Company Logo

Around 500 industrial parks, including prominent ones like Sydney and Bundaberg, offer strategic operational benefits, attracting leading colocation operators like Equinix, NEXTDC, and newcomers like Vantage Data Centers.

Australian Data Center Colocation Market

Australian Data Center Colocation Market

Dublin, Aug. 21, 2025 (GLOBE NEWSWIRE) — The “Australia Data Center Colocation Market – Supply & Demand Analysis 2025-2030” report has been added to ResearchAndMarkets.com’s offering.

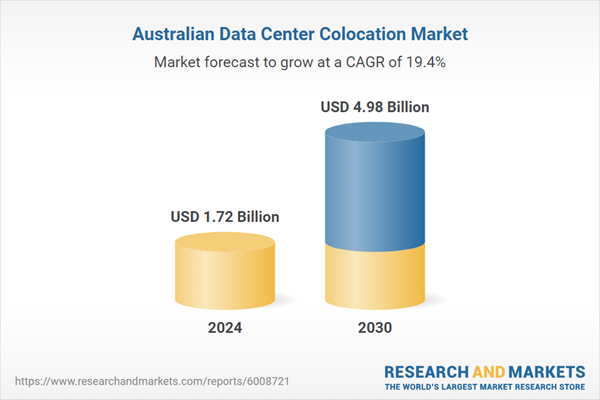

The Australia Data Center Colocation Market was valued at USD 1.72 billion in 2024, and is projected to reach USD 4.98 billion by 2030, rising at a CAGR of 19.39%.

Australia hosts around 500 industrial parks, including Kwinana Strategic Industrial Park, Norwest Business Park, Leppington Business Park, Westlink Industry Park, Peel Business Park, Sydney Business Park, Bundaberg Industrial Park, and others. These industrial parks attract local and global colocation companies to establish and operate their data centers within these industrial parks by offering several benefits, such as incentives, tax deductions, basic infrastructure, shared resources facilities, and other benefits.

Australia is one of the prominent colocation data center hubs in Southeast Asia, which consists of approximately 145 operational colocation data center facilities, of which around 41 facilities are in Sydney, and 23 in Melbourne. The Australia data center colocation market is also witnessing the development of over 37 data center facilities across multiple cities of the country, including Sydney, Melbourne, Canberra, Darwin, Perth, and others. Furthermore, the Privacy Act 1988 in Australia regulates how personal information is stored and processed, and this act plays a significant role in boosting the confidence of enterprises to store their personal data in the colocation data center facilities, as this law helps to protect the individual’s data from potential data breaches and fraud.

WHAT’S INCLUDED?

Transparent research methodology and insights on the industry’s colocation of demand and supply.

The market size is available in terms of utilized white floor area, IT power capacity, and racks.

The market size available in terms of Core & Shell Vs Installed Vs Utilized IT Power Capacity, along with the occupancy %.

The study of the existing Australia data center industry landscape and insightful predictions about industry size during the forecast period.

An analysis of the current and future colocation demand in Australia by several industries.

Study on the sustainability status in the country.

Analysis of current and future cloud operations in the country.

Snapshot of upcoming submarine cables and existing cloud-on-ramps services in the country.

Snapshot of existing and upcoming third-party data center facilities in Australia.

Facilities Covered (Existing): 145

Facilities Identified (Upcoming): 37

Coverage: 21+ Cities

Existing vs. Upcoming (White Floor Area)

Existing vs. Upcoming (IT Load Capacity)

Data Center Colocation Market in Australia

Colocation Market Revenue & Forecast (2024-2030)

Retail Colocation Revenue (2024-2030)

Wholesale Colocation Revenue (2024-2030)

Retail Colocation Pricing along with Addons

Wholesale Colocation Pricing along with the pricing trends.

An analysis of the latest trends, potential opportunities, growth restraints, and prospects for the Australia data center colocation market.

Competitive landscape, including industry share analysis by the colocation operators based on IT power capacity and revenue.

The vendor landscape of each existing and upcoming colocation operator is based on the existing/ upcoming count of data centers, white floor area, IT power capacity, and data center location.

Story Continues