Read our AgLetter Insights Q&A with author David Oppedahl next week for further insights into Seventh District farmland values and agricultural credit conditions described in this issue of AgLetter.

Farmland values

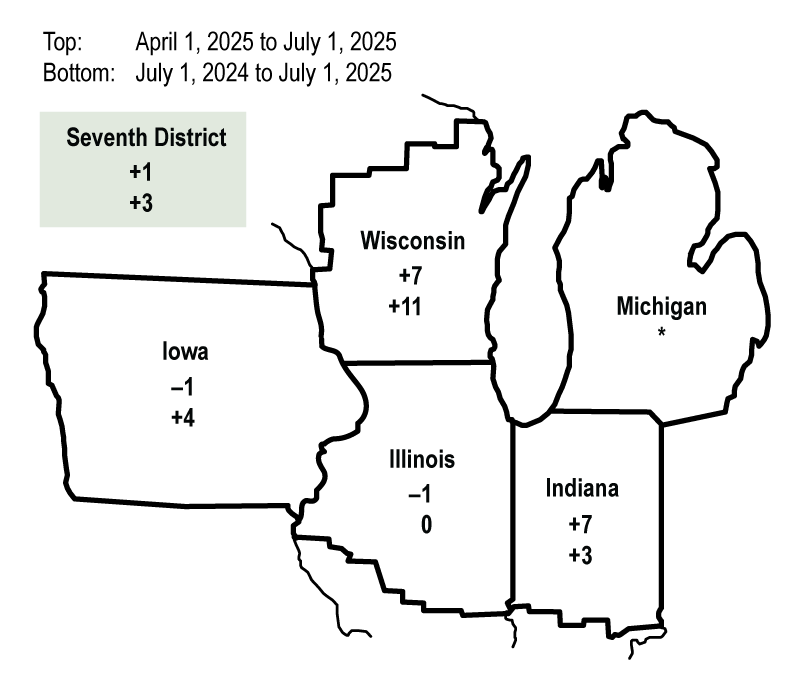

Farmland values for the Seventh Federal Reserve District rose 3% in the second quarter of 2025 from a year

earlier, marking the largest year-over-year gain since the first quarter of 2024. Values for “good” agricultural

land were 1% higher in the second quarter of 2025 relative to the first quarter, according to survey responses

from 98 District agricultural bankers. Indiana, Iowa, and Wisconsin agricultural land values exhibited

year-over-year increases of varying degrees; meanwhile, Illinois farmland values were unchanged on a

year-over-year basis (see figure 1). In real terms (after being adjusted for inflation with the Personal

Consumption Expenditures Price Index, or PCEPI), there was a year-over-year increase of 1% in District

agricultural land values. This was the first positive year-over-year change in real farmland values for the

District since the first quarter of 2024. Indiana and Wisconsin bankers cited real estate development as

contributing to higher farmland values. For Indiana, there was also mention of investment activity, including

solar and wind projects, factoring into rising agricultural land values.

1. Percent change in dollar value of “good” farmland

*Insufficient response.

Credit conditions

Agricultural credit conditions for the District were slightly weaker in the second quarter of 2025 than a year

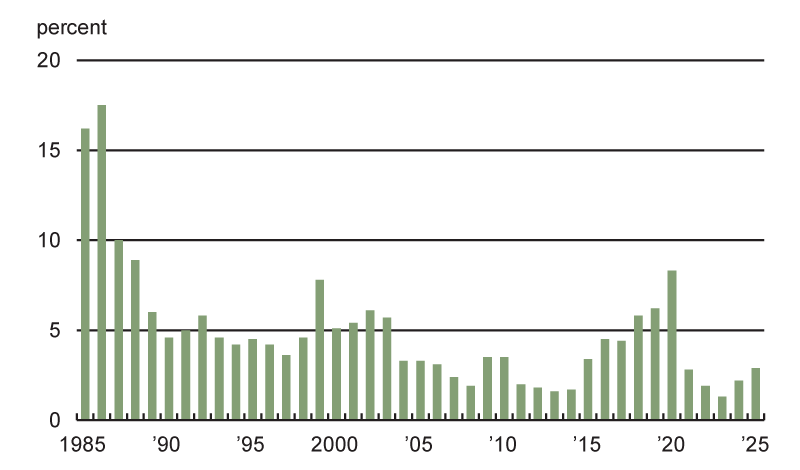

ago. The share of farm loans with “major” or “severe” repayment problems in the District’s agricultural loan

portfolio (as measured in the second quarter of every year) was 2.9% in 2025, up from last year’s level of 2.2%

and the highest reading since 2020 (see figure 2). Furthermore, the share of farm loans with “no” repayment

problems declined to 90.1% from 91.6% a year ago. Also, repayment rates for non-real-estate farm loans were

lower in the second quarter of 2025 compared with a year ago, and renewals and extensions of such loans were

higher (see figure 3). The breakdown of the index numbers follows:

The index of demand for non-real-estate farm loans was 121 for the second quarter of 2025; 40% of survey

respondents observed higher loan demand compared with a year ago, while 19% observed lower demand.

