We’ve found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Quantum Computing’s Investment Narrative?

To believe in Quantum Computing Inc., you need conviction that emerging quantum and photonic chip technologies will see accelerating demand, and that QCi is well-positioned to lead a new era of domestic TFLN photonics. The latest NIST contract, coupled with a Fortune 500 chip order, suggests fresh traction in government and commercial markets. This may shift the company’s most important short-term catalysts: actual delivery and performance on these contracts could fuel revenue visibility and enhance the business narrative, especially as QCi has just begun meaningful government partnerships. However, risks remain: QCi is still unprofitable, has diluted shareholders heavily in the past year, and is caught in a securities fraud lawsuit that could weigh on both reputation and operations. While recent revenue growth has been rapid and the share price reaction has been strong, this new momentum does not resolve longstanding challenges like board inexperience and persistent financial losses.

Yet, the unresolved lawsuit could become a much bigger concern for shareholders than recent wins suggest.

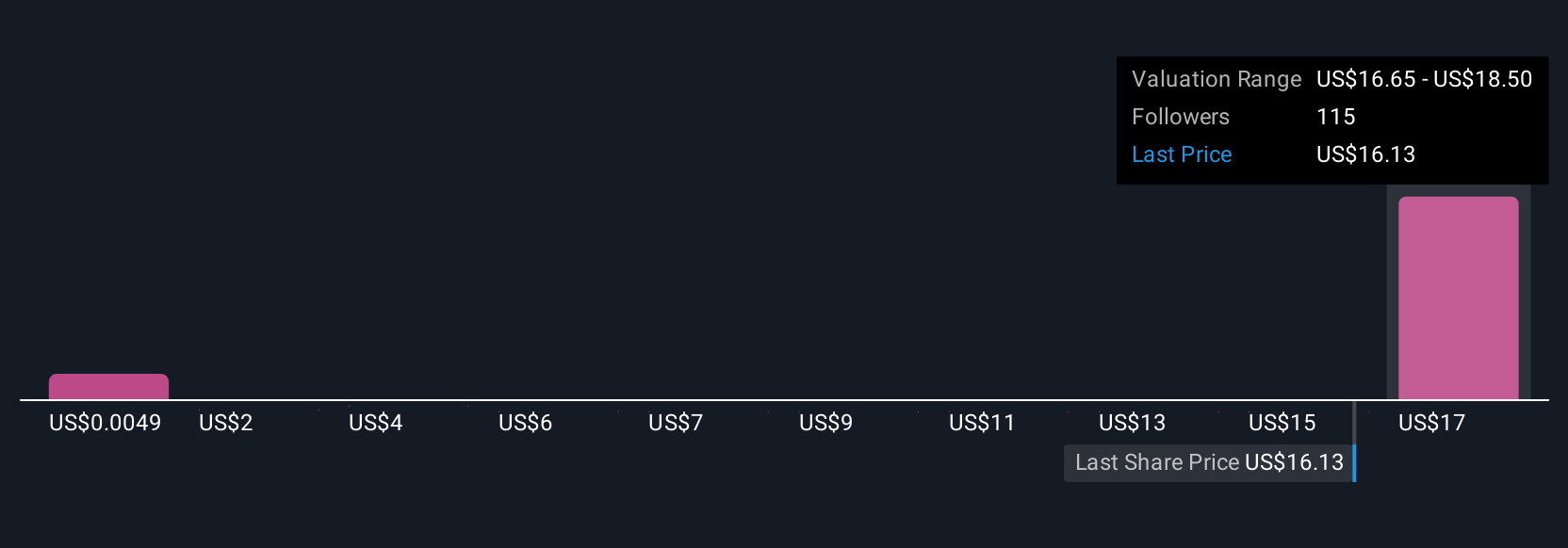

Our valuation report here indicates Quantum Computing may be overvalued.Exploring Other Perspectives QUBT Community Fair Values as at Aug 2025 Over 25 private investors in the Simply Wall St Community have estimated QCi’s fair value anywhere from near zero to US$18.50 per share. While the company’s recent government contract renews short-term optimism, some see legal and profitability risks as bigger factors. Be sure to weigh these diverse viewpoints before drawing conclusions.

QUBT Community Fair Values as at Aug 2025 Over 25 private investors in the Simply Wall St Community have estimated QCi’s fair value anywhere from near zero to US$18.50 per share. While the company’s recent government contract renews short-term optimism, some see legal and profitability risks as bigger factors. Be sure to weigh these diverse viewpoints before drawing conclusions.

Explore 25 other fair value estimates on Quantum Computing – why the stock might be worth as much as 15% more than the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com