Created on August 10, 2025

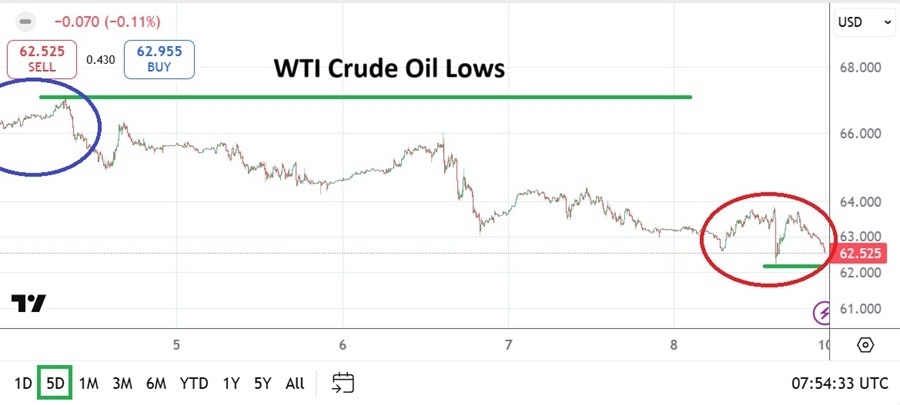

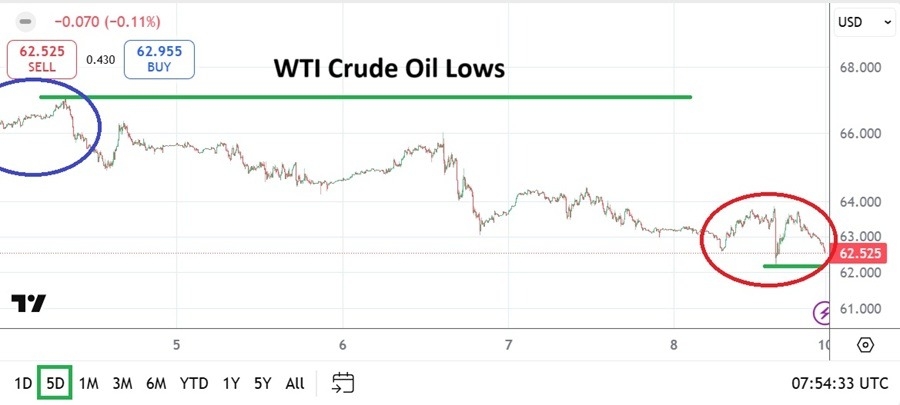

Day traders may assume at some juncture around 62.000 to 61.000 WTI Crude Oil needs to bounce higher and once again occupy the standard 64.000 to 68.000 price range. But reality and speculative zeal could make wagering on a notion that oil prices cannot go lower extremely dangerous. Technical charts are easy to study, from around the 4th of April until the first week in June, WTI Crude Oil traded between 58.000 to 62.000 USD quite a bit, yes, there were outliers lower and higher, but the point is the commodity has seen larger depths before.

WTI Crude Oil remain speculative. Summer travel is certainly upon the northern hemisphere, but this has not equated into higher energy prices. Global economies factor into the outlook of larger traders, but the technical range and established sentiment seems to point to simple supply and demand price movement. Yes, WTI Crude Oil could bounce higher, but it can also trade lower.

As always smaller commodity traders are at the mercy of bigger independent and institutional players in WTI Crude Oil. Unless a smaller trader knows that large buying orders are coming from major global corporations it would be good to simply try and ride the waves created via trends in WTI Crude Oi.

If the commodity opens with a sustained price range near current values and is not able to muster a storm of buying above 62.750 to 63.000 by Monday morning U.S time, then it may mean the lower realms are becoming accepted and will see a test of mid-term support levels.Lower momentum would not be a surprise.Traders should also take into account that higher price rations seen in June were caused by fear of Middle East conflict, these concerns have evaporated now.

It is rather easy to say the one month trend in WTI Crude Oil is lower and current prices indicate more selling. A look however at a three month chart actually shows the price of WTI is straddling important support levels. But perhaps the fundamentally important aspect of a three month glance is the dangerous wrench thrown into the price of WTI Crude Oil when the Israeli / Iranian conflict escalated in June.

Now that these worries have been priced out of the WTI Crude Oil market, we are once again seeing the lower prices be translated into fair market equilibrium. The point to ponder for day traders is whether larger players feel that WTI Crude Oil can go lower? Trading below 62.000 and 61.000 happened in the not so distant past. Looking for lower prices from the current values may feel like overreaching, but further downward steps are not out of the question.

Ready to trade our weekly forecast? Here are the best Oil trading brokers to choose from.