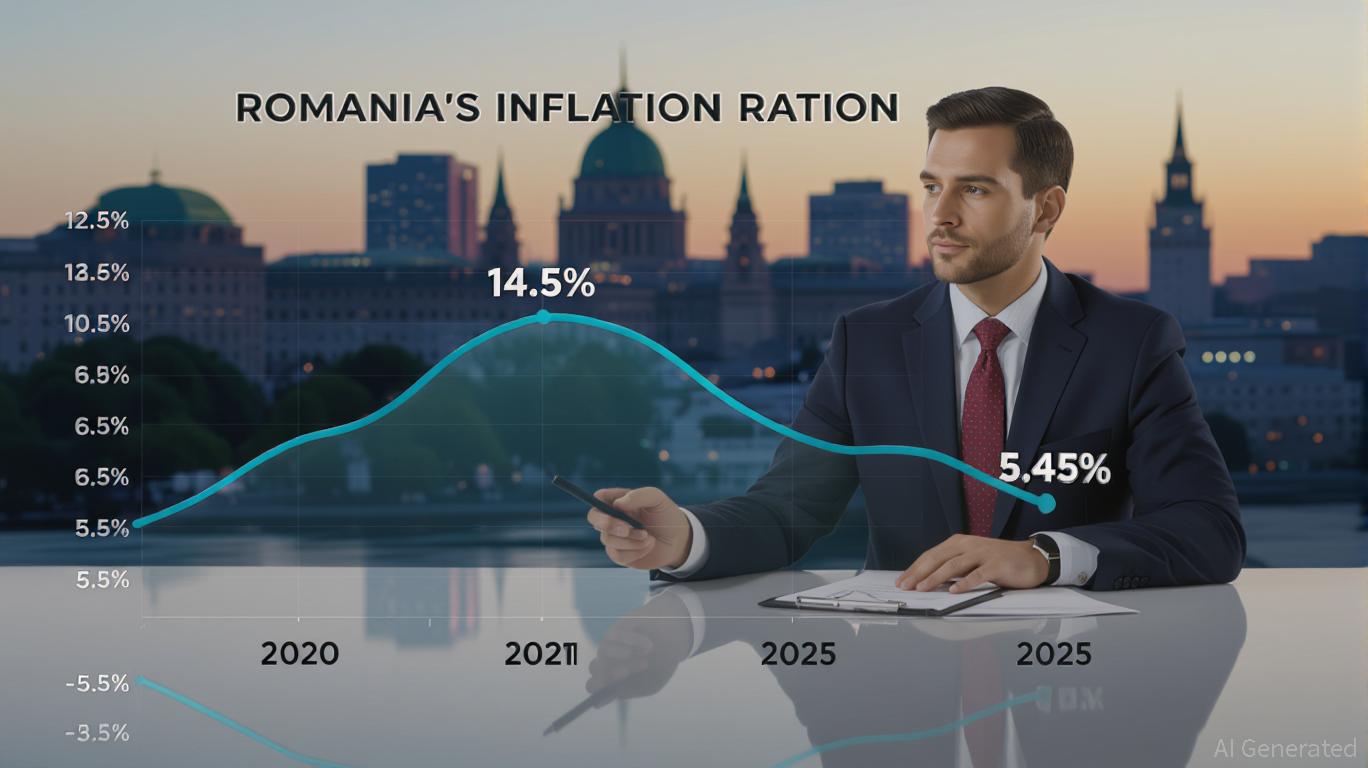

Romania’s economy is navigating a delicate tightrope in 2025, balancing the need to curb stubborn inflation with the imperative to attract foreign investment in a market marked by both promise and volatility. With headline inflation at 5.45% in May 2025—well above the National Bank of Romania’s (NBR) target range of 2.5% ±1 percentage point—the central bank has maintained a restrictive monetary policy, keeping its benchmark interest rate unchanged at 6.5% for seven consecutive months. This decision reflects a strategic prioritization of price stability over growth stimulation, a stance that carries significant implications for foreign investors seeking long-term opportunities in a stabilizing but high-risk environment.

