The state must plan today for the import capacity that can smooth the transition.

When two major California refineries recently announced they would be closing – Phillips 66’s Wilmington facility will shutter in December and Valero’s Benicia plant next April – it put the state on a path to quickly lose about 18% of its refining capacity. There’s been a lot of discussion about what this could do to markets for gasoline and other refined products. And many have proposed state policies to respond.

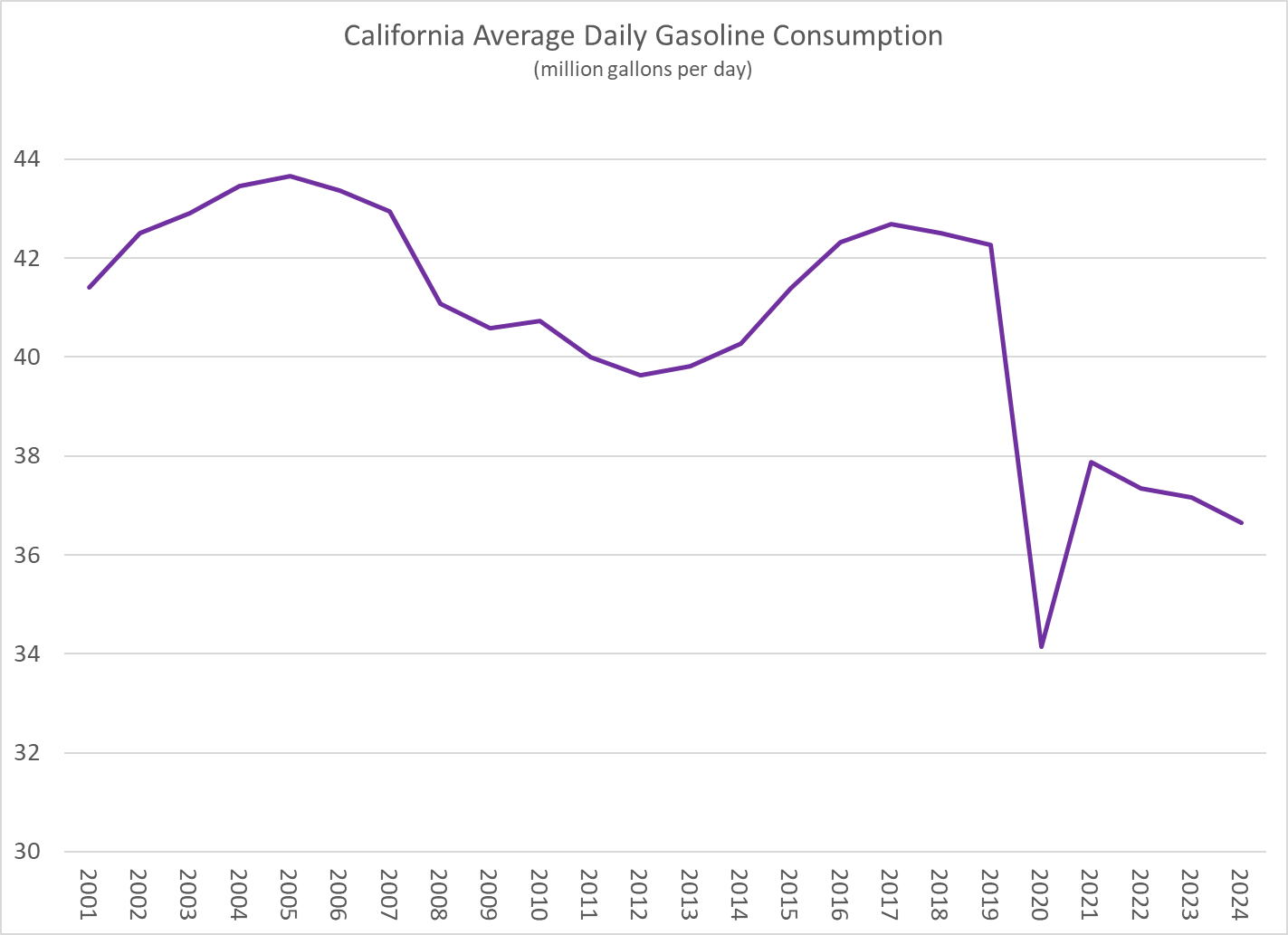

Before we get to solutions, let’s get on the same page about the problem. California refineries have been closing for years, in part due to increasingly strict environmental regulation and local opposition, in part because more efficient refineries have been expanding their production, and most recently because the state has committed to reducing its consumption of petroleum-based transportation fuels. It took a long time for gasoline demand in California show a convincing downward trend, but it finally seems to be happening. Whether that will continue given the powers in Washington D.C. is an open question.

