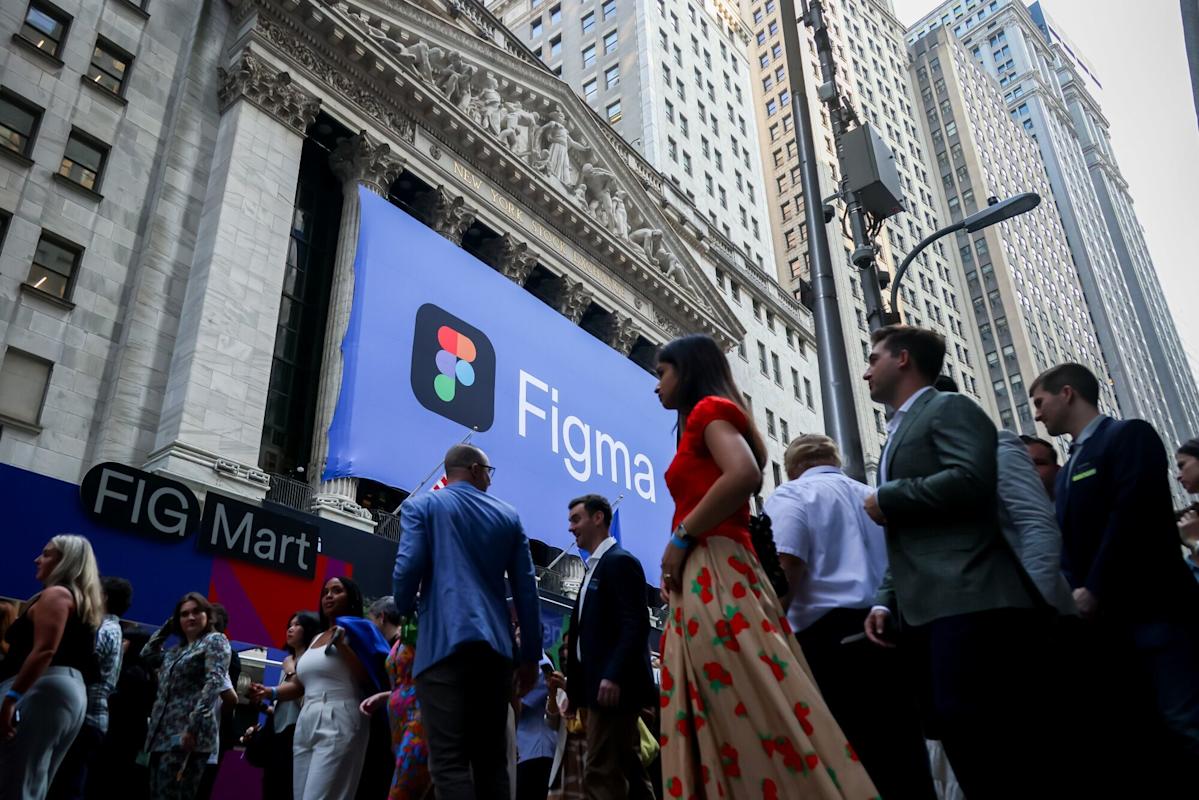

(Bloomberg) — Figma Inc. shares surged as much as 242% after the design software maker and some of its shareholders raised $1.2 billion in an IPO, with the trading valuing the company far above the $20 billion mark it would have reached in a now-scrapped merger with Adobe Inc.

Most Read from Bloomberg

Shares of the San Francisco-based firm traded at $112.77 each on Thursday as of 2:08 p.m. in New York, well in excess of an IPO price of $33 apiece, before they were halted a second time for volatility. The shares were marketed for $30 to $32 per share, after the company increased the range earlier in the week.

The company sold 12.47 million shares in the IPO, which priced Tuesday, while investors including Index Ventures, Greylock Partners and Kleiner Perkins sold 24.46 million shares.

The trading gives Figma a market value of nearly $55 billion, based on the outstanding shares listed in its filings. Accounting for employee stock options and restricted stock units, and restricted stock units for Chief Executive Officer Dylan Field, which are subject to vesting conditions, the fully diluted value is well above $65 billion.

The valuation easily trounces the $20 billion valuation Figma would have fetched in the agreed sale to Adobe that fell apart in 2023.

Field’s stake in the company is approaching $4.9 billion at the last price shares traded at before being halted. The soaring share price also puts into play the performance-based awards Field has, including a 10-year “moon-shot” compensation package awarded just last month that begins to vest once the 60-day average stock price tops $60. The highest hurdle requires shares to top $130.

The shares offered in Figma’s IPO were ultimately more than 40 times oversubscribed, with more than half of the orders receiving no stock, Bloomberg News reported. The robust demand points to a strong open for the first sizable software offering in the US since SailPoint Inc.’s debut in February.

Figma is used to design web and mobile application interfaces. It has expanded its suite of products in an attempt to be more useful for software development and general workplace collaboration.

Like many software firms, Figma charges clients based on the number of users and the kind of seat those users have. It added Dev Mode to the platform in 2023 to enable closer collaboration with developers, and has more recently incorporated AI technology into many of its own tools. This year it introduced Figma Make, an AI-based product that lets the user turn prompts into functional prototypes.