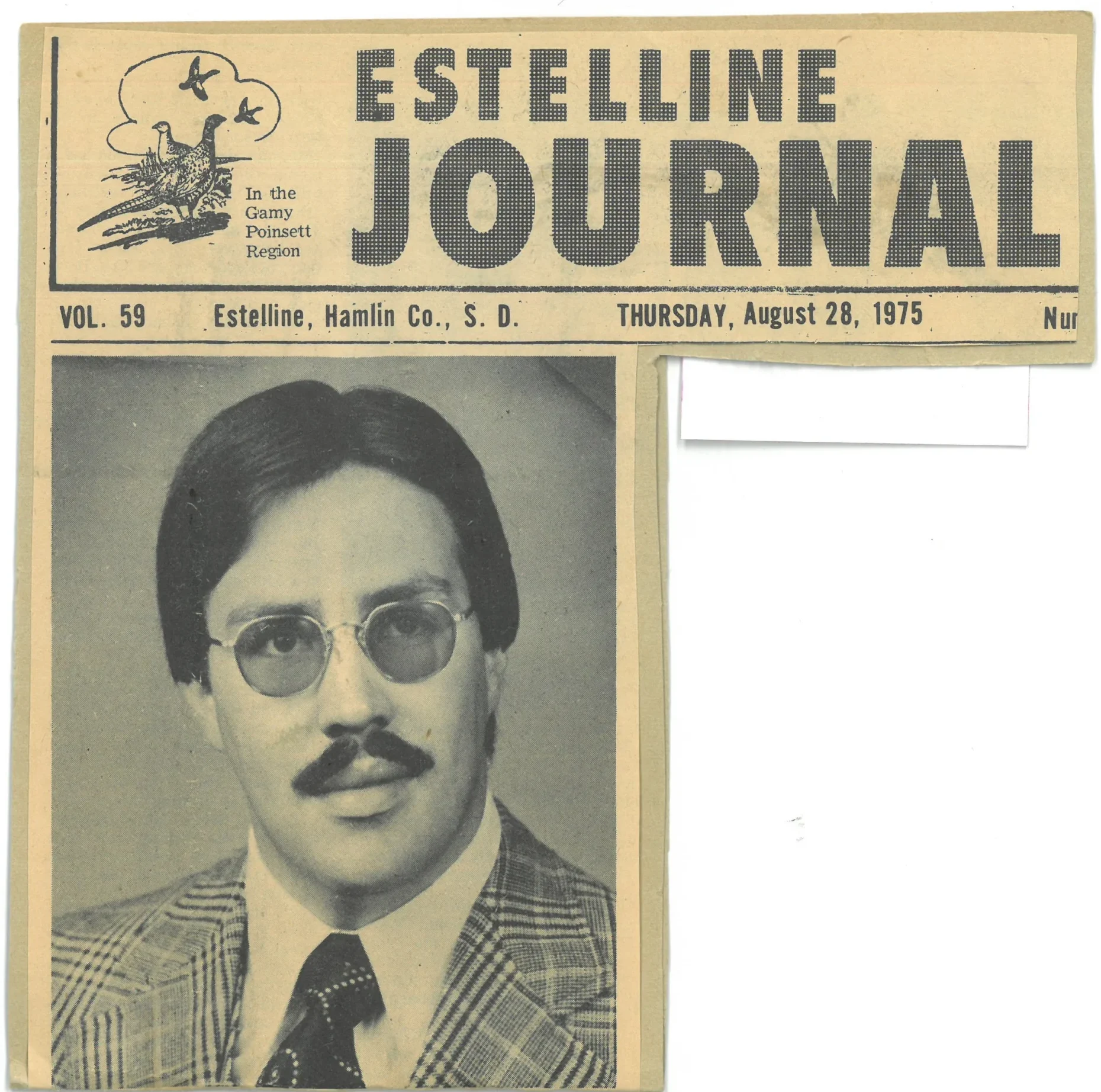

Johnson began at the bank in 1975 as executive vice president, working alongside his father, Walter K. Johnson, who had owned the bank since 1967 and managed it since 1944.