(Source: California Department of Tax and Fee Administration)

These two latest refinery closures would reduce the total production in California faster than in-state consumption will plausibly decline. If that happened, and nothing else changed, the result would be a severe gasoline shortage and likely an unprecedented price increase.

California’s Current Gasoline Price Problem

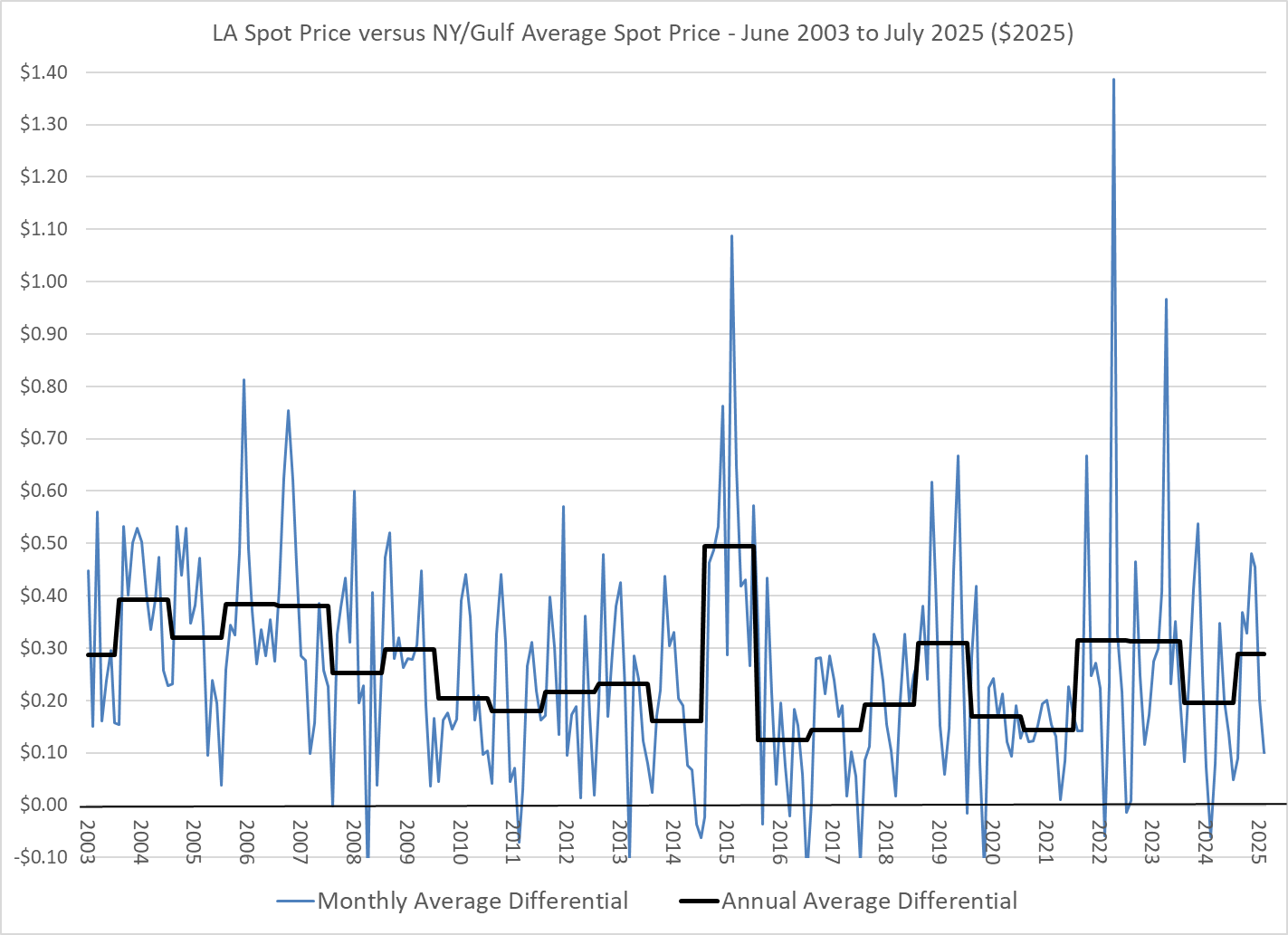

To be clear, these refineries haven’t closed yet and a shortfall of gasoline supply is not the cause of today’s high prices. As I have written about before, the price of gasoline in the wholesale spot market isn’t much out of line with the rest of the country after accounting for the higher cost of making the California blend. And that difference has held steady or declined slightly over the last two decades.

