Natural gas prices (/NGU5) bounced back after trading below the 3 handle this morning following an extended downtrend that has dropped prices by over 15% since July 18.

Traders haven’t seen prices trade at these levels since November 2024, when natural gas saw an intraday drop below the 3 handle. The selling over the past week has frustrated bulls, but there is lasting enthusiasm with the commodity remaining above the psychological level.

Cooler-than-average temperatures in the back half of July have reduced power demand and allowed inventory levels to rise faster than their seasonal averages. That came alongside near-record high production, which added pressure to the commodity.

Traders appeared keen to take on longs during the brief dip below $3 MMBtu today, evidenced by enthusiastic discourse on X, or Twitter. Whether today’s move results in more gains or a failed breakout is yet to be seen, however.

Will bulls regain control in August?

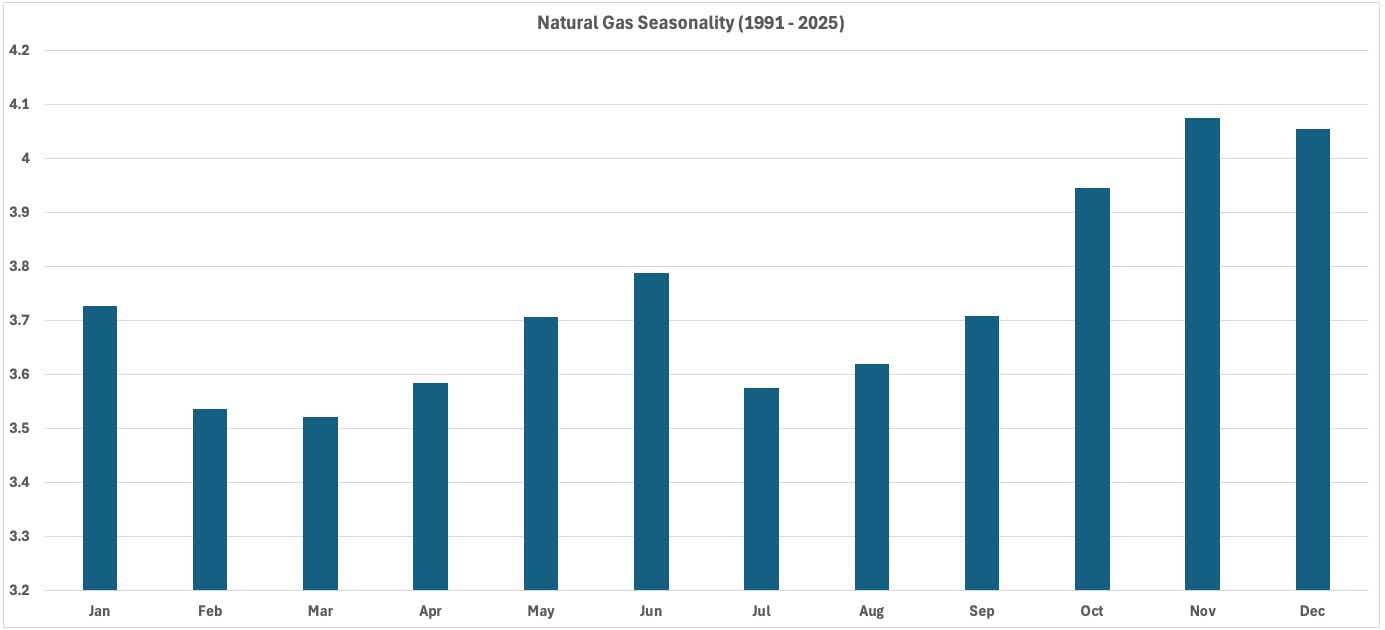

One notable factor for bulls to consider as we move into August is seasonality. Since 1991, the average price of natural gas in July was 3.58 and the average price of natural gas in August was 3.62. That said, since 1991, the average gain from July to August was 1.12%, and seasonality continues to strengthen from August to November. The chart below illustrates the seasonality dynamic.

Natural Gas Seasonality

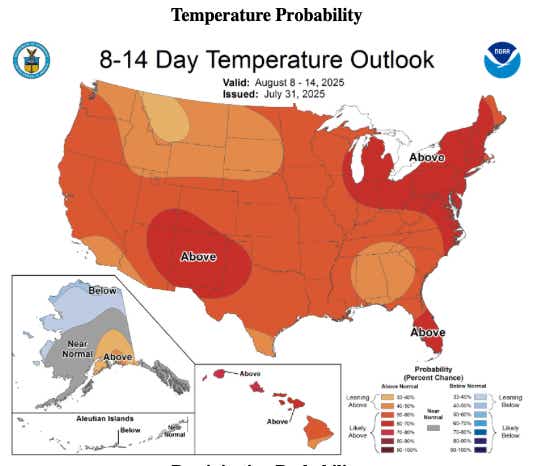

Natural Gas Seasonality While seasonality supports short-term strength, the commodity will require some weather support to help induce demand. One thing lacking in July was heat in the Eastern United States, particularly in the Northeast where a lot of energy demand is concentrated. So far, weather models show a good chance for above-average temperatures through the first half of August, not only in the Northeast but across much of the continental United States.

Natural Gas Futures

Natural Gas FuturesTrading natural gas

Natural gas is trading at its lowest level since April on a continuous contract basis. July prices were on track to record a loss of over 10% in the last day of trading for the month. The sell-off has injected some volatility into the product.

That said, traders looking to position long for August can take a risk-defined strategy of selling a put spread at or outside of the money, which would work out if prices stay above the 3 handle.

Another strategy would be to take a long position, which perhaps could be better achieved for retail traders by trading the micro-sized futures contract (/MNG), which is a tenth of the size of the standard contract at 1,000 MMBtu.

Temperature Probability

Temperature Probability Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.