When Walter Johnson died unexpectedly eight months after his son joined the bank full time, Johnson became managing officer at age 23. The Gloria Johnson family retained ownership, and Howard Peters, a family friend, took on the role of absentee president and adviser to Johnson.

Walter Johnson, center, with sons Paul and Dave

In 1987, Johnson became president and board chair.

“Fifty years in banking really is remarkable, and it’s unique because Dave was in charge for 50 years,” said Johnson’s wife, Jan, who has served on the board since 1992. “Not many people start at the top when they’re 23 years old.”

But every career must wind down, and Johnson began planning for succession as far back as 2015 but became more serious after the bank’s centennial anniversary in 2020.

The Johnsons’ sons, Reid and Ethan, were part of those early conversations. Both hold leadership roles at the bank – Reid is chief culture officer and marketing director while Ethan serves as chief treasury officer.

Through the family’s relationship with Prairie Family Business Association, they connected with Volt Strategy and former owner Gayle Ver Hey, who helped advance the conversation about the future.

“When we first went to Prairie Family’s annual conference in 2015, they suggested having a facilitator, so we got linked up with Gayle, and she suggested quarterly family meetings,” Reid Johnson said.

It became a way for them to regularly touch base, including with their wives, Jessi and Tarah.

Succession planning for one generation is just the start, though.

First-of-its-kind family business meeting

After about a decade of regular family business meetings, the Johnsons realized something: The fourth generation “is getting pretty grown up,” Reid Johnson said.

“So we thought now might be a really good time for them to sit in on the first family meeting and get more of a history of the bank while Dave was transitioning out and learn more about responsibilities and roles and what it means to be an owner of the family business.”

