As the U.S. market navigates a period of uncertainty, highlighted by the S&P 500’s recent decline and investor anticipation surrounding Federal Reserve Chair Jerome Powell’s upcoming speech on interest rates, small-cap stocks continue to present intriguing opportunities. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that can weather economic fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United StatesNameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingFirst Bancorp75.89%1.93%-1.42%★★★★★★Oakworth Capital87.50%15.82%9.79%★★★★★★ASA Gold and Precious MetalsNA12.79%-0.59%★★★★★★Mill City Ventures IIINA16.40%-30.66%★★★★★★First Northern Community BancorpNA8.05%12.27%★★★★★★Valhi44.30%1.10%-1.40%★★★★★☆FRMO0.10%42.87%47.51%★★★★★☆Rich Sparkle Holdings26.73%-6.13%1.75%★★★★★☆Gulf Island Fabrication20.48%3.25%43.31%★★★★★☆Solesence91.26%23.30%4.70%★★★★☆☆

Here’s a peek at a few of the choices from the screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems globally with a market cap of $1.86 billion.

Operations: The company generates revenue primarily from Engineered Integrated Electrical Power Generation Systems, amounting to $597.49 million.

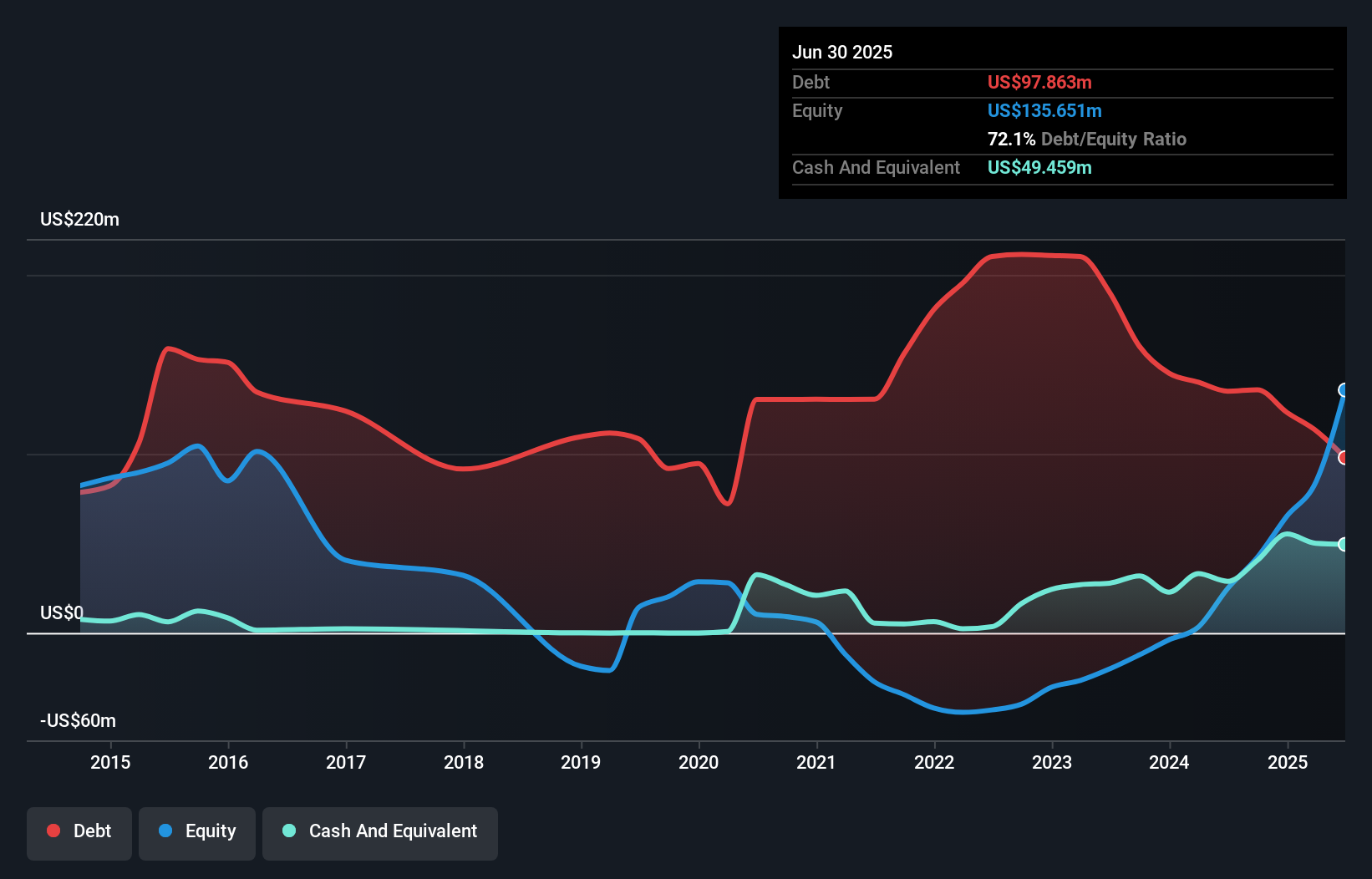

Power Solutions International, with its recent addition to multiple Russell indices, has shown impressive financial performance. Over the past year, earnings surged by 147.5%, significantly outpacing the electrical industry average of 7.5%. The company’s net debt to equity ratio stands at a satisfactory 35.7%, reflecting prudent financial management as it reduced from a staggering 1259.1% five years ago to just 72.1%. Recent amendments to their credit agreement have increased borrowing capacity to US$135 million, providing flexibility for future growth and innovation while maintaining profitability and positive free cash flow at US$75.9 million as of June 2024.

PSIX Debt to Equity as at Aug 2025

PSIX Debt to Equity as at Aug 2025

Simply Wall St Value Rating: ★★★★★★

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of $1.02 billion.

Operations: ATRenew generates revenue primarily through the sale and service of pre-owned consumer electronics in China. The company’s cost structure includes expenses related to procurement, refurbishment, and logistics. Gross profit margin trends are a key focus, with recent figures reflecting its operational efficiency.

