We’ve found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Northern Oil and Gas Investment Narrative Recap

For Northern Oil and Gas, the investment case centers on the belief that disciplined capital allocation and continued strength in U.S. natural gas demand can offset the cyclical and operational risks found in shale-based portfolios. The recent update, strong natural gas output with a lower capital spending outlook, provides some short-term reassurance for free cash flow, but it does not fundamentally change the company’s primary risk, which remains its high exposure to commodity price swings.

Among recent announcements, a series of rising quarterly dividends stands out, with the latest declared at US$0.45 per share, up 7 percent year-over-year. Consistent dividend growth in tandem with improved cash flow forecasts may appeal to income-focused investors, especially amid cautious spending and volatile market prices.

In contrast, investors should also be aware of how persistent volatility in oil and gas prices could quickly…

Read the full narrative on Northern Oil and Gas (it’s free!)

Northern Oil and Gas is expected to generate $2.1 billion in revenue and $255.4 million in earnings by 2028. This projection assumes a 0.2% annual decline in revenue and a decrease in earnings of $353.3 million from the current $608.7 million.

Uncover how Northern Oil and Gas’ forecasts yield a $34.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives NOG Community Fair Values as at Aug 2025

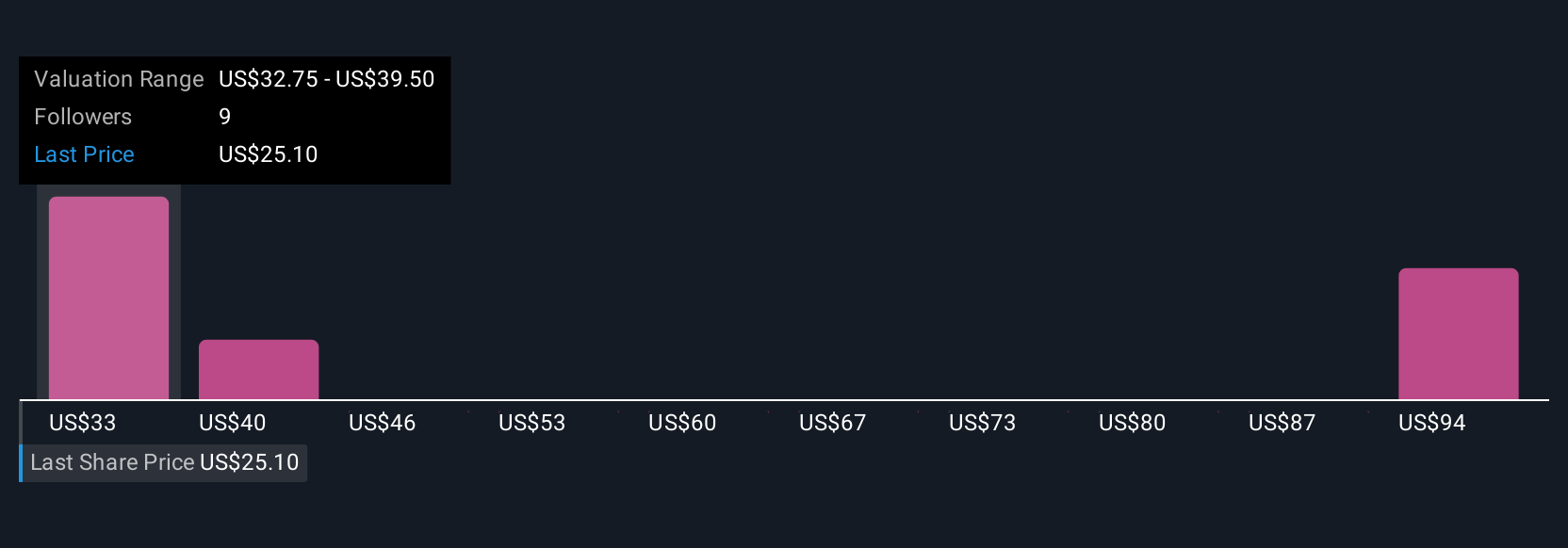

NOG Community Fair Values as at Aug 2025

Five members of the Simply Wall St Community estimate NOG’s fair value from US$32.75 to US$100.27 per share. While many expect long-term growth, some warn that concentrated shale assets could limit future returns, making it vital to compare forecasts before deciding.

Explore 5 other fair value estimates on Northern Oil and Gas – why the stock might be worth over 3x more than the current price!

Build Your Own Northern Oil and Gas Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Northern Oil and Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com