The United Kingdom market has been experiencing some turbulence, with the FTSE 100 index closing lower amid weak trade data from China, highlighting global economic challenges. As major indices face pressure, investors may turn their attention to undiscovered gems within the UK market that demonstrate resilience and potential for growth despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United KingdomNameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingB.P. Marsh & PartnersNA38.21%41.39%★★★★★★BioPharma CreditNA7.22%7.91%★★★★★★Goodwin19.83%10.66%18.55%★★★★★★BioventixNA7.39%5.15%★★★★★★Georgia CapitalNA6.53%10.96%★★★★★★Andrews Sykes GroupNA2.08%5.03%★★★★★★FW Thorpe2.95%11.79%13.49%★★★★★☆Nationwide Building Society277.32%10.61%23.42%★★★★★☆Law Debenture15.39%21.17%19.12%★★★★★☆AltynGold73.21%26.90%31.85%★★★★☆☆

Let’s uncover some gems from our specialized screener.

Simply Wall St Value Rating: ★★★★★★

Overview: M.P. Evans Group PLC, with a market cap of £683.70 million, operates through its subsidiaries to own and develop oil palm plantations in Indonesia and Malaysia.

Operations: The primary revenue stream for M.P. Evans Group comes from its Indonesian plantation operations, generating $352.84 million. The company’s net profit margin is a key financial indicator to consider, reflecting the profitability of its core business activities.

