Occidental Petroleum operates in all three energy segments: upstream, midstream, and downstream.

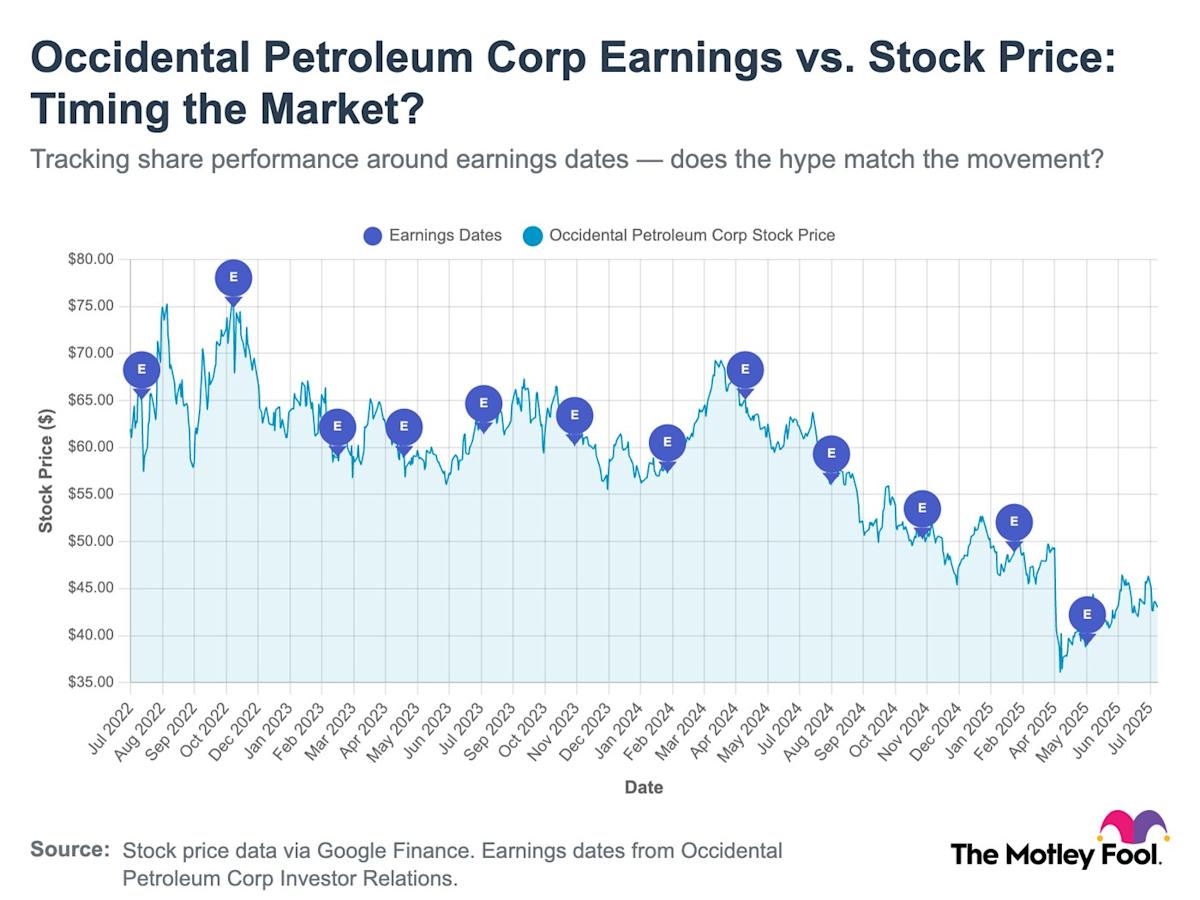

There is no direct correlation between an earnings beat or miss and Oxy’s immediate stock performance.

Rather, Oxy’s stock price movements seem to have followed a path similar to WTI crude oil prices.

10 stocks we like better than Occidental Petroleum ›

Occidental Petroleum (NYSE: OXY), also known as Oxy, is an energy company specializing in oil and natural gas exploration, production, and manufacturing. Operating in all three segments of the energy pipeline — upstream, midstream, and downstream — has made Oxy a fully integrated energy company.

On Aug. 6, Oxy will report its fiscal second-quarter earnings, marking a key date for a company whose stock has lost a quarter of its value over the past 12 months. For investors looking to buy the stock pre-earnings to take advantage of a potential post-earnings stock price jump, you might want to reconsider this thought process. I’ll show you why.

Oftentimes, having a mindset of “this good thing happened, so the stock should rise” or “this bad thing happened, so the stock should decline” can be counterproductive in stock investing. It might make logical sense, but unfortunately, the stock market doesn’t operate on that logic.

Image source: The Motley Fool.

There has been no correlation between Oxy beating, meeting, or missing its earnings-per-share (EPS) estimates and its next-day (or even week) stock price movements.

In its last eight quarters, Oxy has beaten or met EPS estimates seven times, yet the stock only increased the next day three times. This indicates that investors are giving weight to factors other than earnings.

Reported Quarter

Beat EPS Estimates?

Next-Day Stock Price Move

May 2025

Yes

Up

Feb. 2025

Yes

Down

Nov. 2024

Yes

Down

Aug. 2024

Yes

Up

May 2024

Yes

Up

Feb. 2024

Met

Down

Nov. 2023

Yes

Down

Aug. 2023

No

Down

Source: AlphaQuery and YCharts.

Earnings aside, one of the most important factors affecting Oxy’s business (and how investors perceive it) is the West Texas Intermediate (WTI) crude oil prices. Simply put, the higher the WTI is, the more Oxy earns per barrel of oil because it sells most of its oil at a price tied to the WTI.

WTI Crude Oil Spot Price data by YCharts

Oxy’s stock price and WTI prices follow a similar path, but you also don’t want to buy the stock assuming you can anticipate how WTI prices will move, either. Ideally, you would acknowledge the correlation between the two, yet approach Oxy’s stock with a long-term mindset.

Story Continues