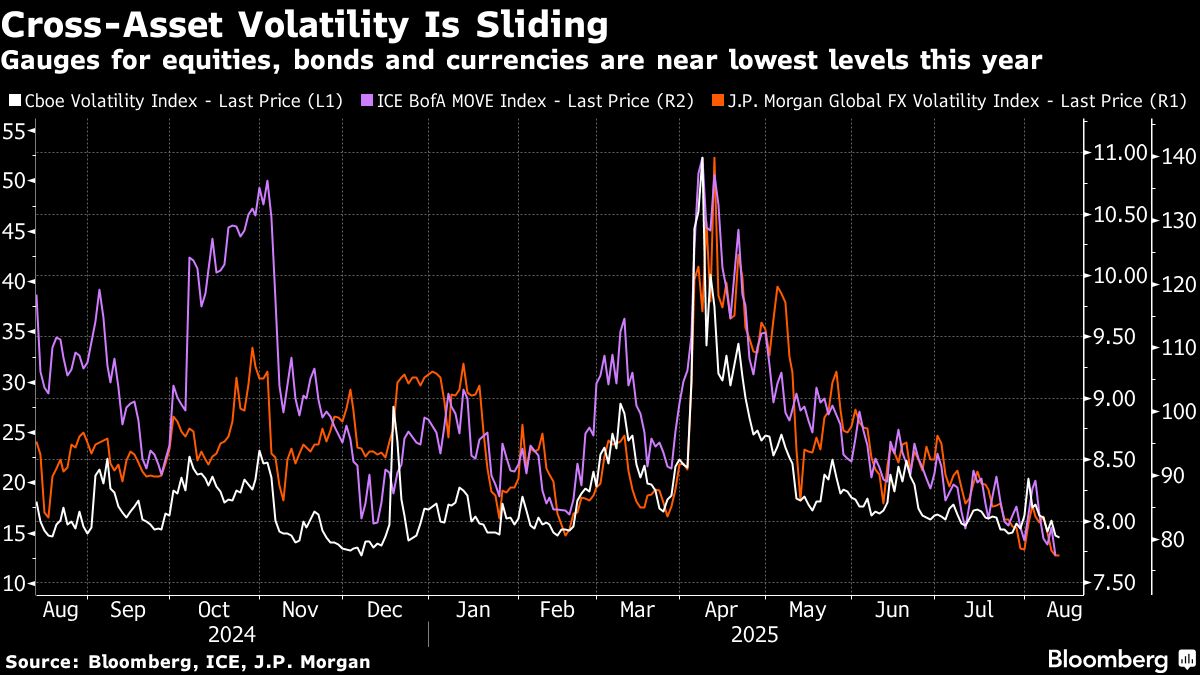

(Bloomberg) — Across equity, bond and currency markets, gauges of volatility are slumping to their lowest levels of the year.

The Cboe Volatility Index, which measures the expected 30-day volatility for the S&P 500 — and dubbed Wall Street’s fear gauge — just fell to its lowest since December. A similar index for global currencies is the weakest in a year, while a gauge for US Treasuries is at levels last seen in early 2022.

Most Read from Bloomberg

It might seem jarring that markets are pricing a limited chance of swings given a backdrop that’s littered with risk, from geopolitical tensions and sticky inflation to US President Donald Trump’s threats to the Federal Reserve’s independence. But dig a little deeper, and the moves start to stack up.

For starters, there’s “a lot of cash sitting on the sidelines,” said Mohit Kumar, chief economist at Jefferies International. That means plenty of investors are ready to snap up assets at lower prices, damping any selloffs before they really get going.

Then there’s the global economy, which seems far from sinking into the recession that many feared was inevitable when Trump moved to reshape global trade in April, triggering weeks of wild price swings.

Indeed, the US President has walked back from his most extreme tariffs threats, stoking investor confidence that he will ultimately always relent after aggressive posturing. That strategy — which analysts and strategists call “TACO” for “Trump Always Chickens Out” — mean investors have stepped in for fear of missing out on a rally.

Investors “realize that they’re watching the market go up,” said Guy Miller, chief market strategist and head of macroeconomics at Zurich. “There are still a lot of risks out there, but they feel they have to participate in this.”

To be sure, markets have seen bouts of turbulence this month. The VIX reached nearly 22 points intra-day on worse-than-expected payrolls data and tariffs, but it’s already displaying the pattern that options traders are accustomed to – fast reversal to lower levels.

The latest retreat came this week as the S&P 500 notched a fresh record high on Tuesday afternoon, with soothing inflation data boosting bets for a Fed interest-rate cut. In contrast to earlier this year, when even one cut was in doubt, money markets are now fully pricing two-quarter point reductions and a chance of a third by year-end.

Story Continues