As the European markets navigate a period of modest economic growth and trade uncertainties, investors are increasingly looking toward companies with robust insider ownership as potential opportunities. In this environment, high insider ownership can be a sign of confidence from those closest to the business, making it an intriguing factor when evaluating growth stocks in Europe.

Top 10 Growth Companies With High Insider Ownership In EuropeNameInsider OwnershipEarnings GrowthXbrane Biopharma (OM:XBRANE)21.8%56.8%Pharma Mar (BME:PHM)11.8%44.2%MedinCell (ENXTPA:MEDCL)13.9%94%Marinomed Biotech (WBAG:MARI)29.7%20.2%KebNi (OM:KEBNI B)38.3%65%Elliptic Laboratories (OB:ELABS)24.4%79%CTT Systems (OM:CTT)17.5%37.9%Circus (XTRA:CA1)24.7%94.8%Bonesupport Holding (OM:BONEX)10.4%62.3%Bergen Carbon Solutions (OB:BCS)12%63.2%

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★★★

Overview: Pharma Mar, S.A. is a biopharmaceutical company specializing in the research, development, production, and commercialization of bio-active principles for oncology across various countries including Spain, Italy, Germany, and the United States with a market cap of €1.42 billion.

Operations: The company’s revenue primarily comes from its oncology segment, generating €178.40 million.

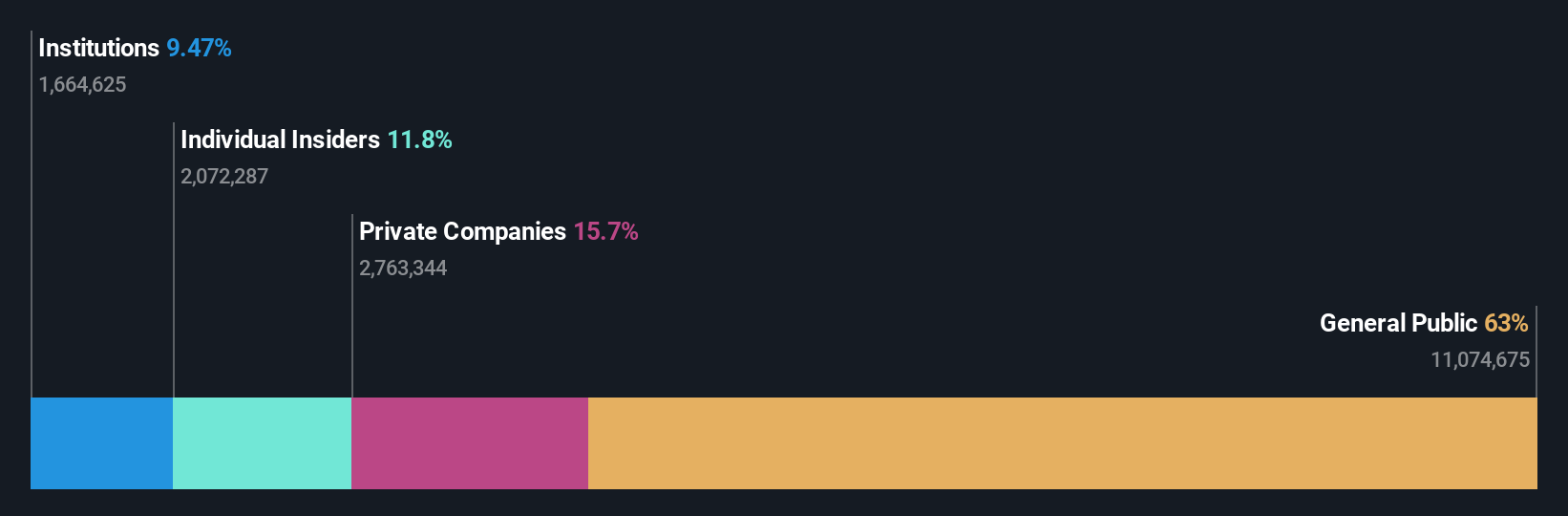

Insider Ownership: 11.8%

Pharma Mar has demonstrated robust growth potential, with earnings expected to grow significantly at 44.15% annually, and revenue projected to increase by 27.3% per year, outpacing the Spanish market. The company recently reported strong half-year results with net income rising from €3.54 million to €19.42 million year-over-year. Despite high share price volatility, Pharma Mar’s innovative treatments in oncology are gaining traction, as evidenced by positive Phase 3 trial results for Zepzelca® in lung cancer therapy.