(Source: Energy Information Administration – data not available before June 2003)

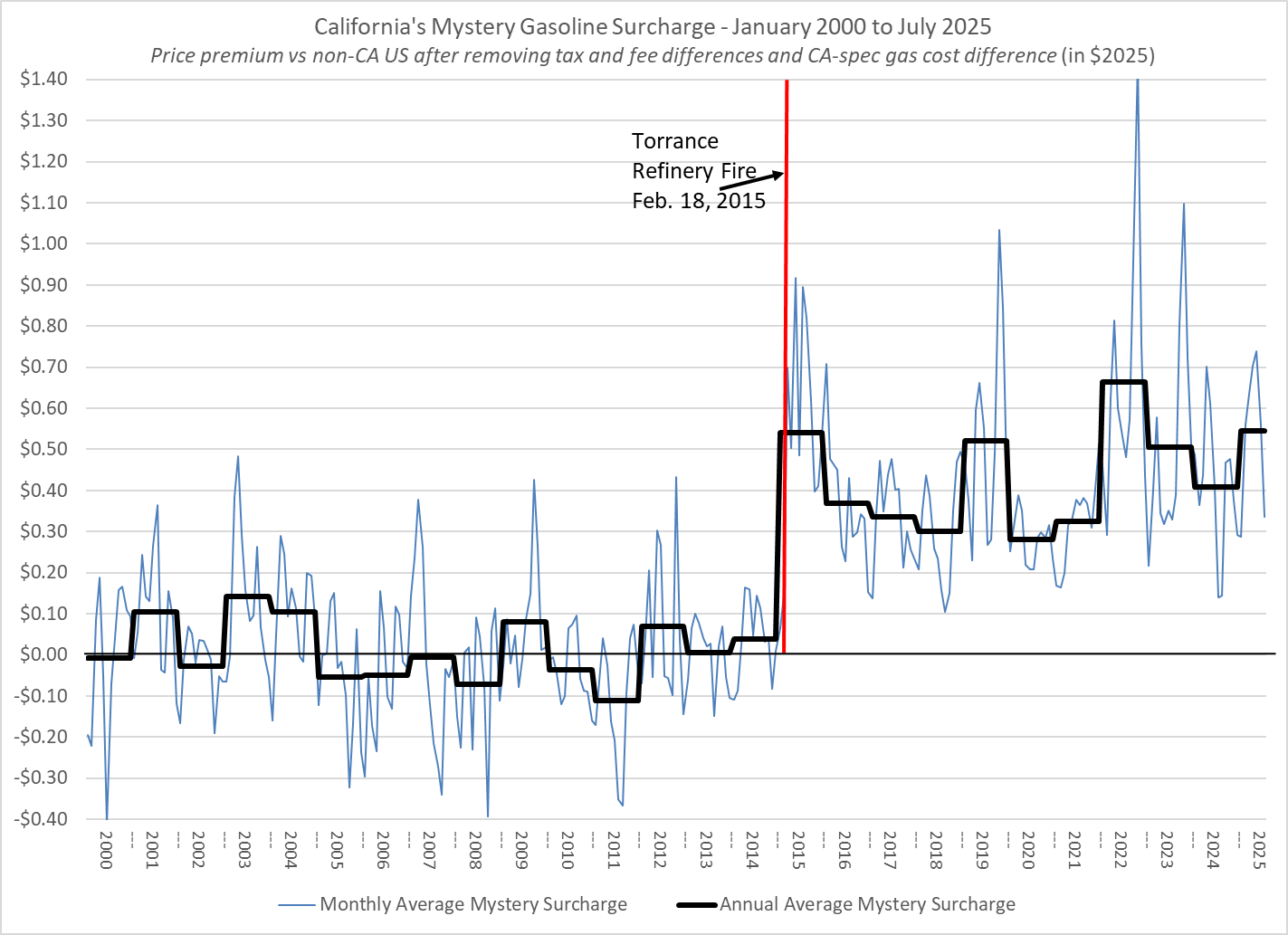

However, so far in 2025, California’s average retail gas price at the pump has averaged $1.47 above the rest of the US. About $0.93 of that difference is due to higher taxes and environmental fees, plus the higher cost of producing our special blend. The other $0.54 is the Mystery Gasoline Surcharge that appeared in 2015 and has elevated our prices ever since. The state is investigating what might be the cause of that extra adder, but most of it is not in the wholesale spot market price, so not caused by an actual lack of gasoline supply.

(Author calculation from many data sources – Supporting Data Here)

How Gas Prices Could Get Worse, or Not

When these two refineries close, will we see shortages that will drive gas prices to $8 per gallon or higher as the oil industry has been asserting? It could happen, but only if there is a major failure of markets and government policy.

For years, some of the supply of our low-polluting gasoline – as well as the “blendstocks” needed to produce it here – has been imported from other states and countries. Despite the common claim that California is a gasoline island, since adopting our special gasoline blend three decades ago we have always imported gasoline and blendstocks. And we have exported gasoline to neighboring states, particularly Arizona and Nevada.

