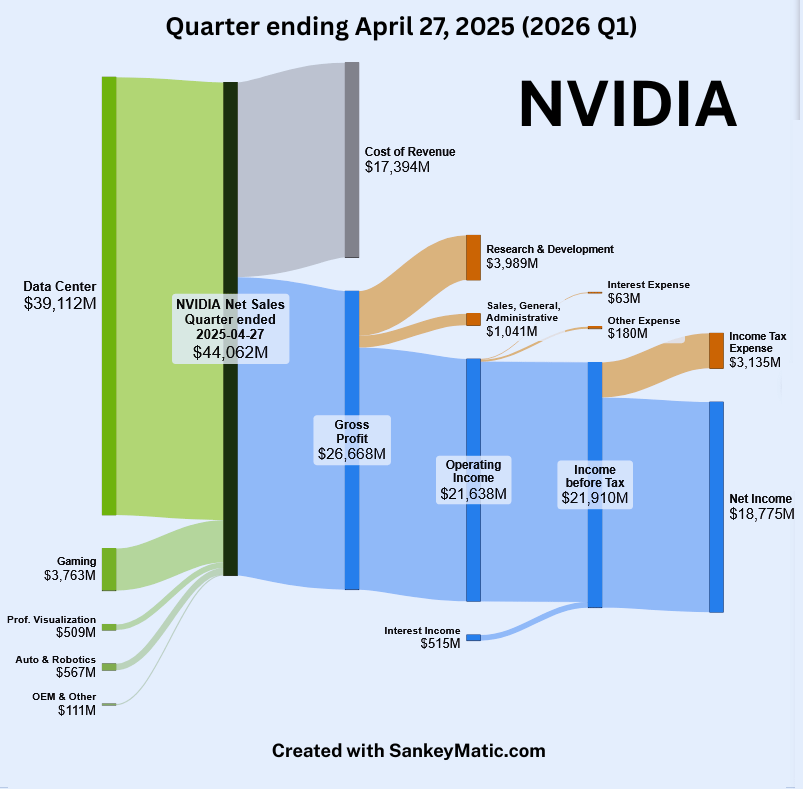

A Sankey diagram showing how NVIDIA’s Q1 2026 revenue of $44.06B (for the quarter ending April 27, 2025) was distributed across various cost centers and ended in a net income of $18.78B.

Source: NVIDIA Investor Relations

Created with SankeyMatic.com

Key Highlights:

Data Center segment: $39.1B of revenue (nearly 89%)

Gross Profit: $26.67B

Net Income: $18.78B (after R&D, SG&A, and tax)

Operating Margin: ~49%

Posted by Japanpa

9 comments

Data Center revenue ($39B) dwarfs everything else!

Surprised by how lean their operating costs are.

What stands out most to you?

I don’t think that this company will survive the burst of AI investment bubble and inevitable decrease in need for data centers with it. There is only so much demand because everyone tries to make it in AI right now, as soon as it matures and companies consolidate, they will suddenly drop and everyone will panic

Gaming…no wonder leather jacket man doesn’t care about us anymore 😭

So it turns out processing sand into chips is highly profitable.

What the lack of competition does to the consumer.

That is an obscene amount of profit. Considering their resources, there really is no excuse for the RTX5 series being such hot garbage.

Wish I could pay 15% tax on my income

So sad seeing gaming being such a small share, and that probably includes all the gaming cards that were bought for ai

Just how little they are putting into research and development as opposed to throwing money at their shareholders should be shocking, but is only depressing.

Comments are closed.