Tourmaline Oil signed a long-term LNG supply contract with German firm Uniper, linking its Canadian gas with European demand.

Calgary-based Tourmaline will supply 80,000 MMBtu/d, or approximately 80 MMcf/d, of Canadian gas into the U.S. Gulf Coast for an 8-year contract beginning November 2028.

The estimated lifetime total volume of the transaction is approximately 234 Bcf, according to a Tourmaline spokesperson.

Under an LNG netback supply agreement, Tourmaline will deliver Alberta and British Columbia (B.C.) gas to the ANR SE trading hub in southeast Louisiana. The contract terms are based on Dutch Title Transfer Facility (TTF) prices, which generally command a premium over North American benchmarks.

Tourmaline has secured long-term transportation to the Gulf Coast along TC Energy’s midstream system. Firm pipeline transport begins in November 2025, giving Tourmaline the flexibility to sell locally into Gulf Coast markets or pursue a shorter-term contract before the Uniper deal starts up.

“This long-term supply agreement with Uniper supports the continued execution of our market diversification strategy,” said Tourmaline President and CEO Mike Rose in a statement. “We’re proud to be supplying Canadian natural gas to meet rising demand in international markets and to enhance European energy security.”

Demand is expected to rise for Western Canadian gas to feed Asian and European LNG demand. Tourmaline anticipates natural gas prices to improve over the current strip in the back half of 2025 with the full startup of the new LNG Canada facility.

LNG Canada, located in Kitimat, B.C. on Canada’s West Coast, shipped its first cargo bound for South Korea this summer.

Shell owns a 40% stake in LNG Canada. Other partners in the joint venture (JV) are Malaysia’s Petronas (25%), PetroChina (15%), Mitsubishi (15%) and Korea Gas (5%).