BME:PHM Ownership Breakdown as at Aug 2025

BME:PHM Ownership Breakdown as at Aug 2025

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ), with a market cap of SEK4.45 billion, develops, manufactures, sells, and installs store concepts for retail chain stores.

Operations: The company’s revenue is primarily derived from its Furniture & Fixtures segment, which generated SEK9.39 billion.

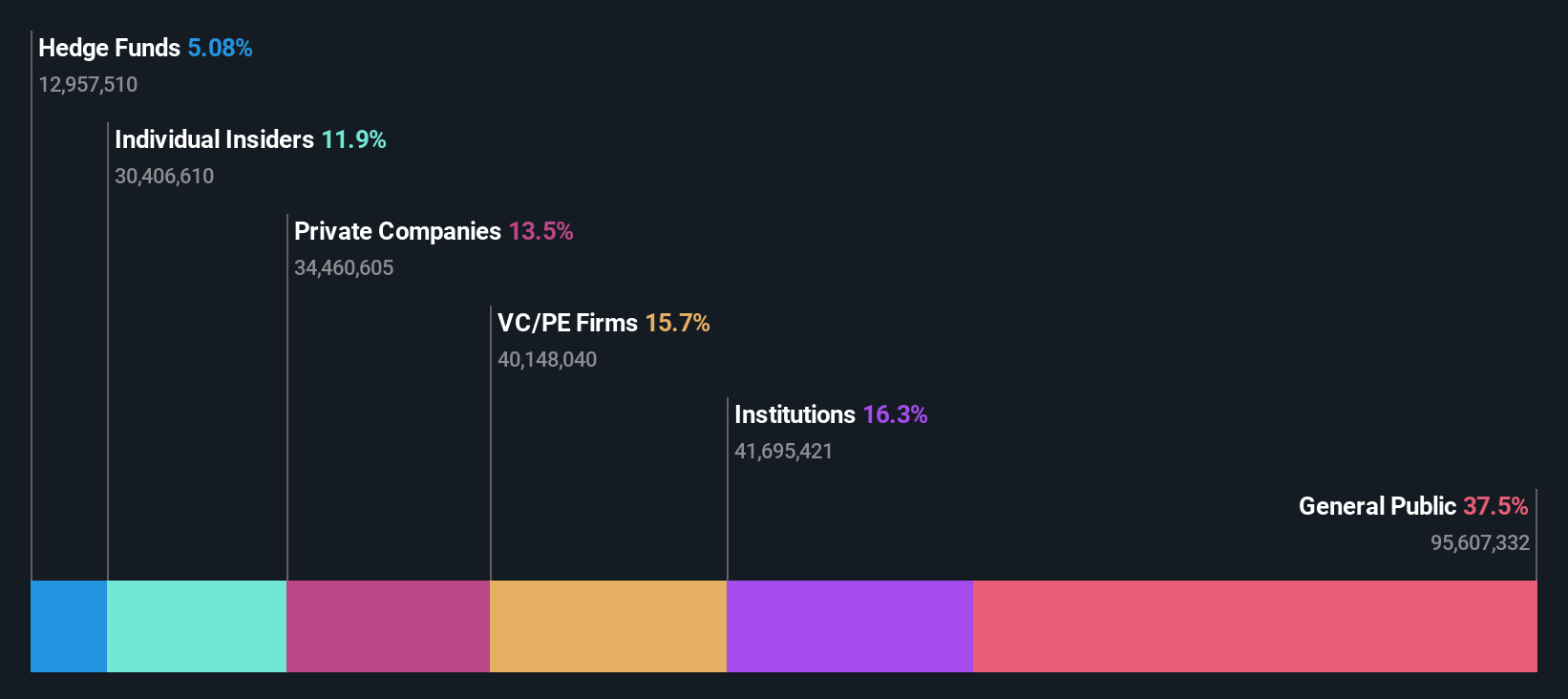

Insider Ownership: 11.9%

ITAB Shop Concept has seen substantial insider buying recently, indicating confidence in its growth trajectory. Despite a decrease in profit margins from 6% to 1.8%, the company is trading at a significant discount to its estimated fair value and is expected to achieve annual earnings growth of 54.3%, outpacing the Swedish market. However, challenges remain as debt coverage by operating cash flow is inadequate, and shareholder dilution occurred over the past year.

OM:ITAB Ownership Breakdown as at Aug 2025

OM:ITAB Ownership Breakdown as at Aug 2025

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK6.75 billion.

Operations: Storytel’s revenue is primarily generated from its streaming services, which account for SEK3.45 billion, and its publishing segment, contributing SEK1.20 billion.