Inflation Resilience: A Test of Policy and Patience

The NBR’s decision to hold rates steady is driven by a confluence of factors. Upcoming fiscal measures, including the expiration of electricity price caps and planned VAT and excise duty hikes, are expected to push inflation higher in the short term. Analysts project that headline inflation could peak at 7.5–7.9% by late 2025 before moderating to 3.4–3.6% by 2027. While this trajectory suggests a path toward stabilization, the prolonged period of elevated inflation—projected to remain above 3.5% until early 2026—poses challenges for investors.

The central bank’s reluctance to provide forward guidance on rate cuts underscores its commitment to anchoring inflation expectations. However, this uncertainty creates a risk-reward dynamic for foreign capital. Investors must weigh the potential for higher returns in sectors insulated from inflation against the volatility of a currency (the Romanian leu) that remains overvalued and vulnerable to capital outflows.

Policy Reforms and Sectoral Opportunities

Amid these macroeconomic headwinds, Romania’s government has launched an ambitious privatization program and infrastructure modernization agenda, offering a counterbalance to inflationary pressures. Key initiatives include the restructuring of state-owned enterprises (SOEs), public listings of strategic assets, and EU-funded projects in energy transition, digital infrastructure, and transportation. These reforms are designed to attract foreign capital by improving governance, reducing fiscal deficits, and aligning with EU recovery plans.

Foreign investors are particularly incentivized to explore sectors such as renewable energy, where government support for solar and wind projects is robust, and advanced manufacturing, where firms like Alstom and Tesla Energy Storage have already established a presence. The decentralization of investment beyond Bucharest—driven by EU-funded industrial zones in cities like Oradea and Constanța—further broadens the appeal of Romania’s market.

Historical Context and Future Projections

Historically, Romania’s inflation has followed a cyclical pattern, peaking at 14.6% in November 2022 before declining to 5.8% in June 2025. The NBR’s revised inflation forecasts—5.1% in Q2 2025, 4.6% by year-end, and 3.4% in 2026—reflect a cautious optimism that disinflation will gain momentum by mid-2026. However, the central bank’s insistence on maintaining a restrictive policy until at least Q3 2025 signals a preference for certainty over premature easing.

For investors, this timeline suggests a window of opportunity in late 2026, when inflation is expected to align with the NBR’s target range and rate cuts could begin to stimulate growth. The key will be to identify sectors and assets that can weather the interim period of high rates and inflation, such as infrastructure projects with long-term revenue streams or companies with pricing power in energy and agriculture.

Strategic Entry Points and Risk Mitigation

While Romania’s market presents compelling long-term prospects, investors must navigate several risks. Political volatility, a current account deficit, and the potential for external shocks—such as U.S. tariff policies or geopolitical tensions—remain critical concerns. To mitigate these, foreign investors should prioritize partnerships with local stakeholders, leverage EU funding mechanisms, and adopt a phased entry strategy that aligns with the NBR’s projected inflation timeline.

For example, investing in EU-backed infrastructure projects now can secure a foothold in sectors poised for growth once monetary easing begins. Similarly, early-stage investments in renewable energy firms, which benefit from government incentives and long-term contracts, offer resilience against short-term inflationary spikes.

Conclusion: A Calculated Bet on Resilience

Romania’s economic landscape in 2025 is one of contrasts: a central bank committed to inflation control, a government pushing for structural reforms, and a market brimming with untapped potential. For foreign investors, the path forward requires patience, a nuanced understanding of policy dynamics, and a focus on sectors that can thrive in both high-inflation and low-interest environments. While the road to stabilization is fraught with risks, the rewards for those who position themselves strategically—particularly in late 2026—could be substantial.

In the end, Romania’s story is one of resilience. By aligning with the country’s long-term vision and exercising disciplined risk management, foreign investors can turn today’s uncertainties into tomorrow’s gains.