Most of Donald Trump’s tariffs are clearly illegal. There is a special court, the Court of International Trade, which is supposed to have jurisdiction over these issues, and it ruled the tariffs illegal on May 28. However, the ruling was stayed while the administration appealed the decision to the Federal Circuit Court. Those following the deliberations mostly believe that this court will uphold the trade court’s ruling. But then the case will go to the Supreme Court, and almost everyone expects the Supremes to rule that Trump can do whatever he wants.

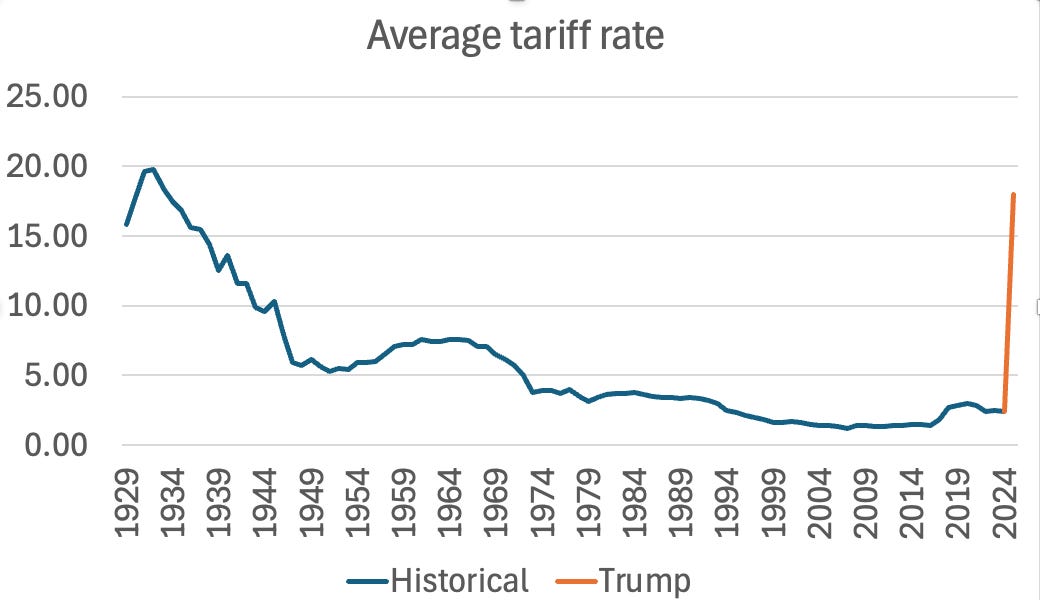

So high tariffs are probably here to stay. And I mean high tariffs. Trump has reversed 90 years of tariff reductions, achieved via reciprocal trade agreements — we’ll cut our tariffs if you cut yours. Here’s a chart of average U.S. tariffs since 1929, just before the infamous 1930 Smoot-Hawley tariff:

Source: Statista and Yale Budget Lab

How should we think about the economics of this huge policy reversal? In last week’s primer I focused on the macroeconomics of Smoot-Hawley 2.0 — its effects on trade flows and real GDP. But as I suggested at the end of that post, the real economic significance of the tariffs — even though they are ostensibly aimed at foreigners — is mainly how they will affect the distribution of income among Americans.

In 2020 Matthew Klein and Michael Pettis published a very good book titled Trade Wars Are Class Wars. They didn’t have Trumpian trade wars in mind, and their analysis was in important ways different from mine. But their meta point — trade policy is mostly about income distribution — was absolutely right, and I am going to steal their tagline.

Not to be coy about it, what I’ll argue in today’s post is that Trump’s trade war should be seen as part of a package of policies that amounts to class warfare — class warfare against middle and lower-income Americans in favor of the affluent, especially the top 10 percent of the income distribution.

Beyond the paywall I’ll discuss the following:

1. Tariffs as regressive tax increases that help pay for regressive tax cuts

2. The false promise of a revival in manufacturing jobs

3. The effects of tariffs on wages