Insider Ownership: 12.7%

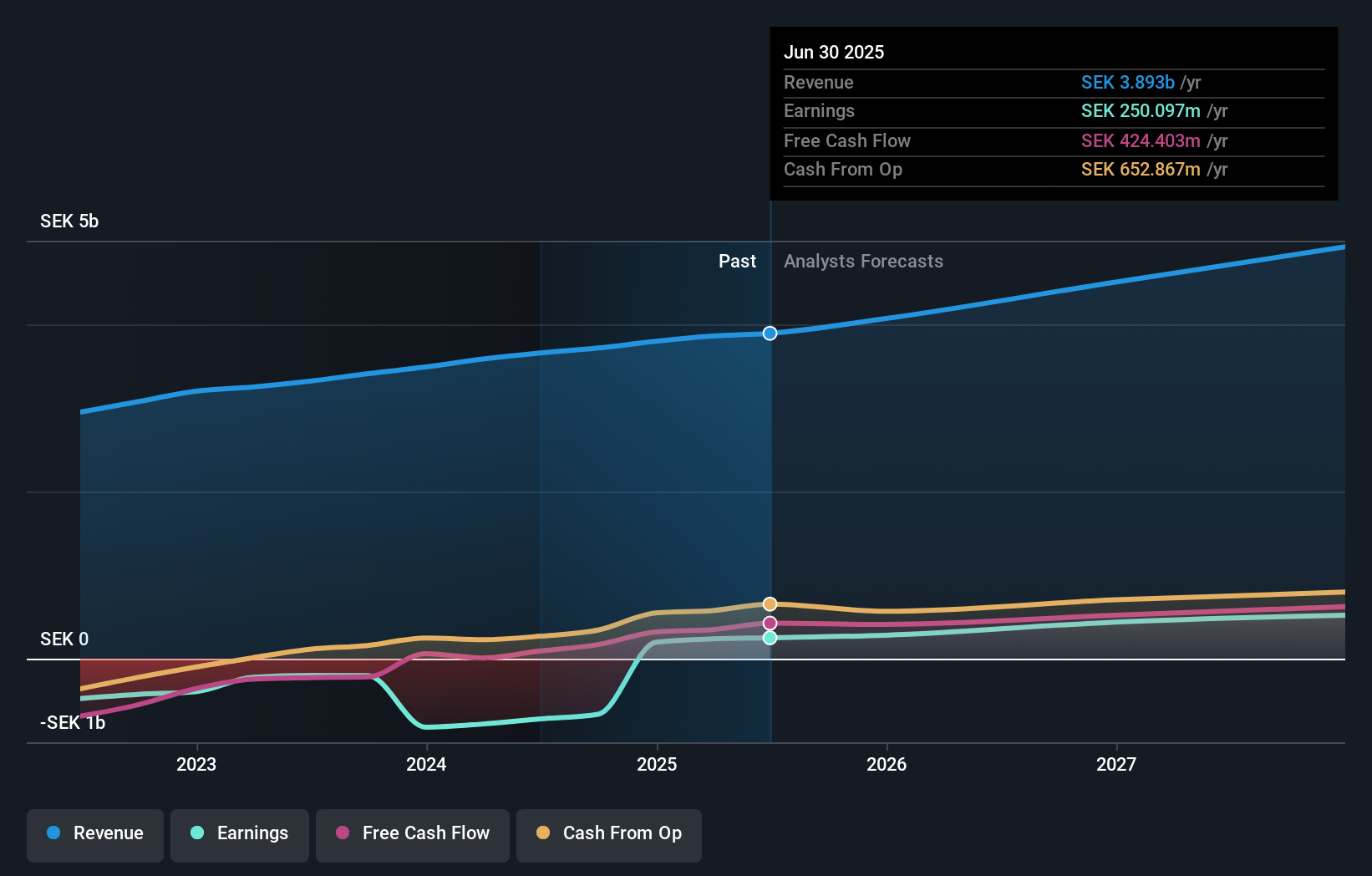

Storytel has demonstrated growth potential with earnings forecasted to grow at 24.4% annually, surpassing the Swedish market’s average. Recent earnings results show increased net income and sales for both the quarter and half-year periods, indicating a positive trajectory. Despite insider selling in recent months, the company trades significantly below its estimated fair value and anticipates revenue growth of 9.4% annually. Strategic acquisitions like Bokfabriken also enhance its market position in Europe’s publishing sector.

OM:STORY B Earnings and Revenue Growth as at Aug 2025Key Takeaways

OM:STORY B Earnings and Revenue Growth as at Aug 2025Key Takeaways

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders.

It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com