Germany is in the middle of a sweeping transformation of its invoicing and VAT compliance system. Over the next three years, the country will not only merge its two federal e-invoicing platforms into a single portal, but also roll out a phased B2B e-invoicing mandate that will require all businesses to issue and receive structured electronic invoices by 2028. These changes are designed to modernize digital finance processes, reduce VAT fraud, and simplify compliance for both suppliers and the government.

Consolidating Federal E-Invoicing Platforms

Since 2018, the German federal administration has operated two separate e-invoicing portals. The ZRE platform has served the central federal administration, while the OZG-RE portal has been used by subordinate federal bodies and several federal states (Länder). This dual-system approach created unnecessary complexity. Suppliers were often uncertain which portal to use, while the government had to maintain two sets of infrastructure.

In November 2024, the Federal Ministry of Finance (BMF) and the Federal Ministry of the Interior (BMI) announced a long-awaited consolidation plan. Moving forward, OZG-RE will serve as the single federal portal for receiving e-invoices from suppliers. The migration will unfold in stages throughout 2025:

On 23 May 2025, the Bundeswehr Purchasing Office became the first agency to switch from ZRE to OZG-RE.

By 20 June 2025, a first wave of additional federal authorities will migrate.

By 31 December 2025, ZRE will be decommissioned, and all federal e-invoices must be sent through OZG-RE.

The practical implications for suppliers vary. Companies that submit invoices through the Peppol network will be automatically rerouted to the correct endpoint, requiring no manual intervention. However, suppliers using the ZRE web portal will need to register on OZG-RE in 2025 to maintain compliance once ZRE is shut down. This consolidation will eliminate redundant infrastructure, simplify the user experience, and make federal invoicing processes more efficient.

Phased Rollout of Mandatory B2B E-Invoicing

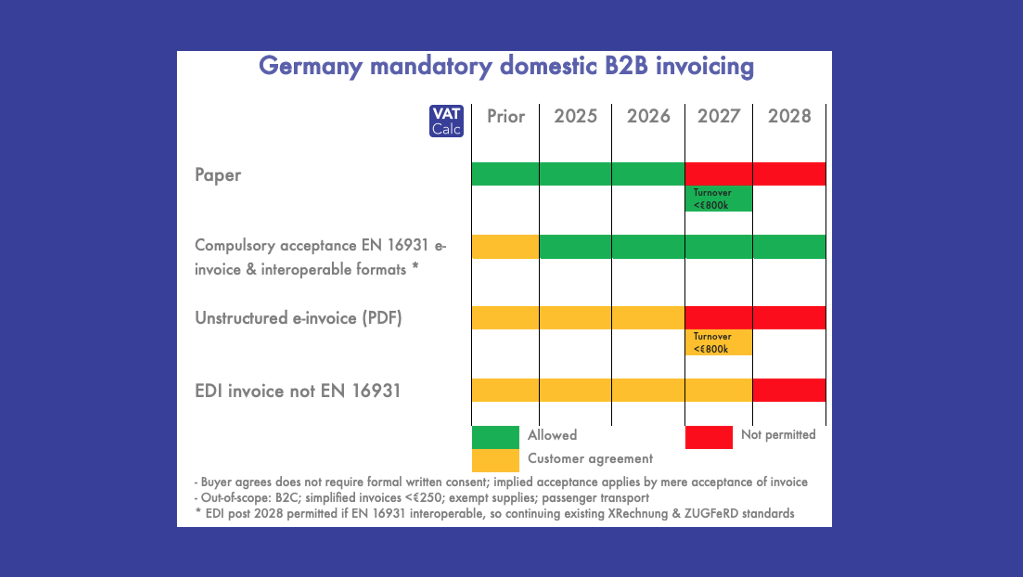

In parallel, Germany is introducing a B2B e-invoicing mandate that will reshape domestic trade documentation. This initiative, aligned with the European e-invoicing standard EN 16931, will be implemented in three main phases:

From 1 January 2025, all VAT-registered businesses must be capable of receiving structured e-invoices. There is no grace period for this requirement, meaning companies must be ready to receive e-invoices immediately.

From 1 January 2027, companies with annual turnover above €800,000 will be required to issue e-invoicesfor domestic B2B transactions.

From 1 January 2028, all businesses, regardless of size, will have to issue structured e-invoices, and paper invoices will no longer be accepted for B2B transactions.

The transition includes several practical allowances. Invoices below €250 are exempt from the full e-invoicing requirements, and small businesses will only need to receive, but not issue, structured e-invoices until 2028. Additionally, the ZUGFeRD 2.3 standard, released in May 2025, has been updated to support these new regulatory requirements.

To support this digital shift, Germany is also standardizing its invoice storage rules. Beginning in 2025, invoices will need to be retained for eight years, aligning archiving periods with the new digital-first environment.