(Bloomberg) — The Bank of England reduced interest rates to a more than two-year low in a closer-than-expected decision that leaves investors with what Governor Andrew Bailey called “genuine uncertainty” on its next move.

Most Read from Bloomberg

In the US, the services sector effectively stagnated last month as sluggish demand and higher input costs prompted companies to reduce employment — the latest evidence of a slowing economy.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Europe

In a judgment that pitted the prospect of inflation hitting 4% against a weakening jobs market, five members of the Bank of England’s Monetary Policy Committee split 5-to-4 in favor of reducing rates by a quarter-point to 4% after deadlock forced it into an unprecedented second vote. The prospect of another reduction this year is now shrouded in doubt. It was the first time in the panel’s 28-year history that two rounds of voting were needed for a presentable outcome on rates.

German industrial production suffered its biggest drop in almost a year, raising the prospect that Europe’s largest economy shrank last quarter by even more than initially estimated.

US

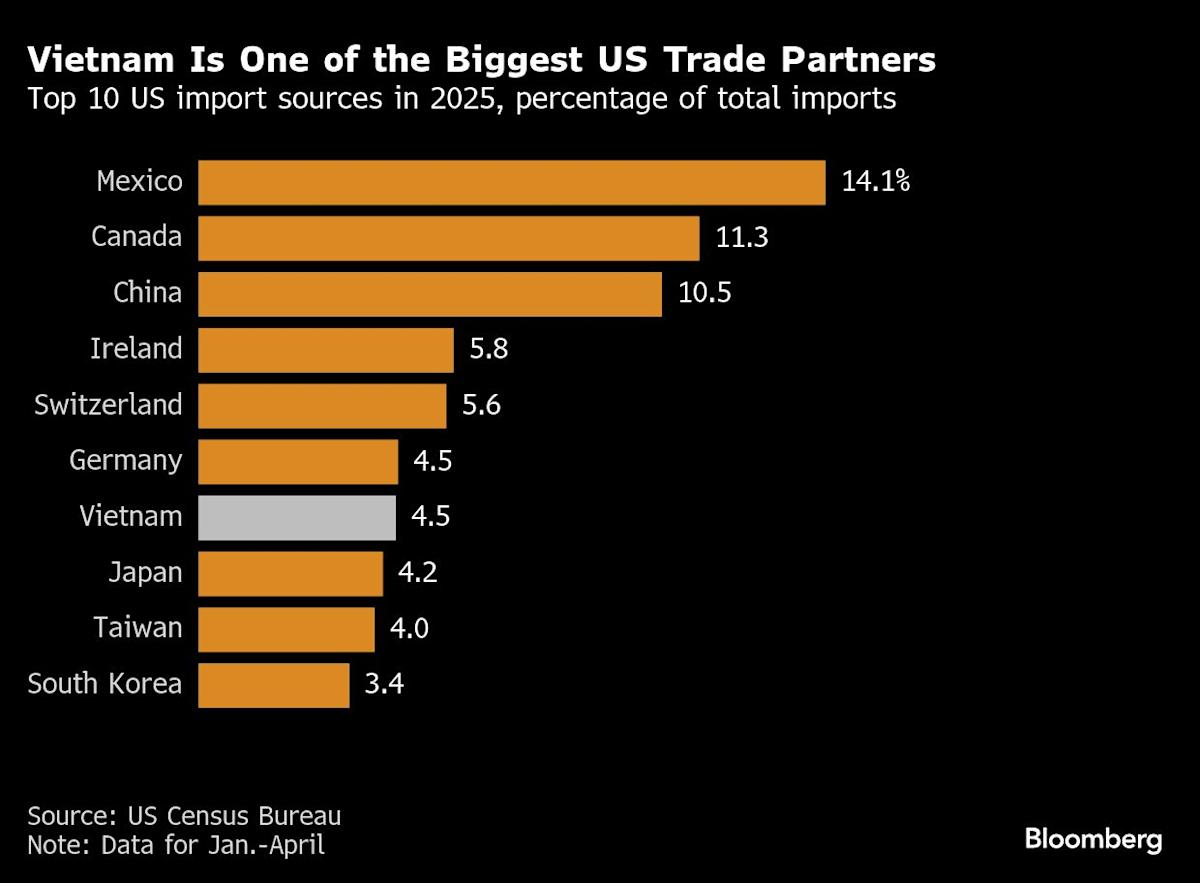

President Donald Trump declared plans for a 100% tariff on semiconductor imports while promising to exempt companies such as Apple Inc. that move production back to the US, triggering a scramble among trading partners and companies worldwide to make sense of the threat.

The US services sector effectively stagnated in July as firms — faced with tepid demand and rising costs — reduced headcount. The Institute for Supply Management’s index of services declined last month to 50.1, below all estimates in a Bloomberg survey of economists. Readings above 50 indicate expansion.

The share of consumer debt in serious delinquency rose in the second quarter to the highest level since early 2020, reflecting a record surge in past-due student-loan debt. In a briefing with reporters, New York Fed researchers said student-loan delinquencies would likely continue to rise, eventually returning to pre-pandemic levels.

Asia

China’s export growth unexpectedly accelerated last month in the fastest gain since April, as demand from around the world compensated for the continued slump in shipments to the US.

Story Continues