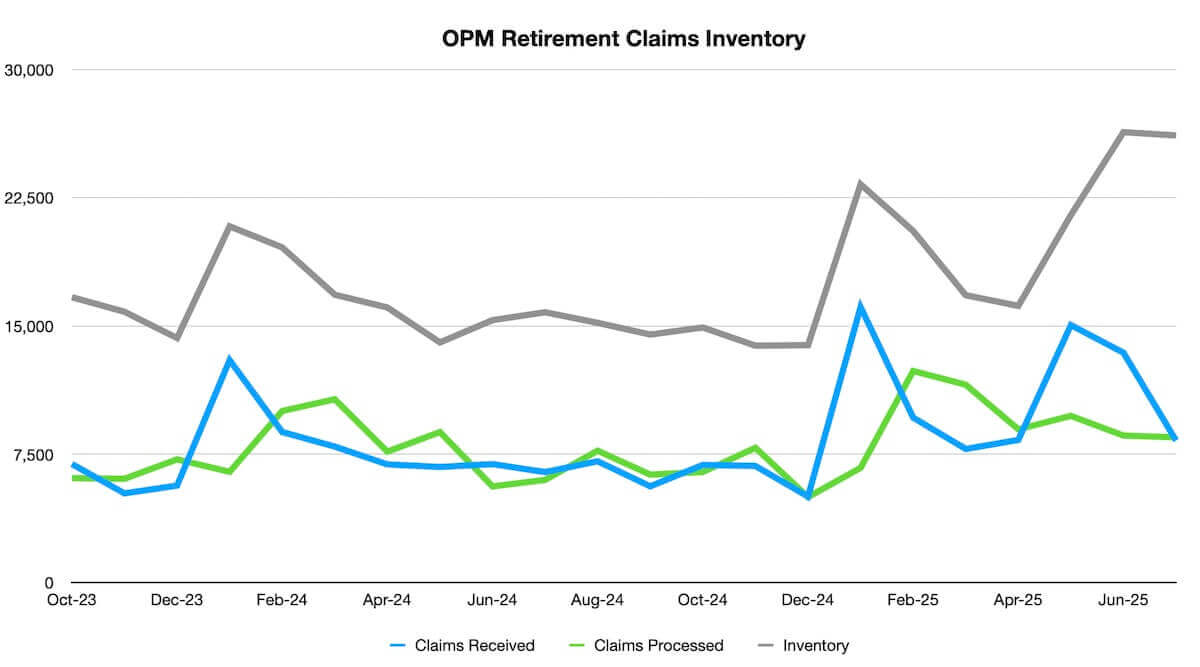

The OPM retirement backlog retreated slightly in July, but the retirement claims that have come into the agency this summer show an unusual seasonal spike from established past trends.

The Office of Personnel Management (OPM) received 8,295 new claims in July and processed 8,485. This brought the total backlog down to 26,138 from the high so far in 2025 in June when it hit 26,328. Processing time took 59 days on average, 31% higher than in June (45 days).

OPM Retirement Backlog Trends for 2025

The average number of claims received per month in 2025 so far is 11,235, which is much higher than the average for 2024 (7,346) and 2023 (7,398). The average number of claims processed per month in 2025 is 9,484, which is also higher than the averages for 2024 (7,381) and 2023 (8,006).

Inventory levels have risen sharply over previous years, with an average of 21,535 in 2025 compared to 15,899 in 2024 and 18,652 in 2023.

On the positive side, the average monthly processing time has improved in 2025 compared to the prior two years. So far this year, it is averaging 51 days which is slightly lower than 2024 (60 days) and much lower than in 2023 (73 days).

Comparison of July 2025 to the Last 5 Years

Although the total inventory level is still elevated from this summer’s claims surge, incoming retirement claims moderated in July compared to May and June.

How does July 2025 compare to previous years? The table below shows how the OPM retirement backlog has fared in July in each of the last five years.

YearClaims ReceivedClaims ProcessedInventory LevelsJuly 20258,2958,48526,138July 20246,4515,99415,797July 20237,2616,58417,047July 20229,48710,70629,224July 20218,9226,92027,001

Incoming retirement claims have fluctuated widely in this time period, ranging from 6,451 (2024) to 9,487 (2022). This indicates that this July’s incoming retirement claims are much more in line with patterns seen in other years.