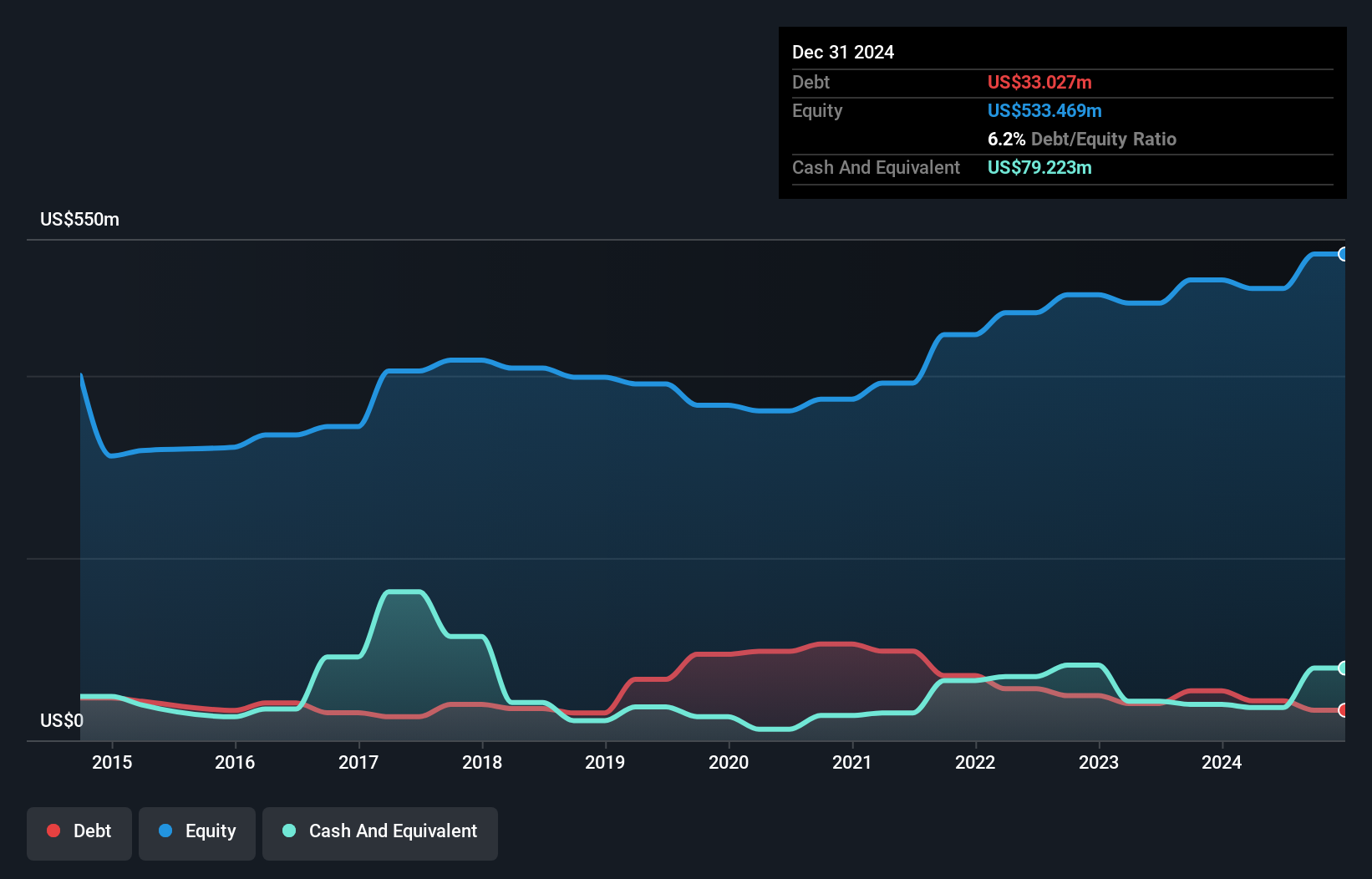

M.P. Evans Group, a small player in the agricultural sector, has been making strategic moves to enhance its production capacity through land acquisitions in Indonesia. Over the past year, earnings surged by 67%, significantly outpacing the food industry’s growth of 11%. The company’s debt-to-equity ratio impressively dropped from 25.7% to 6.2% over five years, indicating improved financial health. Despite trading at nearly 60% below estimated fair value and offering high-quality earnings with strong EBIT coverage of interest payments (52x), potential investors should weigh environmental risks and currency fluctuations that could impact future performance and sustainability efforts.

AIM:MPE Debt to Equity as at Aug 2025

AIM:MPE Debt to Equity as at Aug 2025

Simply Wall St Value Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company specializing in medical diagnostics services, with a market capitalization of $251.13 million.

Operations: IDHC generates revenue primarily from its Pathology segment, contributing EGP 4.49 billion, and a smaller portion from Radiology at EGP 224 million.