The index of funds availability stood at 90 for the second quarter of 2025; 8% of survey respondents noted

that their banks had more funds available to lend than a year ago, while 18% noted they had less.

The index of loan repayment rates for non-real-estate agricultural loans in the second quarter of 2025 was

71; only 2% of responding bankers noted higher rates of loan repayment than a year ago, while 31% noted

lower rates.

The index of loan renewals and extensions of non-real-estate farm loans was 135 in the second quarter of

2025; 35% of survey respondents reported more of them than a year earlier, while no respondents reported

fewer.

The District’s average loan-to-deposit ratio rose to 78.1% in the second quarter of 2025—the highest reading

since the first quarter of 2020 and over 3 percentage points below the average level desired by the responding

bankers. The amount of collateral required by banks across the District was higher than a year ago. Over the

first half of 2025, District banks made more farm operating loans and fewer farm mortgages than normal,

according to responding bankers. Over the same time period, bankers reported that Farm Credit System lenders, as

well as merchants, dealers, and other input suppliers, lent more funds to the agricultural sector than normal,

while life insurance companies lent less.

Average nominal interest rates on farm operating, feeder cattle, and farm real estate loans were down a little

during the second quarter of 2025 from the first quarter. As of July 1, 2025, the District’s average nominal

interest rates on new operating loans (7.63%), feeder cattle loans (7.69%), and farm real estate loans (7.02%)

were at their lowest levels since the fourth quarter of 2022. In real terms (after being adjusted for inflation

with the PCEPI), the average interest rates on operating loans, loans for feeder cattle, and loans for farm real

estate were up slightly from the first quarter of 2025 (their first increases after three consecutive quarters

of declines).

2. Percentage of Seventh District farm loan portfolio with “major” or “severe” repayment problems

Source: Authors’ calculations based on data from Federal Reserve Bank of Chicago surveys of farmland values (for the second quarter of each year).

3. Credit conditions at Seventh District agricultural banks

a Bankers responded to each item by indicating whether conditions in the current quarter were

higher or lower than (or the same as) in the year-earlier quarter. The index numbers are computed by

subtracting the percentage of bankers who responded “lower” from the percentage who responded “higher”

and adding 100.

b During period (in percent).

c At end of period (in percent).

Note: Historical data on Seventh District agricultural credit conditions are available

online.

Latest period

Prior period

Year ago

2025:Q2

2025:Q1

2024:Q2

Indexesa

Loan demand

121

143

104

Funds availability

90

94

74

Loan repayment rates

71

61

85

Loan renewals and extensions

135

133

123

Average loan-to-deposit ratiob

78.1

76.9

76.9

Interest rates on farm loansc

Operating loans

7.63

7.73

8.47

Feeder cattle loans

7.69

7.76

8.44

Real estate loans

7.02

7.09

7.55

Looking forward

Looking ahead to the third quarter of 2025, only 4% of the responding bankers anticipated farmland values to

rise, while 78% anticipated them to be stable and 17% anticipated them to fall (the shares do not add up to 100%

because of rounding). A majority of survey respondents were of the view that District farmland was overvalued

(not a single respondent was of the view that it was undervalued).

Survey respondents expected higher volumes for non-real-estate agricultural loans (primarily for operating loans,

feeder cattle loans, and loans guaranteed by the Farm Service Agency) in the third quarter of 2025 compared with

year-earlier levels. Farm machinery, grain storage construction, and farm real estate loan volumes were expected

to shrink below the levels seen in the third quarter of 2024. According to an Iowa respondent, “If the commodity

market doesn’t significantly improve, our farmers in this area are going to have a tough time making any profit

for the second year in a row.” This view reflected the broad consensus of the responding agricultural bankers

regarding the challenges facing corn and soybean operations, though livestock operations seemed to be in overall

better shape.

On September 30, 2025, the Federal Reserve Bank of Chicago will hold a hybrid event to explore

interrelationships between Midwest farming and agricultural trade. Registration for the annual Midwest

Agriculture Conference is available

online.

Opinions expressed in this article are those of the author(s) and do not necessarily

reflect the views of the Federal Reserve Bank of Chicago or the Federal Reserve System.