The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

International Petroleum Investment Narrative Recap

To be a shareholder in International Petroleum Corporation, you need to believe in the company’s ability to deliver long-term production growth from flagship projects like Blackrod, control capital intensity, and generate strong free cash flow as these assets ramp up. The recent enhanced share buyback and better-than-expected earnings may support short-term confidence, but they do not materially alter the main catalyst, successful Blackrod execution, or mitigate ongoing project and balance sheet risks.

Of the recent corporate events, the completion of the latest share buyback tranche stands out for strengthening per-share value and reinforcing management’s capital allocation approach. While ongoing buybacks and stable production guidance may provide a buffer for earnings per share, the most important company catalyst remains Blackrod’s development progress and its impact on future cash flows and leverage.

Yet, investors should carefully weigh the consequences of any delays or cost overruns at Blackrod, given that…

Read the full narrative on International Petroleum (it’s free!)

International Petroleum’s outlook anticipates $1.2 billion in revenue and $222.4 million in earnings by 2028. This projection is based on a 19.1% annual revenue growth rate and represents a $169 million increase in earnings from the current level of $53.4 million.

Uncover how International Petroleum’s forecasts yield a CA$24.09 fair value, in line with its current price.

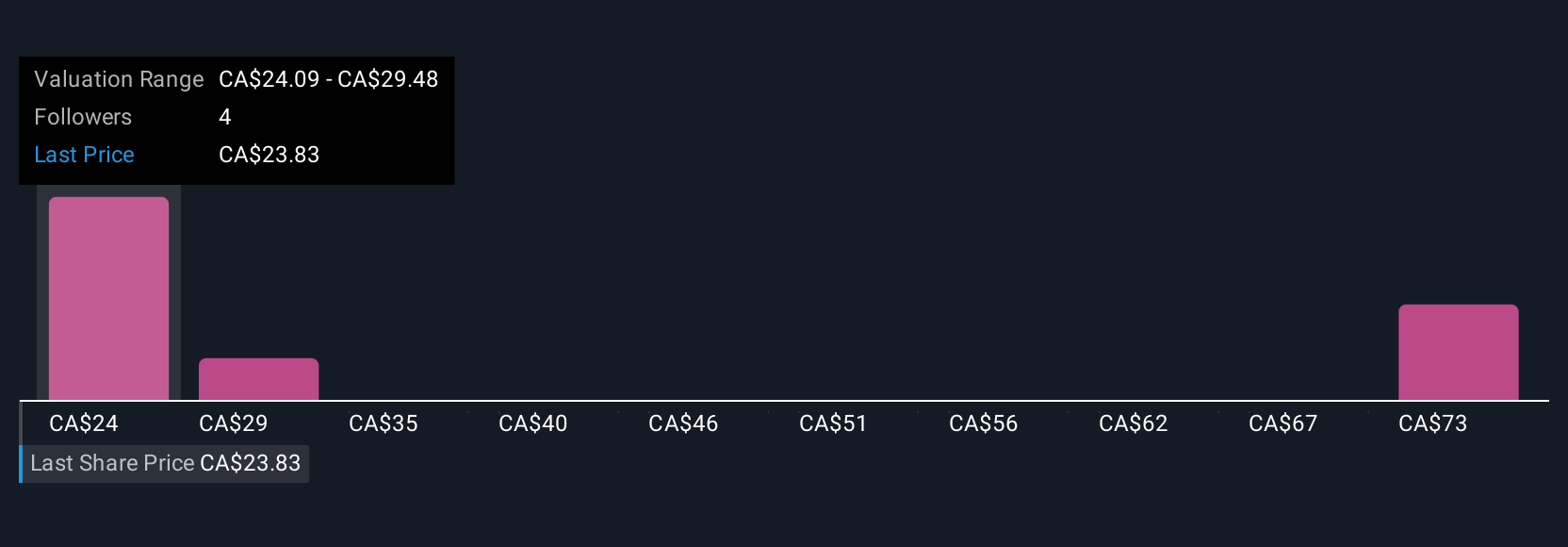

Exploring Other Perspectives TSX:IPCO Community Fair Values as at Aug 2025

TSX:IPCO Community Fair Values as at Aug 2025

Four members of the Simply Wall St Community estimate International Petroleum’s fair value between CA$24.09 and CA$78.00, showing investor opinions can be wide apart. As you weigh these perspectives, consider that heavy reliance on timely Blackrod ramp-up could significantly influence future returns and risks.

Explore 4 other fair value estimates on International Petroleum – why the stock might be worth over 3x more than the current price!

Build Your Own International Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com