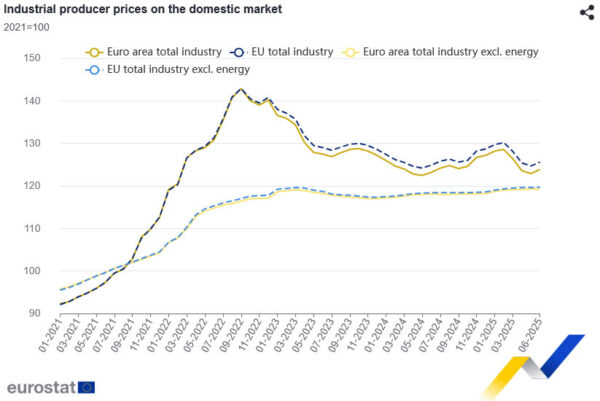

In the Eurozone, PPI rose 0.8% mom and 0.6% yoy in June, slightly missing monthly expectations but beating on the annual rate. Energy prices surged 3.2% on the month, offsetting modest gains elsewhere. Intermediate goods prices slipped -0.2%, reflecting some ongoing input cost disinflation in the manufacturing sector.

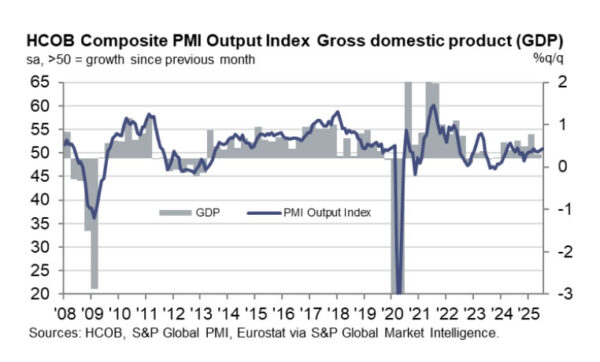

More encouragingly, Eurozone PMI Services was finalized at 51.0 in July, up from June’s 50.5. Composite PMI rose to 50.9 from 50.6. Germany and Italy showed gains, while Spain led the bloc at a five-month high of 54.7. France, however, slipped to a three-month low of 48.6. HCOB noted that services inflation is easing, with input costs growing at the slowest pace in nine months. That, alongside decelerating wage growth, strengthens the case for one more ECB rate cut in the second half of the year.

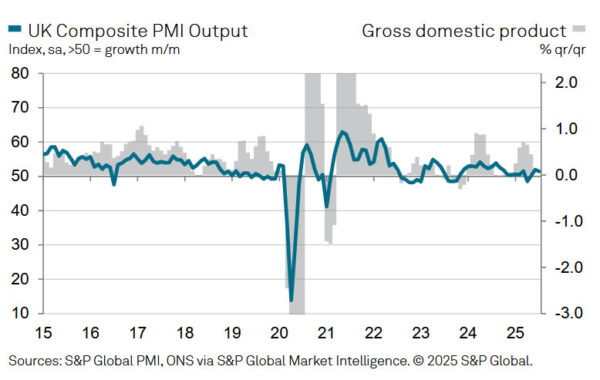

In the UK, the tone was more cautious. July’s PMI Services was finalized at 51.8, down from June’s 52.8, while Composite PMI eased to 51.5 from 52.0. Despite softer prints, S&P Global noted that business confidence improved, supported by receding US tariff concerns and hopes for domestic rate cuts later this year.