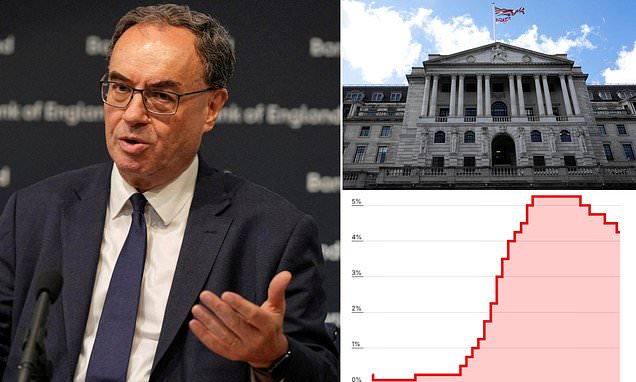

The Bank of England has cut base rate by 0.25 percentage points to 4 per cent in a knife-edge decision that saw the Monetary Policy Committee forced into a second vote for the first time in its history.

It marked the fifth decrease in borrowing costs since the base rate peaked at 5.25 per cent in August last year and will help further relieve pressure for some mortgage holders and home buyers.

Today’s decision marked the first ever time the Monetary Policy Committee has been forced into a second vote, demonstrating the uncertainty over the UK’s economic outlook

The Bank of England’s MPC voted by a majority of 5 to 4 to reduce base rate, with four members of the committee preferring to hold a 4.25 per cent.

In the first round, MPC Alan Taylor voted for an even bigger cut to 3.75 per cent.

But the move comes amid fears over the state of the UK economy with inflation reaching an 18-month high in June by climbing to 3.6 per cent, while unemployment rose to 4.7 per cent, its highest level in four years, in May.

It follows a 0.1 per cent GDP contraction in May, following a 0.3 per cent drop the previous month, and signs of growing pressure on the jobs market.

Bank of England Governor Andrew Bailey said earlier this month that the Bank would be prepared to cut rates if the jobs market showed signs of weakening.

This live page has closed