Crude oil inched higher on Friday, marking the third consecutive day of gains, supported by uncertainty over Russia-Ukraine peace talks, a decline in U.S. inventories, and new sanctions imposed on Iranian oil exports. However, gains were capped by the production increase announced earlier by the Organization of the Petroleum Exporting Countries and its allies (OPEC+), amid sluggish demand projections following mixed economic growth signals from the United States and China, the world’s largest and second-largest economies, respectively.

Data compiled by Polymerupdate Research showed that benchmark Brent crude futures for near-month delivery on the Intercontinental Exchange (ICE) settled marginally higher by 0.09 percent, or US$ 0.06 a barrel, at US$ 67.73 a barrel on Friday, up from US$ 67.67 a barrel the previous day. Friday’s close marked a reversal in sentiment after Brent futures had touched a one-week low of US$65.79 a barrel on Tuesday. This reflected a cumulative gain of 2.95 percent, or US$ 1.94 a barrel, over the past three sessions.

Data compiled by Polymerupdate Research showed that benchmark Brent crude futures for near-month delivery on the Intercontinental Exchange (ICE) settled marginally higher by 0.09 percent, or US$ 0.06 a barrel, at US$ 67.73 a barrel on Friday, up from US$ 67.67 a barrel the previous day. Friday’s close marked a reversal in sentiment after Brent futures had touched a one-week low of US$65.79 a barrel on Tuesday. This reflected a cumulative gain of 2.95 percent, or US$ 1.94 a barrel, over the past three sessions.

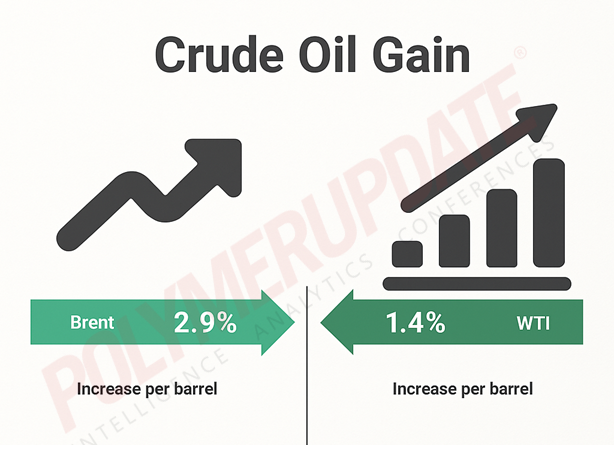

Similarly, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (Nymex) rose by 0.22 percent, or US$ 0.14 a barrel, to US$ 63.66 a barrel on Friday, compared with US$ 63.52 a barrel on Thursday. Also posting a third straight day of gains, the contract climbed 2.10 percent, or US$ 1.31 a barrel, from its over two-month low of US$ 62.35 a barrel recorded on Tuesday. Both benchmarks gained more than 1 percent on Thursday. For the week, Brent rose 2.9 percent while WTI gained 1.4 percent.

“Crude oil prices climbed, albeit marginally, on Friday, supported by strong U.S. demand indicators and lingering geopolitical risks tied to the Russia-Ukraine conflict. Moscow reiterated that peace efforts excluding Russia were a ‘road to nowhere,’ keeping supply-side uncertainty elevated. On the supply front, two Chevron-chartered tankers carrying Venezuelan crude reached U.S. shores—the first such imports since Washington issued a fresh license—hinting at evolving trade flows. Inventory data from the U.S. Energy Information Administration showing a 6 million-barrel draw added further bullish momentum,” said a report from Kedia Stocks and Commodities Research.

Russia-Ukraine peace still away

U.S. President Donald Trump-initiated Russia-Ukraine peace talks were once again pushed to the backburner, with Russian President Vladimir Putin reportedly pressing for new demands to end the more than three-and-a-half-year war in Ukraine. Reports said Putin has demanded that Ukraine relinquish the entire eastern Donbas region, abandon its ambitions to join the North Atlantic Treaty Organization (NATO)—a military alliance of developed nations founded on the principle of collective defense, “an attack on one is an attack on all”—and bar Western troops from entering the country.

