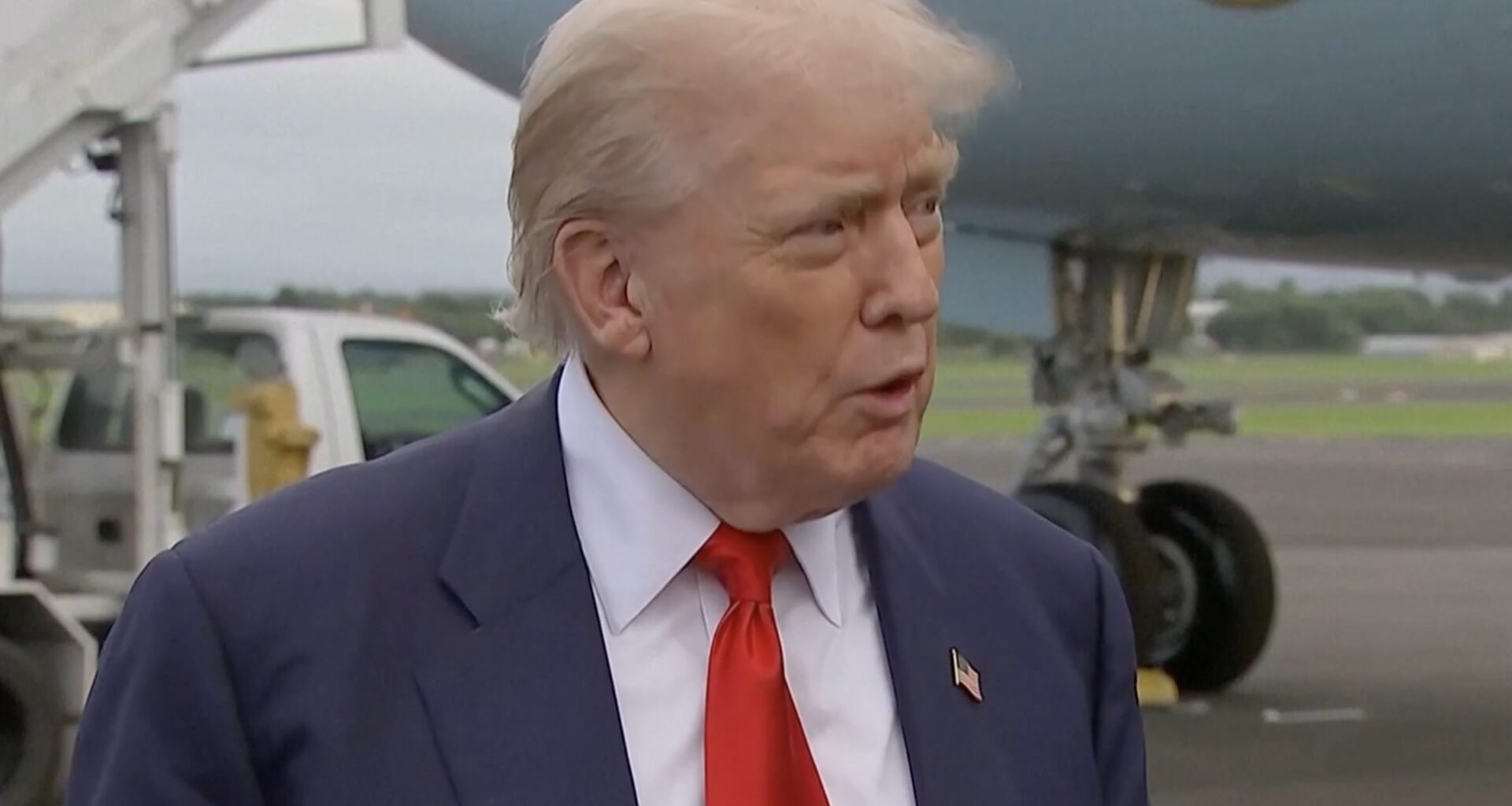

At the centre of the unease lies U.S. President Donald Trump’s shifting stance on Ukraine and Russia, particularly his ambiguous comments regarding Crimea and the possibility of easing sanctions. Traders say the lack of clarity has amplified volatility in bond and currency markets, as fund managers attempt to assess whether a dramatic change in Western policy towards Moscow is imminent.