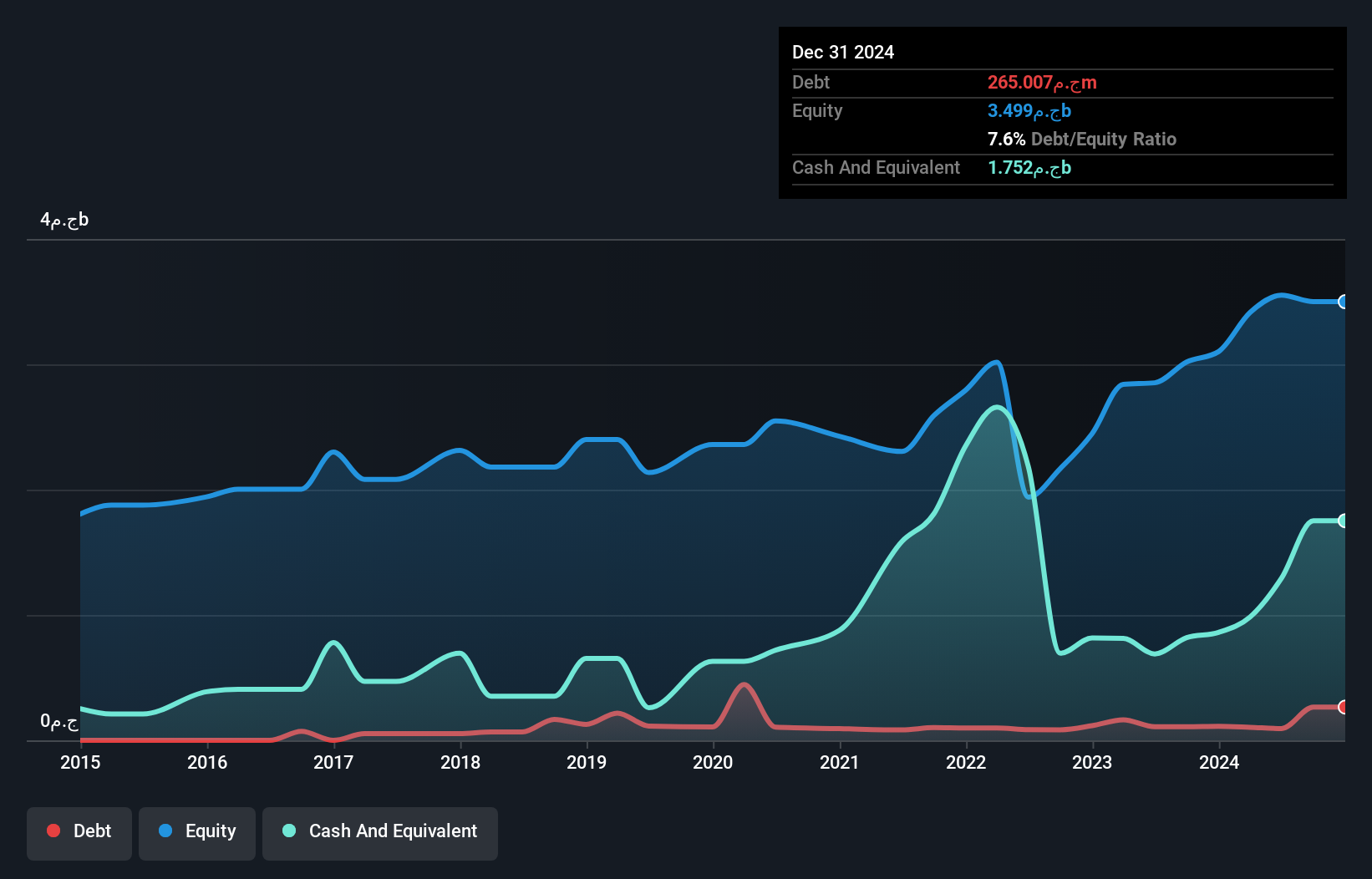

IDH is making waves in the healthcare sector with its strategic moves, including a recent acquisition of CAIRO RAY for Radiotherapy, enhancing its radiology offerings. The company has shown robust earnings growth of 111% over the past year and maintains high-quality earnings supported by strong free cash flow. With a debt-to-equity ratio that increased from 4.5 to 7.6 over five years, IDH’s interest payments are well-covered at 47 times EBIT. The company trades at an attractive value, significantly below its estimated fair value, positioning it as a compelling player in Egypt’s burgeoning healthcare market.

LSE:IDHC Debt to Equity as at Aug 2025

LSE:IDHC Debt to Equity as at Aug 2025

Simply Wall St Value Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the United Kingdom, providing business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders, with a market cap of £279.69 million.

Operations: The company’s revenue is primarily derived from three segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency (£26.96 million). The Surveying and Valuation segment contributes the largest share to the overall revenue stream.