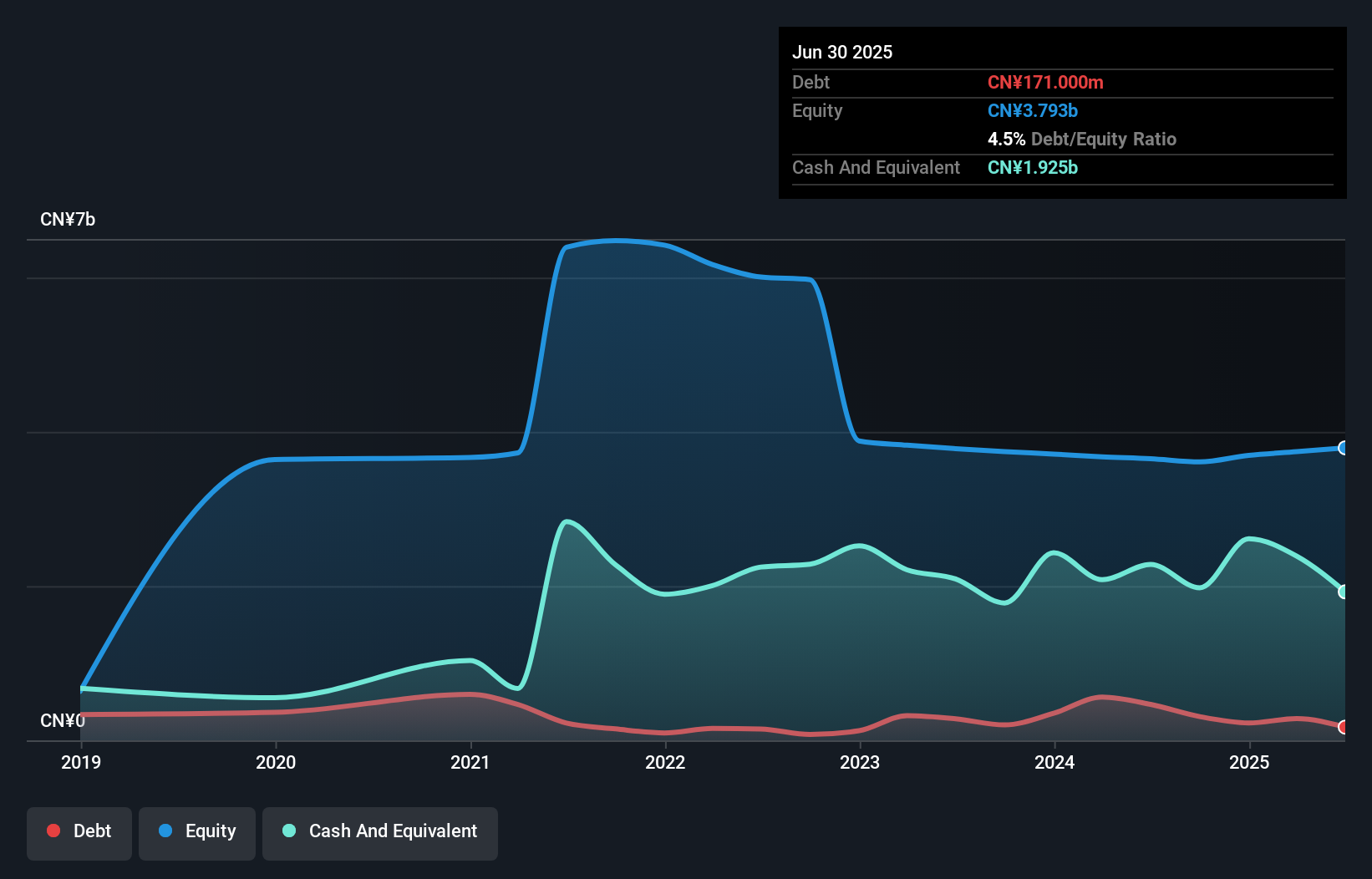

ATRenew, a dynamic player in the pre-owned electronics market, is making waves with its recent profitability and strategic initiatives. The company’s net income for the second quarter of 2025 was CNY 72 million, contrasting with a loss of CNY 11 million last year. Basic earnings per share from continuing operations improved to CNY 0.3 from a loss of CNY 0.04 previously. Leveraging digitalization and sustainability trends in China, ATRenew’s revenue is projected to grow by an impressive 22.7% annually over three years while its debt-to-equity ratio has notably decreased from 13:1 to just over four times in five years, showcasing financial prudence amidst expansion efforts.

RERE Debt to Equity as at Aug 2025

RERE Debt to Equity as at Aug 2025

Simply Wall St Value Rating: ★★★★★★

Overview: Weis Markets, Inc. operates a chain of supermarkets primarily in Pennsylvania, with a market capitalization of approximately $1.77 billion.

Operations: Weis Markets generates revenue primarily from its retail grocery stores, with reported sales of approximately $4.84 billion. The company’s financial performance can be analyzed through its net profit margin, which reflects the efficiency of converting sales into actual profit.

