Midstream firm Williams Cos. is exploring a sale of its Haynesville Shale upstream natural gas assets, CEO Chad Zamarin said.

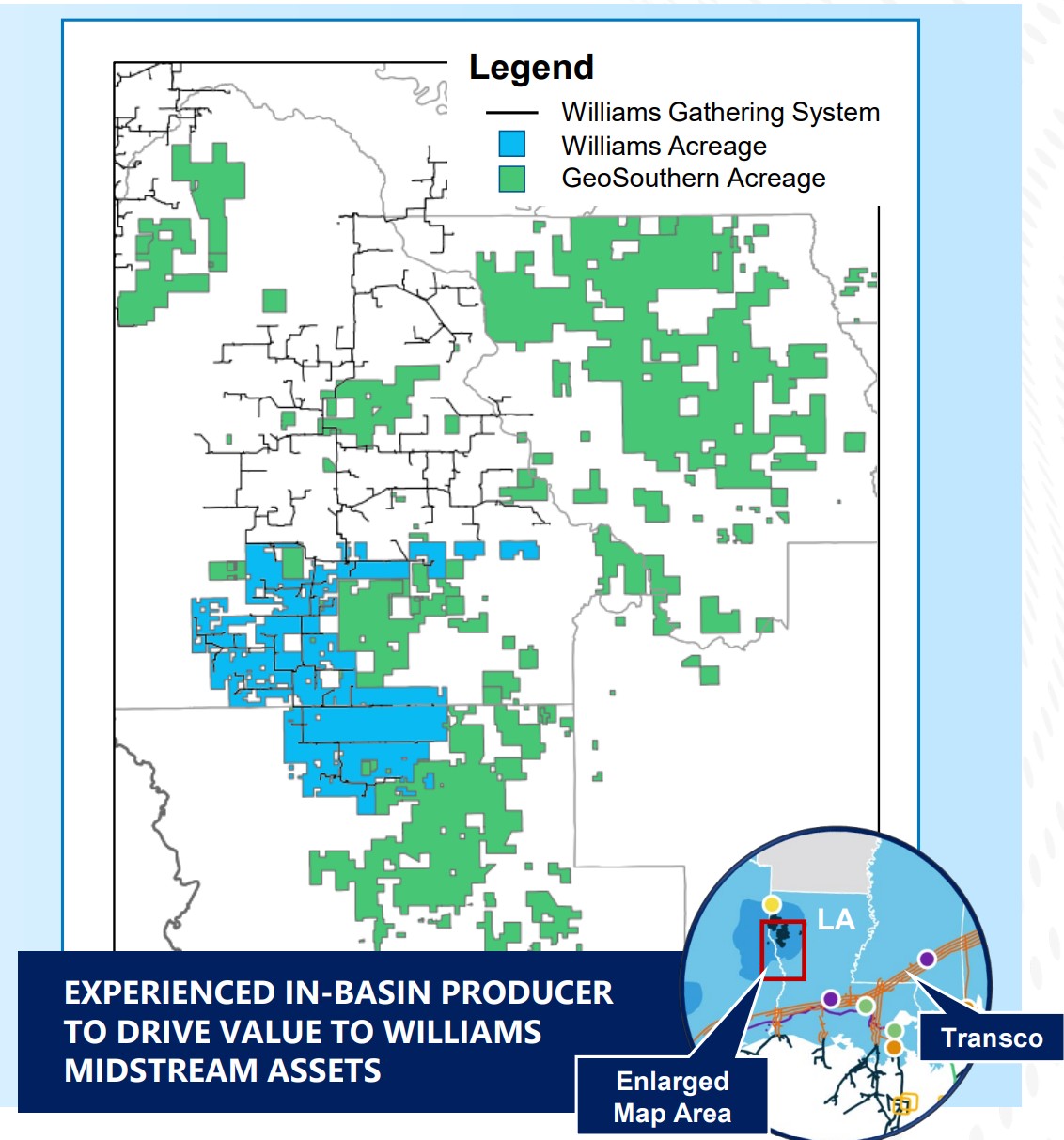

Williams owns a non-operated minority stake in a Louisiana Haynesville joint venture (JV) with E&P GeoSouthern Energy Corp. The JV, called GEP Haynesville II, is one of the largest gas producers in the basin.

Hart Energy reported last month that GeoSouthern and Williams were working with financial advisers to market the Haynesville assets to potential buyers.

Buyer interest for U.S. natural gas assets is increasing as rising demand fuels LNG exports and power generation. Experts say the Haynesville is well positioned to supply large new LNG export projects coming online along the U.S. Gulf Coast.

Asked by Hart Energy about a potential sale during an EnerCom Denver conference luncheon, Zamarin responded: “Our goal is not to be a long-term upstream operator in the Haynesville.”