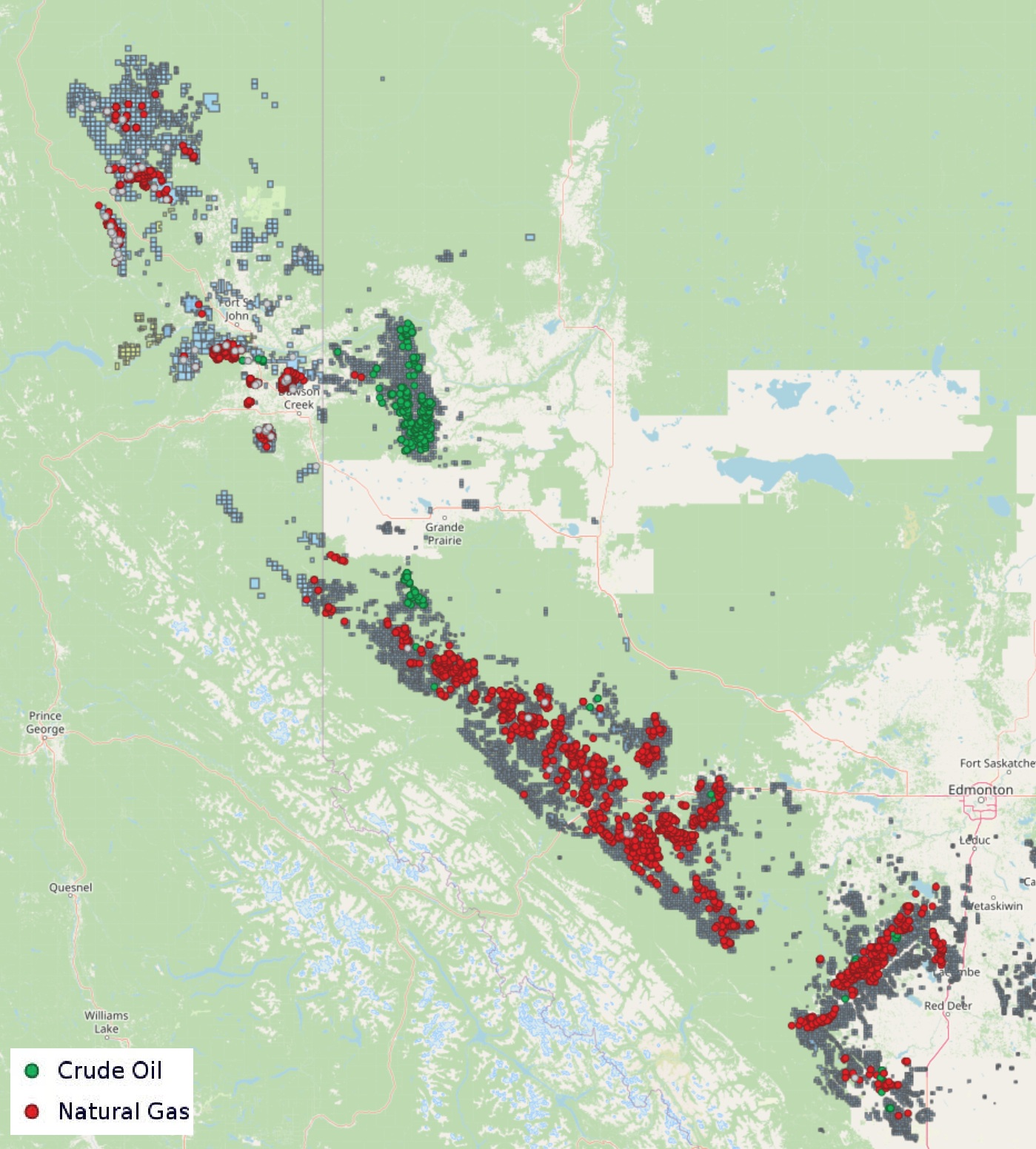

Canada’s West Coast is ideally suited for LNG production with deepwater ports and nearby gas supplies. (Source: Rextag)

Canada’s West Coast is ideally suited for LNG production with deepwater ports and nearby gas supplies. (Source: Rextag)

LNG Canada is expected to produce about 14 million tonnes per annum (mtpa) at full capacity.

The agreement with Tourmaline Oil comes a few months after Uniper signed a separate LNG sale and purchase agreement with Woodside Energy for up to 2 mtpa.

The Woodside transaction includes LNG supply commitments for 1 mtpa from Woodside’s Louisiana LNG export terminal, which is currently under development on the Gulf Coast. Up to 1 mtpa will be sourced from Woodside’s global LNG portfolio, delivered directly to Europe.

“[The Tourmaline deal] showcases our ability to offer important international pricing exposure to a valued North America supplier and further diversifies Uniper’s LNG supply sourcing portfolio, an important aspect of our European security of supply objectives,” said Uniper COO Carsten Poppinga.

Marketing diversification and smart hedging are also benefiting Tourmaline’s bottom line. The company realized an average gas price of CA$3.34/Mcf in the second quarter, 90% higher than the AECO 5A benchmark price of CA$1.72/Mcf over the same period.

RELATED

Canada Deep Dive: Spartan Sees 1,220 boe/d Duvernay IPs

Power in B.C., Alberta

Tourmaline Oil is one of the top liquids and gas producers in the B.C. Montney play and Alberta’s Deep Basin.

Tourmaline produced 620,757 boe/d during the second quarter, including 2.88 Bcf/d of gas and 141,138 bbl/d of crude, condensate and NGL.

Last year, Tourmaline added about 30,000 boe/d, including 130 MMcf/d of gas output, through a US$950 million (CA$1.3 billion) acquisition of Montney assets from Crew Energy.

Tourmaline plans to drill a total of 365 wells this year. The company’s full drilling fleet has been operating since the beginning of the third quarter after lower activity during the spring.

Tourmaline highlighted impressive well results from its Groundbirch–Sunrise Montney SQ2 development zone. A recent test well, 1-24-80-16W6, had an IP180 of 2.53 MMcf/d and 256 bbl/d of condensate and NGL.

Total EURs from the well are estimated at 3.1 Bcf of gas and 204 MMbbl of liquids. Tourmaline estimates 128 incremental Montney locations in the area.

Tourmaline is deferring some B.C. completion activities into the fourth quarter given lower local gas prices so far this quarter. The company also released one drilling rig in the Alberta Deep Basin for the rest of the year.

Active horizontal oil and gas wells on acreage operated by Tourmaline Oil (blue) and Crew Energy (yellow) in Alberta and British Columbia. (Source: Rextag)

Active horizontal oil and gas wells on acreage operated by Tourmaline Oil (blue) and Crew Energy (yellow) in Alberta and British Columbia. (Source: Rextag)

RELATED

Tourmaline’s $950MM Crew Energy M&A Drills Deeper In Montney