The Free Trade Response

Probably the most commonly discussed solution to losing refining capacity in the state is to increase imports. But that requires having sufficient supply available from other markets, the shipping capacity to bring it to California (nearly all imports will need to come by sea), the port capacity to offload it once it gets here, the pipeline capacity to move it from the ports, and the storage capacity to make it available as it is needed. In an important recent analysis, Stanford economists Neale Mahoney and Ryan Cummings found that much, but not all, of this capacity already exists. Compensating for the refinery losses will still require concerted effort and government oversight to remove barriers that stand in the way of developing adequate capacity at each step of the supply chain. Nonetheless, adjusting trade with other regions to balance our gasoline market is both a realistic solution and a common practice in California, as well as in all other markets in the country. Even the CEO of Phillips 66 thinks imports (page 9) are the way to replace the lost refinery capacity.

Reducing exports from California might also be part of that solution. The gasoline California’s refineries send to neighboring states typically does not meet California specifications, but with additional refining and blendstocks more of it could. This would likely happen without any government intervention as refineries see a greater profit opportunity selling in California than in neighboring states. The politics of this would be delicate to navigate as those states would likely howl that California was just transferring some of its fuel shortage to neighboring states, thereby raising their costs. There’s something to that, just as California has for years transferred some of its surplus fuel to neighbors, thereby lowering their costs.

(Source)

Subsidies for Local Refining

An alternative to import and export changes is to just keep the refineries open. This would almost certainly require subsidizing refinery operations. Something similar is occasionally done in electricity markets. It would, however, be much more complicated in this case, because refineries are far more complex operations than electricity generation. They take in many different types of crude oil and produce many different types of refined products, so it would require substantial resources and data to figure out how much additional revenue the refinery needs to stay in business. Meanwhile, refineries would happily quote the highest number they think that the state would be willing to pay. Given that these plants are shutting down while California is importing gasoline, the market is already sending a pretty strong signal that these refineries are not cost competitive with imports.

Reducing Environmental Regulation

Some critics of California’s choice to use a separate gasoline blend suggest that the solution is to switch to using the same specification as elsewhere in the country. Completely apart from the refinery closures, that’s worth considering – even some advocates of the cleaner formulation a few decades ago argue that the benefits are likely now much smaller as engine technology has improved. It is possible that the clean air benefits of our special formulation are no longer large enough to justify the costs. Still, it’s unlikely that dropping California’s separate blend would do much to address the shortage from the refinery closures. There are no pipelines to bring in supply from refineries outside California. Furthermore, Mahoney and Cummings present evidence that there would not be a problem finding additional supplies of California-spec fuel or the blendstocks to make it.

Some in California’s oil industry have argued that the state should respond to the impending refinery closures by loosening environmental restrictions on oil drilling to boost crude production. Obviously, the connection is very indirect. They contend that California crude oil production helps keep refineries open by supplying oil more cheaply than when it comes from out-of-state wells. While increased in-state oil production might keep a refinery open due to the specific logistics of supply, the environmental restrictions reflect real damage imposed by production that needs to be weighed in policy. At the same time, California will remain a crude oil importer, so the price of gasoline will still be driven by the world price of crude. More importantly, the longer run challenge is to balance refining supply and demand, which oil production doesn’t address. As our gasoline consumption ramps down, we will lose refineries and import capacity will be needed. Its importance will be even greater as the the number of California refineries dwindles and importing becomes a critical check on the market power of the remaining in-state refiners. So, now is the time to reduce barriers to imports.

Hard Market Truths of Weaning Off Gasoline

California has committed to winding down its use of gasoline, which will inevitably lead to refinery closures. At times we will have less production capacity than is needed, and at other times we may have more. The state has to figure out how to navigate this supply/demand volatility. Other states don’t attempt to produce exactly the quantity of gasoline (or any other good) that they consume. Instead they allow imports and exports to adjust in order to keep markets in balance.

Once again, California is on the bleeding edge of decarbonization policies. We have the opportunity to lead by example, but also the risk of becoming a cautionary tale.

—

I am now posting suggested energy readings (and some political views) most weekdays on Bluesky @severinborenstein.bsky.social

Follow us on Bluesky and LinkedIn, and subscribe to our email list to keep up with future content and announcements.

Suggested citation: Borenstein, Severin. “California’s Refinery Closure Drama” Energy Institute Blog, UC Berkeley, August 18, 2025, https://energyathaas.wordpress.com/2025/08/18/californias-refinery-closure-drama/

—

By default comments are displayed as anonymous, but if you are comfortable doing so, we encourage you to sign your comments.