New International Monetary Fund (IMF) research confirms what many suspected: stablecoins are accelerating dollar adoption worldwide, with billions flowing from the US to regions where local currencies face volatility – exactly the kind of digital dollarization that strengthens America’s monetary dominance.

While Asia Pacific leads in absolute volumes, the most striking adoption rates emerge in Africa, the Middle East, and Latin America, where stablecoin flows reach remarkable proportions of GDP. These regions also show the highest rates of international payments, revealing how digital dollars are reshaping global finance.

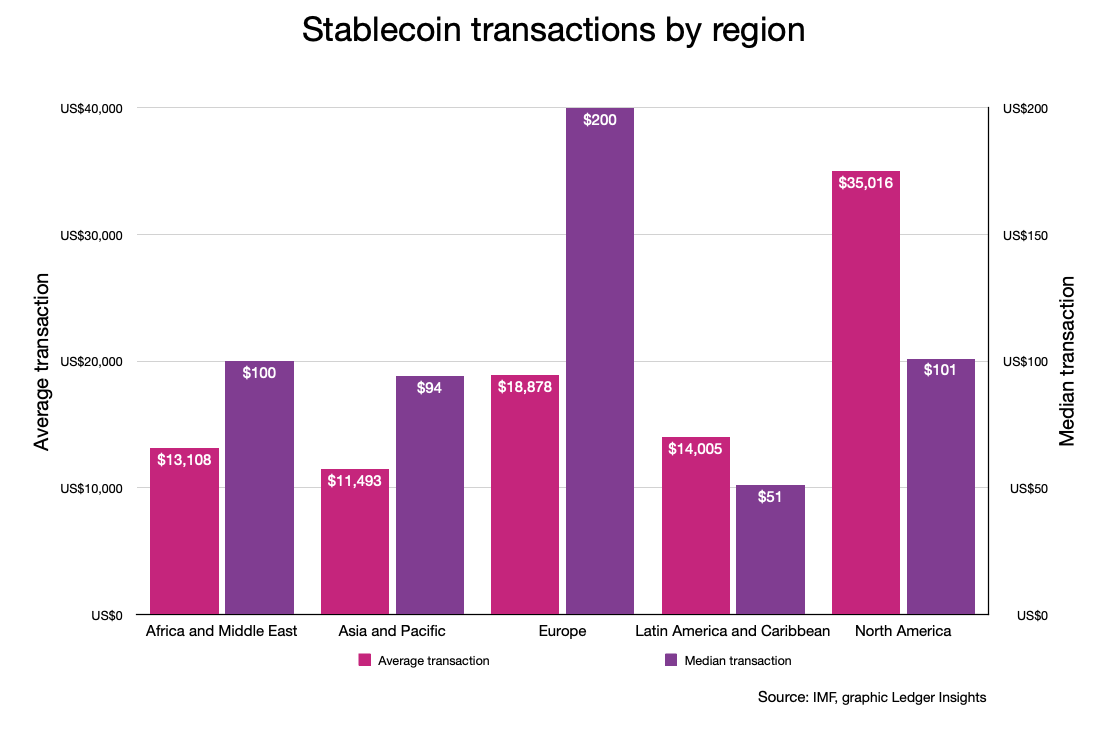

The data exposes sharp regional contrasts: European users favor larger individual transactions, while a clear correlation between exchange rate instability and stablecoin adoption confirms these tokens serve as digital sanctuaries during currency crises.

Most intriguingly, the IMF’s novel methodology – which accounts for VPN usage unlike industry-standard approaches – has produced some eye opening findings about both Chinese and US stablecoin flows. While broadly confirming existing patterns, the research reveals significant blind spots in conventional analysis that have major implications for understanding global adoption.

Article continues….

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.