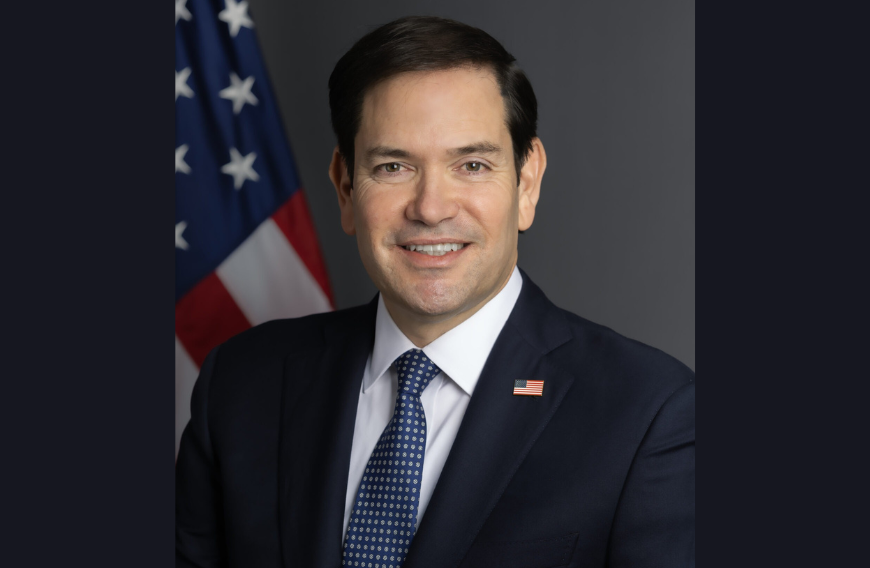

U.S. Secretary of State Marco Rubio has come out with a justification for President Donald Trump’s so-called hypocrisy when sparing China from tariffs while escalating tariff tensions with India.

Rubio has explained why America has spared China — Russia’s biggest oil buyer — from any secondary sanctions, even as 50% tariffs were imposed on India, including a 25% duty for New Delhi’s trade with Moscow. According to Rubio, the majority of Russian oil that Beijing is purchasing is being refined and then sold in the global marketplace. He noted that any additional sanctions on China could drive up global energy prices.

“Well, if you look at the oil that’s going to China and being refined, a lot of that is then being sold back into Europe. Europe’s also buying natural gas still. Now, there are countries trying to wean themselves off it, but there’s more Europe can do with regard to their own sanctions,” Rubio said in an interview with Fox Business on Sunday.

READ: ‘Golden Age of Crypto’: Trump appoints new group to promote digital finance (July 31, 2025)

China plays a critical and multifaceted role in the Russian oil trade, far beyond simply refining it. As Western nations imposed sanctions on Moscow following the Ukraine war, China emerged as Russia’s largest energy customer and a vital economic lifeline.

First, China imports massive volumes of Russian crude oil, primarily ESPO (East Siberia Pacific Ocean) and Urals blends, at discounted prices. These are refined by both state-owned giants like Sinopec and independent refineries, particularly in Shandong province. The resulting product, diesel, gasoline, and petrochemicals, are used domestically and also exported, particularly to Asia and Africa.

Beyond refining, China helps Russia bypass sanctions through financing, logistics, and insurance. Chinese banks and insurers have stepped in where Western institutions withdrew, facilitating payments and underwriting shipping. Transactions often occur using China’s Cross-Border Interbank Payment System (CIPS), an alternative to SWIFT, reducing exposure to U.S. and European financial controls.

China also strategically stockpiles Russian oil in its massive petroleum reserves, increasing energy security while gaining leverage in global markets. Some oil is blended with other crude types to obscure its origin before re-export, complicating enforcement of sanctions.

Additionally, China has invested heavily in Russian energy infrastructure, gas pipelines like Power of Siberia, Arctic LNG projects, and port terminals, cementing long-term energy ties.

In essence, China doesn’t just refine Russian oil, it enables, secures, and expands Russia’s energy trade. This relationship has strengthened as Western pressure isolates Moscow, positioning China as both a key energy partner to Russia and a central player in reshaping global oil flows and geopolitical dynamics.

Marco Rubio said the European nations that buy Russian oil from China have already expressed unease over any punitive measures against Beijing.

To a follow-up question on whether sanctions are being contemplated against Europe for continuing to buy oil and gas from Russia, Rubio said, “Well, I don’t know about (sanctions) on Europe directly, obviously, but certainly there are implications to secondary sanctions.”

He added that he doesn’t want to get into a tit-for-tat with the Europeans on this matter. “I think they can play a very constructive role here in helping us get to that point,” he said.

It seems the reasoning behind sparing China is that sanctioning China more aggressively risks driving up global energy prices, potentially destabilizing economies worldwide. Additionally, European nations’ dependence on energy indirectly linked to China’s refining activities complicates sanction enforcement. China’s multifaceted engagement, including financing, logistics, strategic stockpiling, and infrastructure investments, makes it a pivotal player in sustaining Russian energy exports despite Western pressure.