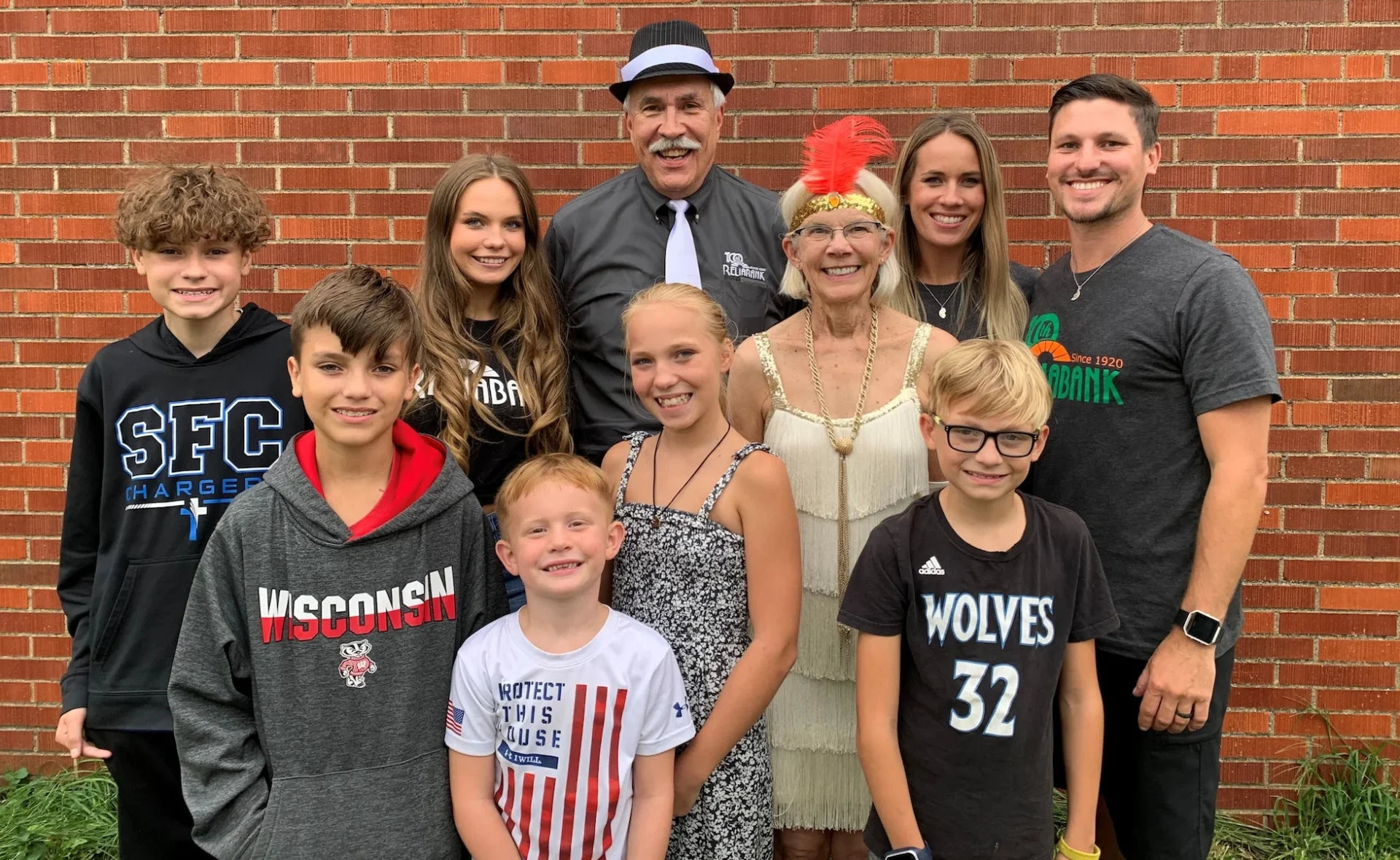

There are eight fourth-generation members, and those age 15 to 21 attended the family’s recent meeting facilitated by Rana DeBoer, who now owns VOLT Strategy.

“Facilitated family business meetings are so valuable,” Prairie Family Business executive director Stephanie Larscheid said. “I love how the Johnsons successfully used the concept for years and then expanded it to bring in their next generation.”

The oldest of the fourth generation, Alyza Aukes, began working at Reliabank in 2020 at age 16, helping out when the bank was short-staffed at the teller line.

“Then, I realized this is a lot to learn,” she said. “In my previous job, I was a hostess, so I got a little customer service, but banking is very different.”

What started as a summer job continued when Aukes went back to school, then moving from the teller line to experience other areas of the operation.

“In college, I helped with our risk department and marketing department, which is what I’m doing now,” she said.

She’ll graduate from the University of Sioux Falls in three years and is still determining her next move.

“Even though I might pursue another career path, I want to still have some role in the bank, whether that’s on the board or some other involvement with the bank,” Aukes said.

At the family business meeting, “I was very intrigued to learn what we were going to talk about,” she said. “It was different for me than my siblings because I’d worked here five years, but learning more about everything – the history and the sacrifices it took – really put it into perspective, and all the kids, even though they’re different ages, got something from it, and it was enjoyable.”

The second generation and third generation spoke, and then all families members who had worked in the business did a panel-style discussion and answered questions.

“We made sure the kids hear there’s no obligation to work here,” Reid Johnson said. “If banking isn’t your thing and you want to explore other things or other places, go for it.”

Reid and Ethan, however, have made the decision to be third-generation leaders, but neither wanted to be CEO.

“They both said they love ownership and didn’t want to sell the bank but had no desire to be CEO. They like what they’re doing, and they’re doing what speaks to their strengths,” Jan Johnson said.

CEO from outside the family

Josh Hogue, who had joined the bank as a vice president and business lender in 2012, was named president in 2019.

“Josh Hogue comes from a South Dakota banking family, has a thirst for banking knowledge, a family history of being in the business and leadership skills with employees and with trade associations,” Johnson said. “That combination convinced our family he was the right person to be CEO of Reliabank.”

For Hogue, it was important that his values and vision aligned with the Johnson family.

“And they align perfectly,” he said. “The core vision and mission is doing what is right for customers, employees and our communities. They also recognize that I have placed a lot of trust in them over the years and with the acceptance of this position. This balance of trust, benefit of doubt and belief that we are all working for the common good of our key stakeholders is what appealed to me most.”