The geopolitical tremors come at a time when many stock indices are pushing to record highs, propelled by strong corporate earnings and resilient consumer demand. Yet the disconnect between buoyant equities and nervous geopolitics has left some analysts warning that investors may be too complacent.

Crimea in the Spotlight

The focus of market jitters has been Trump’s suggestion, made in recent remarks, that the United States should “rethink its stance” on Crimea. The peninsula, annexed by Russia in 2014, remains internationally recognised as Ukrainian territory, and Western sanctions imposed in the wake of the annexation continue to bite Moscow’s economy.

Trump’s musings about “a new arrangement” were interpreted by some as an openness to sanctions relief, a prospect that alarmed European allies and left investors scrambling. “Markets crave stability, and what they got instead was the spectre of a major policy reversal,” said Elena Grigoryeva, chief economist at a London investment house. “If sanctions are lifted suddenly, energy markets, defence stocks, and sovereign bonds across Eastern Europe will all have to be repriced overnight.”

Europe Watches Nervously

For European capitals, the uncertainty has a dual effect. On the one hand, relief in energy markets could help lower costs for industries and households, particularly as winter approaches. On the other, any weakening of Western resolve is seen as undermining Ukraine’s defence, with potential knock-on effects for regional security.

Bond spreads in Eastern Europe widened on Monday, with Lithuanian and Polish government debt facing selling pressure, reflecting fears that any U.S. rapprochement with Russia could embolden the Kremlin to test NATO’s eastern flank. The euro also softened slightly against the dollar as traders sought safe-haven positions.

Diverging Market Signals

Despite the geopolitical fog, U.S. and European stock markets have continued to post gains, buoyed by strong corporate results in the technology and healthcare sectors. The S&P 500 touched a new high, while Frankfurt’s DAX and Paris’s CAC 40 were also firmer. Investors appeared willing, at least for now, to separate immediate earnings optimism from longer-term strategic uncertainty.

Yet not everyone is convinced the calm can last. “Markets are not good at pricing geopolitical risk until it is too late,” said Markus Weber, a Frankfurt-based fund manager. “This is the same complacency we saw before the invasion of Ukraine in 2022, when investors assumed diplomacy would prevail. We know how that ended.”

Currency and Commodity Turbulence

The sharpest moves have been in commodities and currencies. Oil prices slipped as traders weighed the potential for increased Russian exports should sanctions be relaxed. Conversely, natural gas futures rose, reflecting European fears of renewed supply pressure if diplomacy falters.

The rouble strengthened modestly against the dollar, an unusual move during times of geopolitical uncertainty, underscoring market expectations that Moscow could gain economically if sanctions are rolled back. Meanwhile, gold prices ticked higher as investors sought refuge from volatility.

Trump’s Unpredictability

Underlying the market gyrations is the unpredictability of Trump’s approach. Unlike previous administrations, which maintained consistent lines on sanctions policy, Trump has oscillated between tough rhetoric and conciliatory language. Investors are left guessing whether his comments on Crimea represent a trial balloon, a negotiating tactic, or a genuine policy shift.

“The difficulty is that no one knows how seriously to take him,” said a senior European diplomat in Washington. “Markets are trying to price in uncertainty, but that is inherently impossible when the President himself thrives on ambiguity.”

Investor Caution Ahead

Looking ahead, traders are bracing for further volatility as diplomatic manoeuvres continue. Zelenskyy’s meetings in Washington this week, alongside several European leaders, are expected to yield signals about whether the U.S. remains committed to Kyiv or whether it is preparing to recalibrate its position.

For now, investors are hedging their bets. Options activity in both equity and bond markets has spiked, while demand for U.S. Treasuries—long considered the ultimate safe asset—has risen sharply.

The paradox is that while stock markets celebrate strong quarterly results, the geopolitical backdrop grows darker. Whether the optimism of the trading floor or the caution of the bond market proves right will depend on decisions taken in Washington over the coming weeks.

As one London trader put it: “Right now, the world’s most important market signal is not an earnings report or a central bank speech—it is a comment from Donald Trump. And that is making everyone nervous.”

Post Views: 771