Lawmakers in Madison introduced legislation aimed at trying to stop scams using cryptocurrency ATMs. Scams using the ATMs are on the rise, increasing 99% from 2023 to 2024 nationwide, victims lost $246.7 million, according to FBI numbers.12 News Investigates spoke to two women who lost thousands, sending the money away in cryptocurrency using a crypto ATM. One woman, who recently moved out of state, fell victim to the scam, losing $14,900. She received a call that sounded legitimate, urging her to pay money in Bitcoin or face arrest for allegedly missing jury duty. The person on the other end of the phone claimed to be a sheriff’s deputy.”It was just the fear, number one, it was perfect vulnerability,” she said. “I did actually legitimately get a Milwaukee County jury summons late last year. I thought I missed something.”The other woman received a text message from someone claiming to be with PayPal reporting that she purchased an iPhone. So, she called the number, the person claimed to be a detective and said she needed to convert cash to cryptocurrency to prevent fraud. She sent away $6,000.”It’s a lot of money to me,” she said. “It was out of our savings account, checking account, you know that we use to pay bills.”The common thread in both scams: a bitcoin or cryptocurrency ATM. The ATMs are typically in gas stations and liquor stores and allow a user to easily convert cash to crypto. The digital form of money is not regulated. State Rep. Ryan Spaude (D-Ashwaubenon), state Sen. Kelda Roys (D-Madison)introduced legislation to stop fraud, a host of other lawmakers cosponsored the bill.”Right now, these unregulated crypto kiosks are being used for criminal activity and scams,” said Roys. “That’s not right. People do not deserve to lose their hard-earned money through fraud.”The legislation will require the ATM operator to issue a refund if the customer is scammed. The customer must report the transaction to law enforcement and the crypto ATM operator within 30 days. Plus, the bill will require operators to know their customers, giving authorities names and contact info in the event of a scam.”We’re going to have more information, more documentation for law enforcement to go out there and prosecute the actual criminal who’s behind the scheme,” said Spaude. Plus, the legislation limits the fees operators can charge to $5 or 3%, whichever is higher. It will also require on-screen and printed signs warning of scams, create a $1,000 limit per person per day, and require operators to be licensed.Wisconsin is already stepping in to combat scams involving bitcoin ATMs by implementing new regulations to protect consumers. The bill will increase the restrictions.The bill, Assembly Bill 384, was referred to the committee on financial institutions. Representative Cindi Duchow (R-Delafield) is the chair of that committee. Duchow’s office says it recently received the legislation and is in the process of reviewing it.

Lawmakers in Madison introduced legislation aimed at trying to stop scams using cryptocurrency ATMs. Scams using the ATMs are on the rise, increasing 99% from 2023 to 2024 nationwide, victims lost $246.7 million, according to FBI numbers.

12 News Investigates spoke to two women who lost thousands, sending the money away in cryptocurrency using a crypto ATM.

One woman, who recently moved out of state, fell victim to the scam, losing $14,900. She received a call that sounded legitimate, urging her to pay money in Bitcoin or face arrest for allegedly missing jury duty. The person on the other end of the phone claimed to be a sheriff’s deputy.

“It was just the fear, number one, it was perfect vulnerability,” she said. “I did actually legitimately get a Milwaukee County jury summons late last year. I thought I missed something.”

The other woman received a text message from someone claiming to be with PayPal reporting that she purchased an iPhone. So, she called the number, the person claimed to be a detective and said she needed to convert cash to cryptocurrency to prevent fraud. She sent away $6,000.

“It’s a lot of money to me,” she said. “It was out of our savings account, checking account, you know that we use to pay bills.”

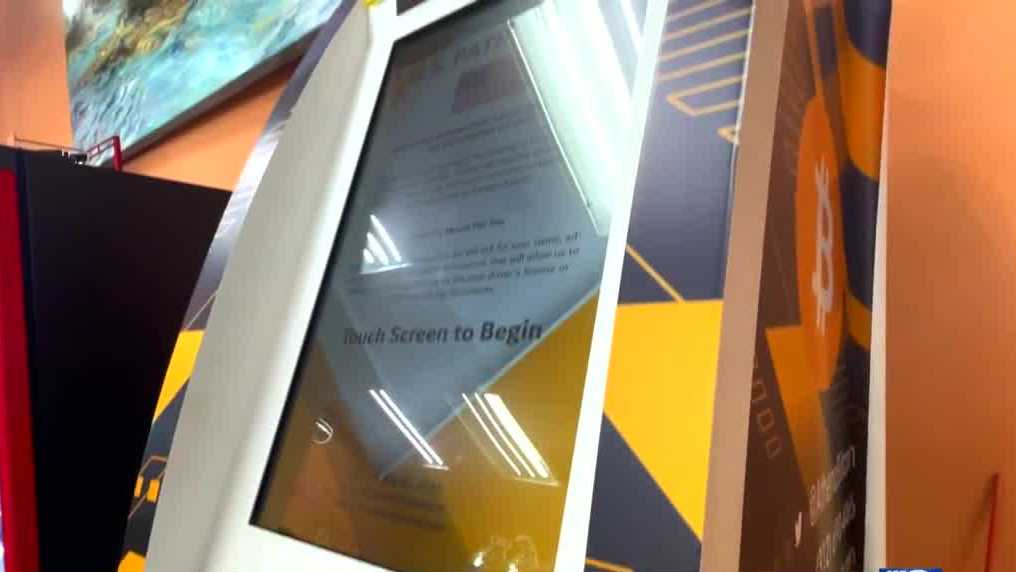

The common thread in both scams: a bitcoin or cryptocurrency ATM. The ATMs are typically in gas stations and liquor stores and allow a user to easily convert cash to crypto. The digital form of money is not regulated.

State Rep. Ryan Spaude (D-Ashwaubenon), state Sen. Kelda Roys (D-Madison)introduced legislation to stop fraud, a host of other lawmakers cosponsored the bill.

“Right now, these unregulated crypto kiosks are being used for criminal activity and scams,” said Roys. “That’s not right. People do not deserve to lose their hard-earned money through fraud.”

The legislation will require the ATM operator to issue a refund if the customer is scammed. The customer must report the transaction to law enforcement and the crypto ATM operator within 30 days. Plus, the bill will require operators to know their customers, giving authorities names and contact info in the event of a scam.

“We’re going to have more information, more documentation for law enforcement to go out there and prosecute the actual criminal who’s behind the scheme,” said Spaude.

Plus, the legislation limits the fees operators can charge to $5 or 3%, whichever is higher. It will also require on-screen and printed signs warning of scams, create a $1,000 limit per person per day, and require operators to be licensed.

Wisconsin is already stepping in to combat scams involving bitcoin ATMs by implementing new regulations to protect consumers. The bill will increase the restrictions.

The bill, Assembly Bill 384, was referred to the committee on financial institutions. Representative Cindi Duchow (R-Delafield) is the chair of that committee. Duchow’s office says it recently received the legislation and is in the process of reviewing it.