“Right now might be a good time—we’ll see.”

Williams and GeoSouthern hold approximately 50,000 net acres in the southern portion of the Louisiana Haynesville play. The mostly undeveloped properties were transferred to Williams as part of Chesapeake Energy’s bankruptcy and restructuring process.

Williams formed a JV with GeoSouthern Energy in 2021 to develop a block of Haynesville acreage adjacent to GeoSouthern’s existing assets. (Source: Williams Cos. investor relations)GEP Haynesville II

Williams formed a JV with GeoSouthern Energy in 2021 to develop a block of Haynesville acreage adjacent to GeoSouthern’s existing assets. (Source: Williams Cos. investor relations)GEP Haynesville II

Williams partnered with GeoSouthern in the summer of 2021 to develop the acreage. A seasoned Haynesville operator, GeoSouthern had been active in the basin since 2015 under a separate partnership with Blackstone’s credit arm, GSO Capital Partners.

“It has Haynesville and Middle Bossier acreage, which was just starting to see [Indigo Natural Resources] and [Vine Energy] have success in that area,” Zamarin said.

When Williams and GeoSouthern took over the Haynesville asset, it was only producing around 20 MMcf/d. Today, GEP Haynesville II produces about 600 MMcf/d, Zamarin said.

The huge production expansion has supported the build-out of Williams’ gas gathering assets in the Haynesville. Williams recently placed the new Louisiana Energy Gateway project into service, increasing the company’s natural gas gathering capacity by 1.8 Bcf/d.

“We’ve driven a tremendous amount of value through that downstream infrastructure,” Zamarin said.

Williams executives have been vocal about their intent to divest the upstream Haynesville assets after successfully expanding the midstream footprint.

But Zamarin noted that Williams and GeoSouthern aren’t pressured to sell during a period of price weakness. Henry Hub gas prices have plunged in recent months, partly on weaker demand from mild summer weather.

U.S. natural gas spot prices were trading around $2.75/MMBtu on Aug. 20. Futures prices average $3.50 over the next 12 months; 24-month strip is $3.70.

“For the right opportunity, we’ll be looking to exit,” Zamarin said. “So, I’d stay tuned on that.”

Sellers have fetched relatively high prices for Haynesville assets in recent transactions. TG Natural Resources, a subsidiary of Tokyo Gas, acquired a 70% stake in Chevron’s East Texas Haynesville assets for $75 million in cash and $450 million in capital carry, or about $525 million.

This spring, hedge fund Citadel acquired private Haynesville E&P Paloma Natural Gas for $1.2 billion. Paloma was the 10th-largest Haynesville gas producer.

Haynesville gas output is forecast to average 16 Bcf/d in the third quarter, up 11% year-over-year from 14.4 Bcf/d, according to U.S. Energy Information Administration (EIA) data.

“In the Haynesville region, we expect production to remain near current levels through early 2026, before rising in the second quarter in response to LNG-related demand,” the EIA wrote in its Aug. 12 Short-Term Energy Outlook.

RELATED

Exclusive: GeoSouthern, Williams Market Haynesville Gas Assets

Wyoming exploration

Williams is “far along the checklist of things we wanted to accomplish” with the Haynesville upstream assets.

The company is at an earlier stage with its operated footprint in Wyoming.

Williams partnered with Crowheart Energy to develop Wyoming’s Wamsutter Field in 2021. Williams owned a 75% stake in the JV; Crowheart, with 25% interest, operated the asset.

Crowheart and Williams landed horizontal wells in the Lewis Shale, one of Wyoming’s less-recognized benches, but with surprising results.

An Energy Advisors Group analysis found the Lewis wells competitive with those drilled in more established Rockies plays, such as the Uinta and Powder River basins.

Last November, Williams closed an acquisition of Crowheart Energy for $307 million in cash, taking over the Wyoming asset.

“That’s almost a 1-million-acre footprint,” Zamarin said. “It’s a massive footprint and it’s got some really interesting geology that I don’t think is well enough understood.”

The Late Cretaceous Lewis Shale member lies above the marginal marine Almond Formation of the Mesaverde group and below the shallow marine Fox Hills Sandstone. There are three parts to the Lewis: a lower shale, the middle “Dad” sandstone member and an upper shale, according to Novi Labs research.

Williams views the Wyoming asset through both an upstream and midstream lens, rather than treating it as purely an upstream play.

“We gather, we process, we move the NGLs, we have a fractionator at [Conway, Kansas], we have infrastructure that gets all the way down to [Mont Belvieu, Texas],” he said. “Think about how many times we touch that molecule and how much margin we can capture.”

After fully exploring and delineating the Wyoming asset, Williams will look to pursue a similar divestiture strategy in the future, Zamarin said.

RELATED

Williams Cos. Targets Lewis Shale After $307MM Green River JV Buyout