Summer Surge in Retirement Claims

The summer of 2025 experienced an unusually high surge in incoming retirement claims, starting in May and continuing into June. This surge can be largely attributed to the significant number of federal employees who have left federal service through various programs, including deferred resignation, Voluntary Early Retirement Authority (VERA), and others.

According to OPM, approximately 154,000 federal employees have resigned under the deferred resignation program, and OPM Director Scott Kupor said recently that he anticipates the total federal workforce reduction to be at least double that number in the near future.

The table below shows the retirement claims for the last three months:

MonthClaims ReceivedClaims ProcessedInventory LevelsMay 202515,0489,73921,483June 202513,4308,58526,328July 20258,2958,48526,138

Compared to previous years, the claims received during these months in 2025 were significantly higher as illustrated in the table below:

YearMay Claims ReceivedJune Claims ReceivedJuly Claims Received202515,04813,4308,29520246,7516,9196,45120236,0964,8547,26120227,6736,0329,48720217,6847,2648,922

OPM’s Digital Retirement Processing System

OPM has been developing a digital retirement processing system known as its Online Retirement Application (ORA) which officially launched in May.

OPM Director Scott Kupor said recently, “The team at OPM have been working tirelessly to take the federal retirement system digital. Success will be for nearly all federal employees to self retire in a matter of seconds as opposed to the antiquated process that can take several months if not years to complete.”

Dealing with digitizing federal employees’ retirement records in light of the multitude of varying sources from which they originate was a challenging task. Al Himler, former Chief Technology Officer at OPM who worked on the digital retirement processing system prior to leaving for a private sector job at IBM, described some of the considerations in developing the new system in a blog post he wrote recently:

Considering that, in an average year, about 100,000 people retire from Federal service annually, that volume of paper becomes a logistical “ball-and-chain” that must be managed to respond to annuitant needs. How could OPM best do so?

The most insightful answer, from one of my Retirement Services partners, was to focus on the incoming materials as the higher priority and as quickly as possible automate the processes to efficiently handle new paper coming in the door. Sounds deceptively simple, but paper comes in from different directions: people planning to retire, payroll centers, people who have retired, people claiming to be a survivor needing to be verified, and so on. Digitizing all the inputs simultaneously, and on a constrained budget, was a challenge, but we made incremental progress. For example, we were able to automate the process of accepting retirement packages for a single payroll provider and a small handful of agencies. Beyond accelerating the receipt of error-free applications, the project also demonstrated our ability to define digital interfaces with other agencies so that we could receive retirement applications, and the payroll data required for annuity calculations. The plan for the remainder of FY2025 was to add a second payroll provider (there are a total of five) and begin to accept retirement applications from another set of agencies. This project provided the first implementation where Retirement Services digital processing replaced paper processing.

The ongoing development of the new system is anticipated to significantly expedite the retirement process for federal employees in the future.

OPM Retirement Processing Status: July 2025

The latest retirement processing statistics are included below for reference.

MonthClaims ReceivedClaims ProcessedInventory (Steady state goal is 13,000)Monthly Average Processing Time in DaysFYTD Average Processing Time in DaysOct-236,9246,09816,6787373Nov-235,2076,05915,8266669Dec-235,6627,19614,2926869Jan-2412,9976,46720,8226668Feb-248,79410,02519,5914762Mar-247,94310,71116,8235561Apr-246,9017,64716,0776161May-246,7518,79314,0356061Jun-246,9195,61415,3406461Jul-246,4515,99415,7976561Aug-247,0837,70215,1786461Sep-245,6186,30214,4946362Oct-246,8726,45814,9086262Nov-246,8087,87213,8445558Dec-245,0204,98813,8765758Jan-2516,1016,70023,2776460Feb-259,63712,36420,5504455Mar-257,80311,55916,7945054Apr-258,3328,95316,1734953May-2515,0489,73921,4834952Jun-2513,4308,58526,3284552*Jul-258,2958,48526,1385952

Disability determinations are included in the pending number after approval. Average Processing Time in Days represents the number of days starting when OPM receives the retirement application through final adjudication.

*Initial retirement cases produced in less than 60 days, on average took 39.8 days to complete; whereas cases that were produced in more than 60 days, on average, took 108 days to complete.

© 2025 Ian Smith. All rights reserved. This article

may not be reproduced without express written consent from Ian Smith.