Following Trump’s meeting with Putin in Alaska on August 15, Ukrainian President Volodymyr Zelenskyy told Trump at a subsequent summit in Washington that he would not cede any territory to Russia. Meanwhile, Trump assured Zelenskyy of U.S. security guarantees to deter any future Russian reinvasion, but ruled out immediate military intervention. NATO leaders and Ukraine’s European partners are also awaiting clarity on Washington’s stance in the Russia-Ukraine conflict.

US inventories fall

According to the U.S. Energy Information Administration (EIA), commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) fell by 6 million barrels for the week ending August 15, compared with the previous week. The decline was steeper than analysts’ expectations of a 1.8 million-barrel draw. At 420.7 million barrels, U.S. crude oil inventories are about 6 percent below the five-year average for this time of year.

Total motor gasoline inventories decreased by 2.7 million barrels from the prior week and are now 1 percent below the five-year seasonal average. The drop in gasoline stocks defied market expectations for a 915,000-barrel draw, reflecting steady driving demand during the summer travel season. This trend was also visible in the four-week average of jet fuel consumption, which rose to its highest level since 2019.

Both finished gasoline inventories and blending components declined last week. Distillate fuel inventories rose by 2.3 million barrels but remain about 13 percent below the five-year average. Propane/propylene inventories increased by 2.6 million barrels and stand 12 percent above the seasonal average. Total commercial petroleum inventories decreased by 4.2 million barrels, the EIA said in its report on Wednesday.

U.S. crude oil refinery inputs averaged 17.2 million barrels per day (bpd) during the week ending August 15, 2025—up 28,000 bpd from the previous week’s average. Refineries operated at 96.6 percent of their operable capacity. U.S. crude oil imports averaged 6.5 million bpd last week, down 423,000 bpd from the prior week. Over the past four weeks, crude oil imports averaged about 6.4 million bpd, 2.3 percent lower than in the same period last year.

More sanctions on Iran

The U.S. Treasury Department on Thursday announced additional Iran-related sanctions, adding 13 commercial entities in Hong Kong, China, the United Arab Emirates (UAE), and the Marshall Islands to its existing list. The Trump administration also sanctioned eight vessels and two China-based port operators in Qingdao and Yangshan, further tightening pressure on Iran. The designations include Greek national Antonios Margaritis and his network of companies and vessels, which the Treasury said were involved in transporting Iranian oil exports in violation of sanctions.

Treasury also designated Ares Shipping Limited in Hong Kong, Comford Management in the Marshall Islands, and Hong Kong Hangshun Shipping Limited. Sanctioned crude oil tankers include the Panama-flagged vessels Adeline G and Kongm, as well as Lafit, registered under the flag of São Tomé and Príncipe. In a separate action, the State Department imposed sanctions on two China-based operators of oil-related terminals and storage facilities, stating that they had handled imports of Iranian oil carried on tankers previously targeted by U.S. sanctions. These companies were identified as Qingdao Port Haiye Dongjiakou Oil Products Co. in Shandong province and Yangshan Shengang International Petroleum Storage and Transportation Co. in Zhejiang province.

Meanwhile, Iran suspended talks with Washington aimed at curbing the Islamic Republic’s nuclear ambitions after U.S. and Israeli strikes on its nuclear sites in June. Tehran denies any intent to develop nuclear weapons. On Wednesday, Iran’s top diplomat said the time for “effective” nuclear talks with the United States had not yet arrived, though Iran would not completely cut off cooperation with the United Nations’ nuclear watchdog.

Outlook

Crude oil fundamentals remain shaky, with prices likely to swing either way amid volatility driven by conflicting market signals. The OPEC+ decision to fully unwind 2.2 million bpd of earlier cuts through an additional 547,000 bpd output increase by September is set to add to an already oversupplied market. Weak demand forecasts from the International Energy Agency (IEA) have further dampened sentiment, while mixed economic signals from the United States and persistent weakness in China point to sluggish demand ahead.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com