(Bloomberg) — Treasuries edged up to recover some of their losses from a higher US inflation print, which led traders to trim bets on an interest-rate cut by the Federal Reserve next month.

Bonds inched up across the curve, with yields on the policy-sensitive two-year note falling one basis point to 3.72%. The dollar weakened while the yen led most Group-of-10 currencies higher. Gold rose along with an index for Asian equities. Oil was steady as investors braced for the summit between the US and Russian presidents in Alaska later Friday. Futures for the S&P 500 gained 0.2% and that for European stocks advanced 0.4%.

Shares in Hong Kong weakened 1.2% after data showed China’s economy slowed in July with factory activity and retail sales disappointing, suggesting Donald Trump’s trade war is starting to weigh on the world’s No. 2 economy. Japanese shares rose 1% after the country’s economy expanded faster than expected last quarter.

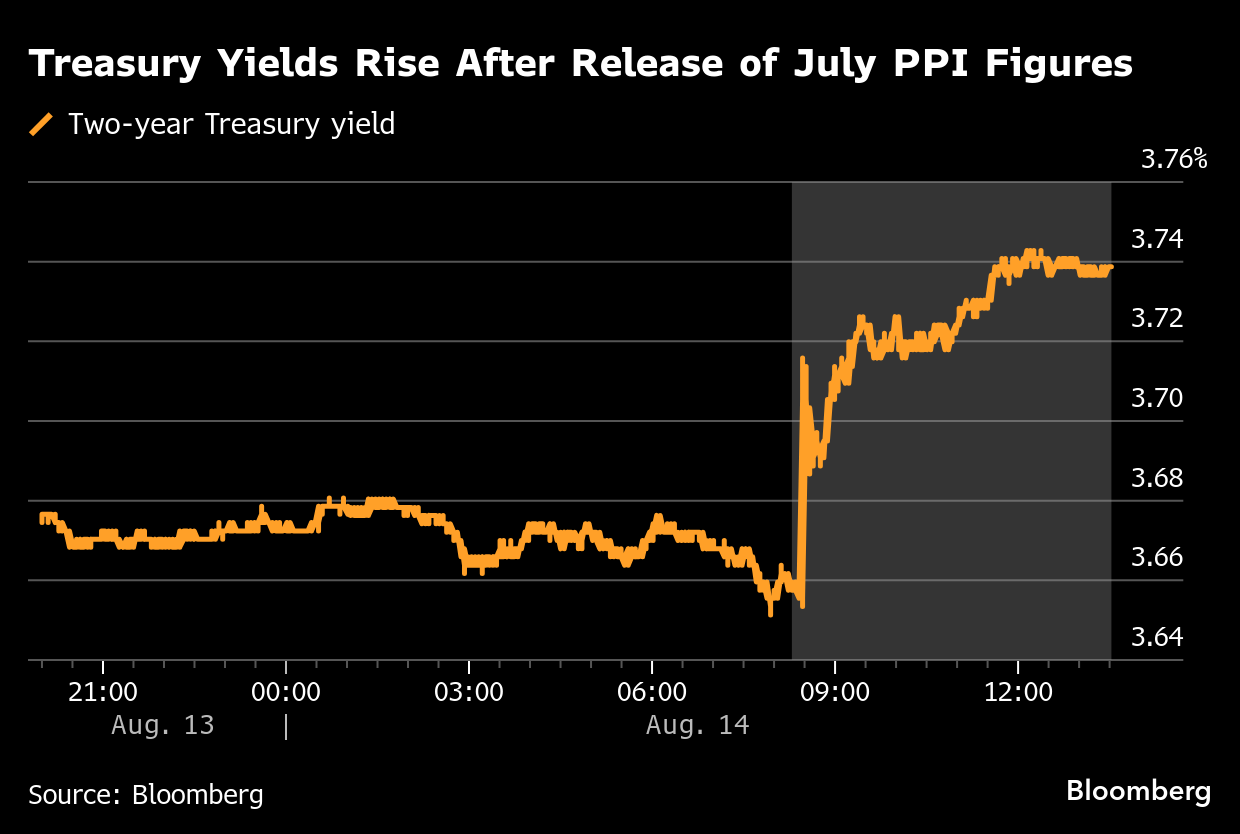

Risk sentiment had been buoyed in previous days by expectations of monetary easing in the US, with traders fully pricing in a quarter-point reduction. But with US wholesale inflation accelerating in July by the most in three years, traders trimmed the odds of a September rate cut to about 90% from previously fully pricing it in.