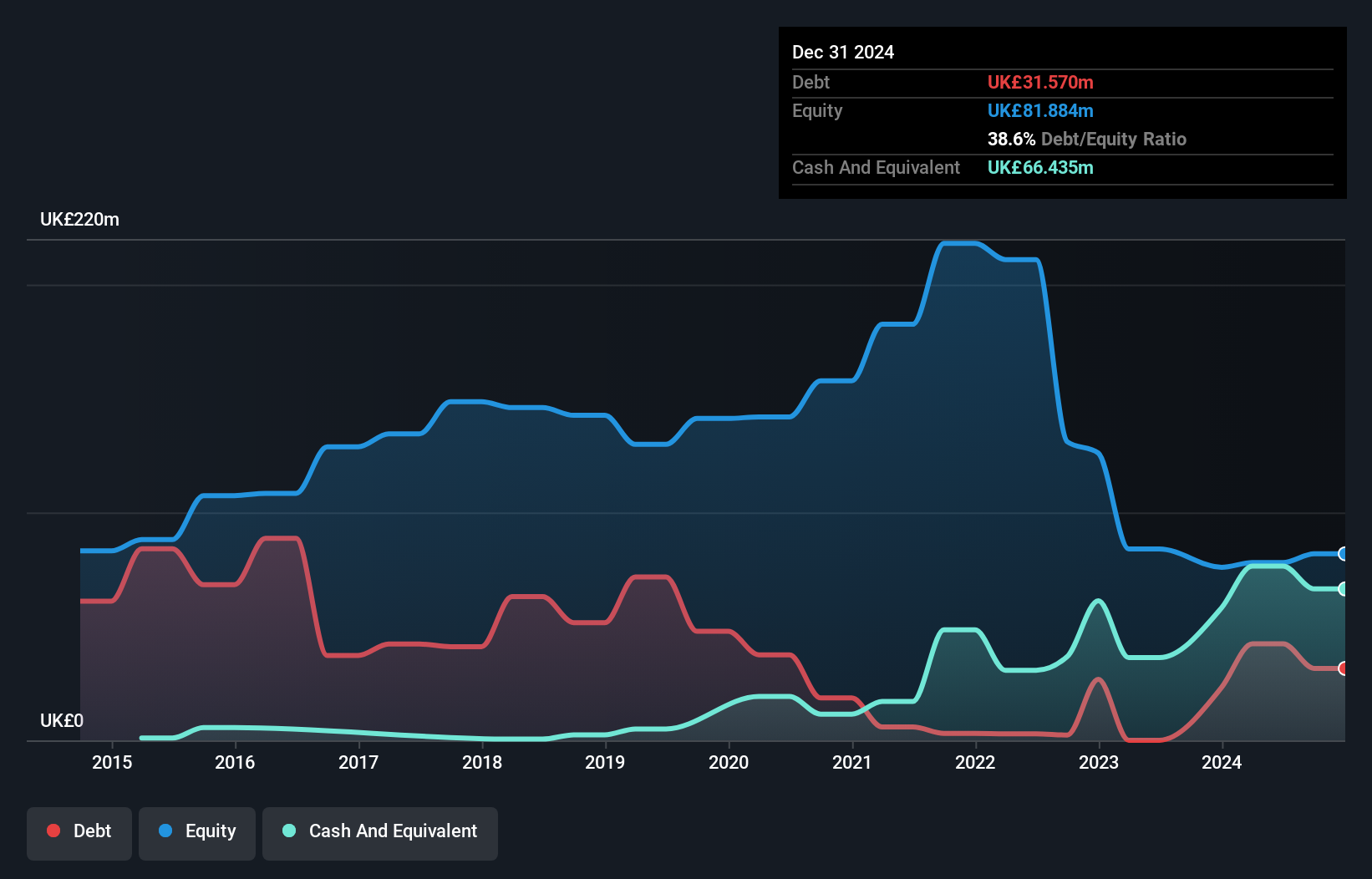

LSL Property Services, a smaller player in the UK real estate scene, shows promise with its earnings growth of 119% last year, outpacing the industry’s 23%. Trading at 52.6% below estimated fair value, it offers potential upside for investors. The company has more cash than total debt and earns more interest than it pays, indicating sound financial health. Despite a slight rise in its debt-to-equity ratio from 33.9% to 38.6% over five years, LSL remains robust with high-quality earnings and positive free cash flow. Recently approved dividends of £0.074 per share highlight ongoing shareholder value initiatives.

LSE:LSL Debt to Equity as at Aug 2025Taking AdvantageReady For A Different Approach?

LSE:LSL Debt to Equity as at Aug 2025Taking AdvantageReady For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com