Fugitive car tycoon Carlos Ghosn has said Lebanon needs the International Monetary Fund (IMF) to ensure fiscal discipline rather than to lend money, which can be easily sourced from Lebanese diaspora to fund rebuilding efforts.

The IMF’s $3 billion programme by itself will not save Lebanon but it would help restore investors’ confidence in the economy, Mr Ghosn said in an exclusive interview with CNN Business Arabic.

“We are going to the IMF to organise us [the Lebanese], not because of the $3 billion,” he said in Beirut. “The $3 billion you can easily collect from the Lebanese living abroad … Why? because it is good business, not because of sentiment. Everything is so cheap in Lebanon,” he said referring to land, companies and asset prices.

If investors were confident in the government’s rebuilding efforts, they would buy assets now and sell them later for a bigger profit, he added.

Lebanon has been grappling with deep financial crises, as successive governments’ unrestrained borrowing sent the economy into a tailspin in 2019.

Lebanon’s economy, which plunged into the worst crisis in its history after the Covid-19 pandemic, suffered another blow after Israel bombed the country heavily during its fight against Hezbollah. The bombing campaign has severely damaged critical infrastructure and devastated residential neighbourhoods in several areas of the country.

In April 2022, Lebanon reached a staff-level agreement with the IMF on a comprehensive economic reform programme supported by a 46-month extended fund facility, proposing access to about $3 billion. However, Lebanese authorities have been accused of dragging their feet on the required reforms.

Lebanon’s new government is committed to implementing vital reforms to lift the country out of its economic crisis, but such changes could take time, Minister of Economy and Trade Amer Bisat told The National in April.

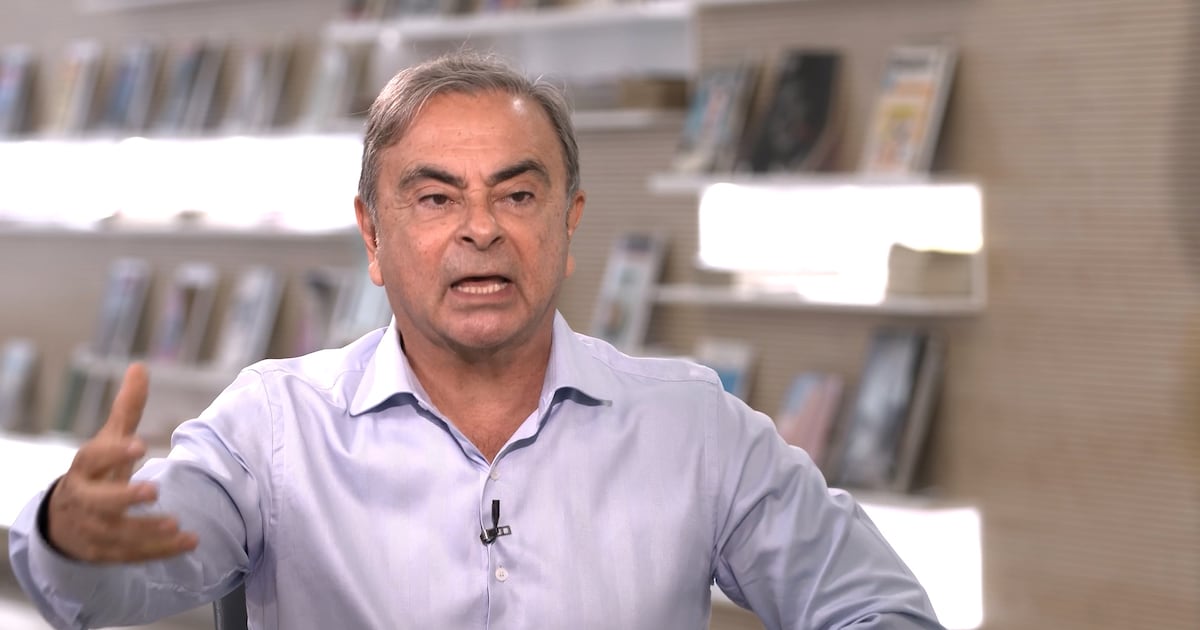

Mr Ghosn was speaking about Lebanon’s economy during an interview in Beirut, where he has lived in exile for the last six years since his dramatic escape from Japan.

The former Nissan chief executive, who is wanted by France and Japan over financial misconduct claims, last year said he remains “blocked in Lebanon” due to an Interpol red notice issued after he fled Tokyo in a musical equipment case. Mr Ghosn has Lebanese, French and Brazilian nationality, and Lebanon does not extradite its citizens.

‘Theft’ not reform

The former auto executive urged the private sector in Lebanon to help run government-owned projects, but stopped short of calling for the privatisation of state assets.

“I’m not talking about privatisation, because today prices are so cheap … If you privatised [projects] in Lebanon today it would be theft, you’d be robbing the government and the Lebanese people,” he said.

Private companies should manage these projects, while the state continues to own them without interfering with their work, Mr Ghosn said. This will boost the quality of these entities and increase their value and profitability. “This alone will help the country stand back up,” he said.

Despite a $93 billion deposit hole in Lebanese banks since 2019, Mr Ghosn is cautiously optimistic about the banking system. “Deposits will come back, but it will take a long time,” he said.

Lebanese banks imposed arbitrary restrictions on their clients in 2019 after the state failed to honour its bond commitments and the economy went into a tailspin. Customers have been waiting to access their life savings, which have been stuck in banks for the past six years.

Chinese EVs to dominate

In the wide-ranging interview, the motors tycoon turned his trademark candour on China’s automotive dominance, Nissan’s decline, AI disruption and cryptocurrencies versus banks. Mr Ghosn traced China’s rise back to 2006–2007, when Beijing turned the auto-making industry into a strategic national priority.

“It was clear that the Chinese will be a very important factor in the industry,” he said. “Legacy players mocked Chinese cars back then. Today, BYD’s market cap dwarfs Renault, Nissan and Mitsubishi.”

The rapid rise to supremacy of China’s electric vehicles is enabling Beijing to wage a successful economic contest with the US, analysts have said. China’s BYD is locked in a supercharged competition in the electric vehicle market with Tesla Motors.

China has transformed from 10 to 20 years ago and is now competing with US, German and Japanese car makers, Mr Ghosn said. “The Chinese will become a major part in the car manufacturing industry from now and into the next 10 years, especially in EVs,” he said.

Toyota, Mercedes and BMW are among the rivals who will endure and will face Chinese competition, he added. “Companies who fear [competition] and hide in their own markets and ask the state to protect them and put tariffs, will disappear,” he said. “It might take a year, two or three, but they will vanish.”

The former Nissan executive highlighted the Japanese company’s early EV lead with the Leaf model, which debuted in 2009, and Renault’s Zoe model, which entered the market in 2012. “Five per cent is strategy, 95 per cent is execution. Nissan lost because of poor management after I left,” Mr Ghosn said.

Nissan’s stock now trades at less than $2, compared to $15 during his tenure, even during global recessions, he said. He slammed current executives for “empty promises and TV appearances”, saying trust and vision are the only levers to restore market value.