The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

Duke Energy Investment Narrative Recap

To invest in Duke Energy, shareholders need confidence in steady regulated utility growth, ongoing infrastructure investment, and a reliable dividend, all while managing shifting energy demand and large-scale capital requirements. The recent earnings beat and successful asset sales increase short-term financial flexibility and help address immediate needs for grid and clean energy investment, but they do not fully resolve ongoing risks linked to capital intensity and long-term demand pressures.

The recent completion of the US$6 billion minority stake sale in Duke Energy Florida stands out, immediately improving the company’s balance sheet and supporting its plans for a US$4 billion increase in capital expenditure for grid and renewable upgrades, key factors for long-term growth, even as funding challenges persist.

Yet, despite these positives, investors should be alert to the contrasting issue of dividend growth that isn’t fully supported by free cash flow…

Read the full narrative on Duke Energy (it’s free!)

Duke Energy’s outlook anticipates $35.5 billion in revenue and $6.0 billion in earnings by 2028. This scenario implies a 4.8% annual revenue growth rate and a $1.3 billion increase in earnings from the current $4.7 billion.

Uncover how Duke Energy’s forecasts yield a $130.07 fair value, a 3% upside to its current price.

Exploring Other Perspectives DUK Community Fair Values as at Aug 2025

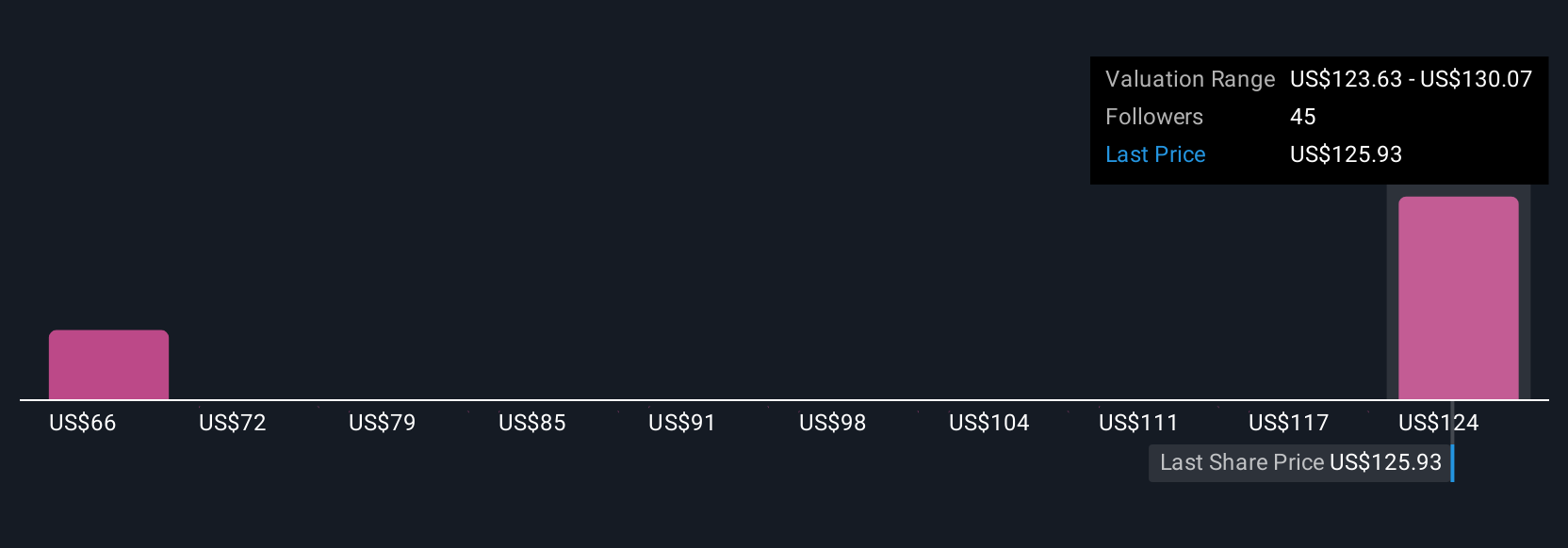

DUK Community Fair Values as at Aug 2025

Six fair value estimates from the Simply Wall St Community span US$65.63 to US$130.07 per share, reflecting wide differences in growth expectations. With capital needs rising and free cash flow concerns highlighted, now is a good time to explore how diverging viewpoints may influence your outlook.

Explore 6 other fair value estimates on Duke Energy – why the stock might be worth as much as $130.07!

Build Your Own Duke Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com