“Markets shouldn’t take for granted that rates will be cut deeply because there is an inflation problem in the US,” said Kyle Rodda, a senior market analyst at Capital.com in Melbourne.

The higher-than-expected increase in the US producer price index — which suggests companies are passing along elevated import costs tied to tariffs — halted a Treasuries rally and surprised investors.

Traders had piled into bets on a September rate cut, with some wagering on a 50-basis-point move, after a largely benign report on consumer prices this week and comments from Treasury Secretary Scott Bessent in which he said policymakers could bring down borrowing costs as much as 1.5 percentage points.

What Bloomberg Strategists say:

“Treasuries will remain nervous heading into next week’s Jackson Hole event. The risk is for sharp steepening moves, with inflation concerns likely to see long-dated debt underperform.

Garfield Reynolds, MLIV Team Leader.

Chinese financial authorities are taking “encouraging” steps to combat deflationary trends in the economy, according to Barclays APAC Chief Asia Economist Jian Chang. Chang speaks as China’s economy has been slowing across the board in July with factory activity and retail sales disappointing.Source: Bloomberg

Chinese financial authorities are taking “encouraging” steps to combat deflationary trends in the economy, according to Barclays APAC Chief Asia Economist Jian Chang. Chang speaks as China’s economy has been slowing across the board in July with factory activity and retail sales disappointing.Source: Bloomberg

Meanwhile, production at Chinese factories and mines rose at the slowest rate since November and expanded 5.7% last month from a year earlier. The median forecast of economists in a Bloomberg survey was for an increase of 6%. Retail sales grew 3.7% on year in July, the least this year, down from 4.8% in the previous month.

China’s new-home prices fell at a faster pace in July, in a further sign that a series of stimulus measures has failed to revive the moribund market.

China’s housing slump has dragged on for more than four years, with sales falling further since the second quarter. Calls for additional policy support have grown as the effects of a stimulus blitz last September wear off.

In geopolitical news, Russian President Vladimir Putin sought to strengthen his rapport with Trump ahead of their summit, praising the US leader’s efforts to broker an end to the war in Ukraine and dangling the promise of economic cooperation as well as a new arms control treaty.

Corporate News:

The Trump administration is in talks with Intel Corp. to have the US government take a stake in the beleaguered chipmaker, according to people familiar with the plan, in the latest sign of the White House’s willingness to blur the lines between state and industry.Applied Materials Inc., the largest American producer of chipmaking gear, plunged in late trading after giving a disappointing sales and profit forecast,Guangzhou Innogen Pharmaceutical Group Co., a Chinese biotech firm looking to tap the vast domestic market for obesity drugs, surged as much as 296% in its trading debut in Hong Kong.Hon Hai Precision Industry Co. shares rose as much as 4.3% in Taipei after the company reported better-than-projected 2Q results and forecast strong AI server growth.Warren Buffett’s Berkshire Hathaway Inc. bought shares of UnitedHealth Group Inc. in the second quarter, sending the health insurer’s stock soaring in post-market trading.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 1:32 p.m. Tokyo timeJapan’s Topix rose 1.3%Australia’s S&P/ASX 200 rose 0.5%Hong Kong’s Hang Seng fell 1.2%The Shanghai Composite rose 0.5%Euro Stoxx 50 futures rose 0.4%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%The euro rose 0.1% to $1.1660The Japanese yen rose 0.4% to 147.15 per dollarThe offshore yuan was little changed at 7.1856 per dollar

Cryptocurrencies

Bitcoin rose 1.1% to $119,272.44Ether rose 2.1% to $4,631.1

Bonds

The yield on 10-year Treasuries declined one basis point to 4.27%Japan’s 10-year yield advanced one basis point to 1.565%Australia’s 10-year yield advanced two basis points to 4.23%

Commodities

West Texas Intermediate crude fell 0.2% to $63.85 a barrelSpot gold rose 0.3% to $3,346.34 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.