In preparation for the transition, “Dave and Jan have invested in me with many educational opportunities throughout my 13 years at Reliabank,” Hogue said.

“In addition to formal education, they encouraged me to get involved with local nonprofits and state and national banking associations. Internally, I have been part of the annual strategic planning and multiple committees for Reliabank since my first day on the job.

“They provided me with challenging projects and checked in with support and guidance all along the way. They were always willing to listen to an idea and help me formulate a viable strategy to see the idea come to fruition.”

Hogue also attends the family meetings.

“Being a part of these meetings has been extremely valuable to leading the organization. They provide me with the road map to carry out their vision,” Hogue said.

“Gathering the family together provides a space for all opinions to come to light and helps us align our priorities for the betterment of Reliabank.”

Discussions are open and candid and typically conclude with everyone on board with a common direction, he said.

“It is imperative that I am able to listen to comments and concerns from all family members. It is also vital that the family is willing to listen to any concerns that I may have about strategy. Being a trusted guest at the family meeting is imperative for effective implementation of their strategy for the organization.”

But it didn’t happen by accident.

“Without Prairie Family Business, I know we would not be where we are today. Family businesses are hard, even when your family gets along well,” Jan Johnson said. “You just have different personalities and different ideas.”

Reliabank is a strong example of what connecting with the association’s resources can do, Larscheid said.

“The Johnson family has done so many things right,” she said. “It’s been rewarding to watch them intentionally plan and now execute their transition, and I know many family businesses are going to benefit from learning about their experience.”

A key moment for the Johnsons came at the Paul Nelson Farm, where they attended a Family Business Retreat through Prairie Family Business Association with Ver Hey facilitating.

“She really helped guide us and worked with Reid and Ethan to give them an opportunity to think about their path forward and what they wanted to do,” Jan Johnson said. “We finally came to the realization that we’re in a good spot.”

For Dave Johnson, the moment of truth started to crystalize a couple of years ago at a banking conference involving technology that he had attended for years.

“I realized that the questions I was asking were harder to come up with and quite a few of the answers to my questions I did not understand,” he said. “This was the first time in my career that I realized that I no longer had the energy to keep up with a fast-changing industry, and it was time for me to get out of the way.”

In January, Johnson officially transitioned out of his CEO role while continuing to serve as board chair. As of Aug. 1, that role will pass to Jan Johnson.

“Community bankers wear many hats, and for nearly my entire 50-year career, the board of directors’ chairman and CEO have been held by one person. I have also been the board secretary,” Johnson said. “Jan will become chairman of the board while Josh is president and CEO, so my job is now being delegated to three people, and we decided on a six-month transition into this change to get all three prepared.”

While there’s nothing magical about six months, “I wanted to work 50 years, and I started in August 1975,” Johnson said.

For Jan Johnson, “I hope I can be the transition as the board chair for the next generation,” she said. “I think it’s a good idea to have this time where we think about what does the board look like in five years, for example, so that’s why I decided to step in.”

The family uses an 11-person board with three family and eight nonfamily members.

Johnson “will still be involved with the family business,” his wife added, “and will see what’s in store for the next generation.”

Having the recent fourth-generation meeting “was a joy,” Johnson said.

“I am the youngest of five Johnson children, and both my grandfathers were deceased before I was born. I lost one grandmother at age 5 and the other at age 7. Two of my grandchildren have already worked as tellers in Sioux Falls, and in 2020, I got to coach one grandson’s basketball team.

“In short, I have had the opportunity to interact with our grandchildren and speak sincerely about community banking, which is something I was deprived of as a kid.”

Jan Johnson said she also “really enjoyed” the meeting,

“They were very interested in what Dave and I said, and what surprised me was the emotion. Dave and I figure we can cry at the drop of a hat, but we didn’t expect some of our grandkids to get teary-eyed. That was really special because it shows me every generation feels connected. Every generation feels pride in the business. And that’s really wonderful to see.”

You can request guidance like the Johnson family received through Prairie Family Business Association by emailing fba@usd.edu or calling 605-274-9530.