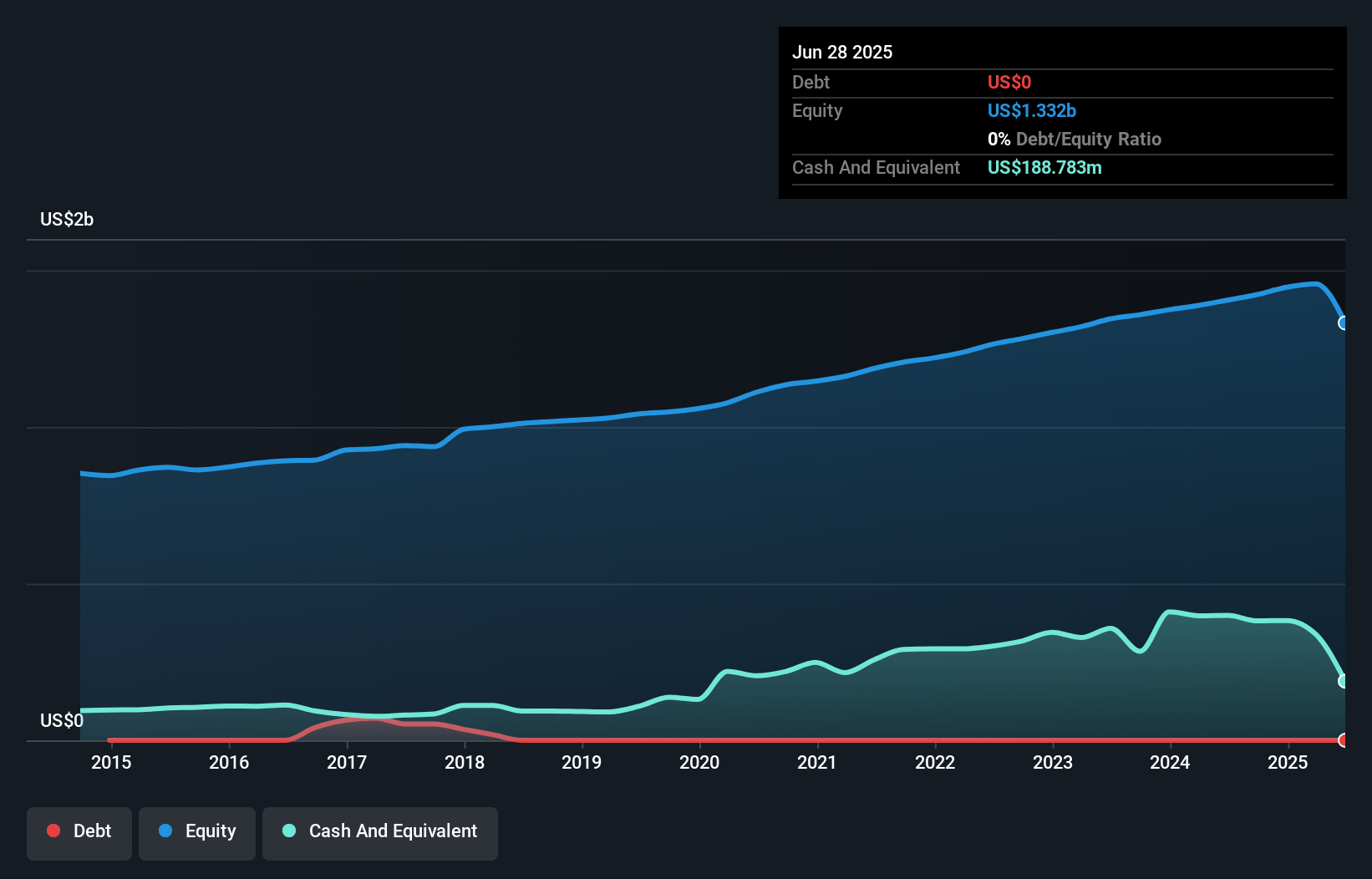

Weis Markets, a debt-free entity in the retail sector, has shown robust earnings growth of 15.3% over the past year, outpacing its industry peers at 9.1%. Despite this positive performance, significant insider selling was noted recently. The company’s price-to-earnings ratio stands at 16.5x, which is more attractive compared to the broader US market’s 18.7x. Although earnings have declined by an average of 1.9% annually over five years, Weis Markets continues to generate high-quality earnings and remains profitable with no free cash flow positivity yet achieved in recent times.

WMK Debt to Equity as at Aug 2025Taking AdvantageReady For A Different Approach?

WMK Debt to Equity as at Aug 2025Taking AdvantageReady For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Weis Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com