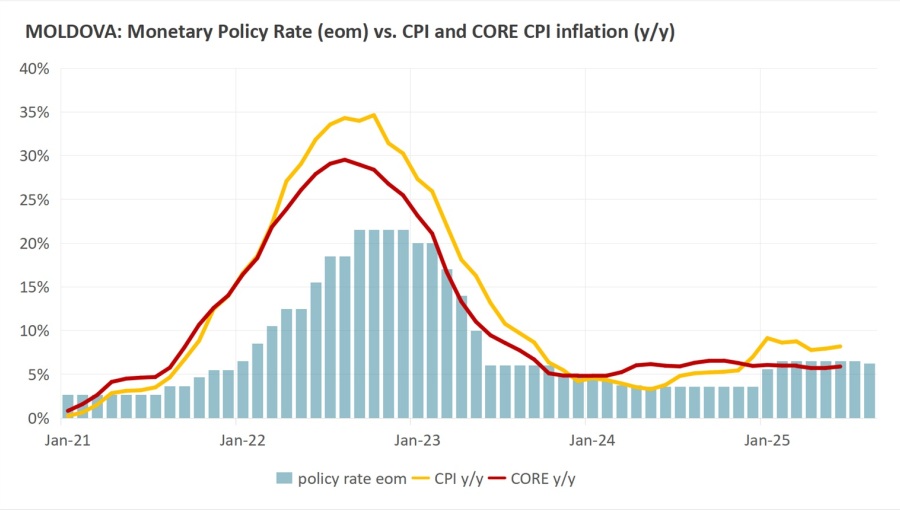

The National Bank of Moldova (BNM) reduced its base interest rate (chart) by 25 basis points (bp) to 6.25% on August 7 in an effort to support economic recovery after a period of monetary tightening earlier this year, the central bank reported on August 7.

The decision follows a two-step rate increase in January and February that brought the policy rate up to 6.5% from 3.6%, a move prompted by rising energy prices after Russia halted gas supplies to the separatist region of Transnistria. The central bank confirmed that the tightening cycle has now ended, and the focus has shifted towards reviving domestic demand.

“The new monetary policy stance is intended to stimulate aggregate demand and support economic growth, while maintaining inflation expectations anchored,” the BNM stated. Moldova’s economy registered marginal growth of 0.1% year-on-year in 2024, and contracted by 1.2% in the first quarter of 2025.

Headline inflation rose to 6.9% year-on-year in June, up from 6.6% in May. Core inflation also increased slightly to 5.9% from 5.7% in the same period. However, the central bank expects the recent energy price reductions to help stabilise inflation. Its forecast projects a year-end inflation rate of 6.5%, declining further to 4% by the end of 2026, below the 5% target.

Despite inflation remaining above the BNM’s target, the current monetary stance can be described as “moderately restrictive,” contrasting with previous periods of more aggressive stimulus, such as the 3.6% rate maintained in late 2024 even when inflation was elevated above the 5% target.

The central bank assured that the effects of the rate cut would transmit gradually through reduced interest rates across money, deposit, and credit markets. It added that recent inflationary pressures stemming from Middle East tensions had only a short-lived impact on consumer prices.

The BNM also acknowledged that domestic inflation remains affected by lingering supply-side shocks, including higher regulated tariffs and reduced agricultural output due to adverse weather.