Methodology & scope:

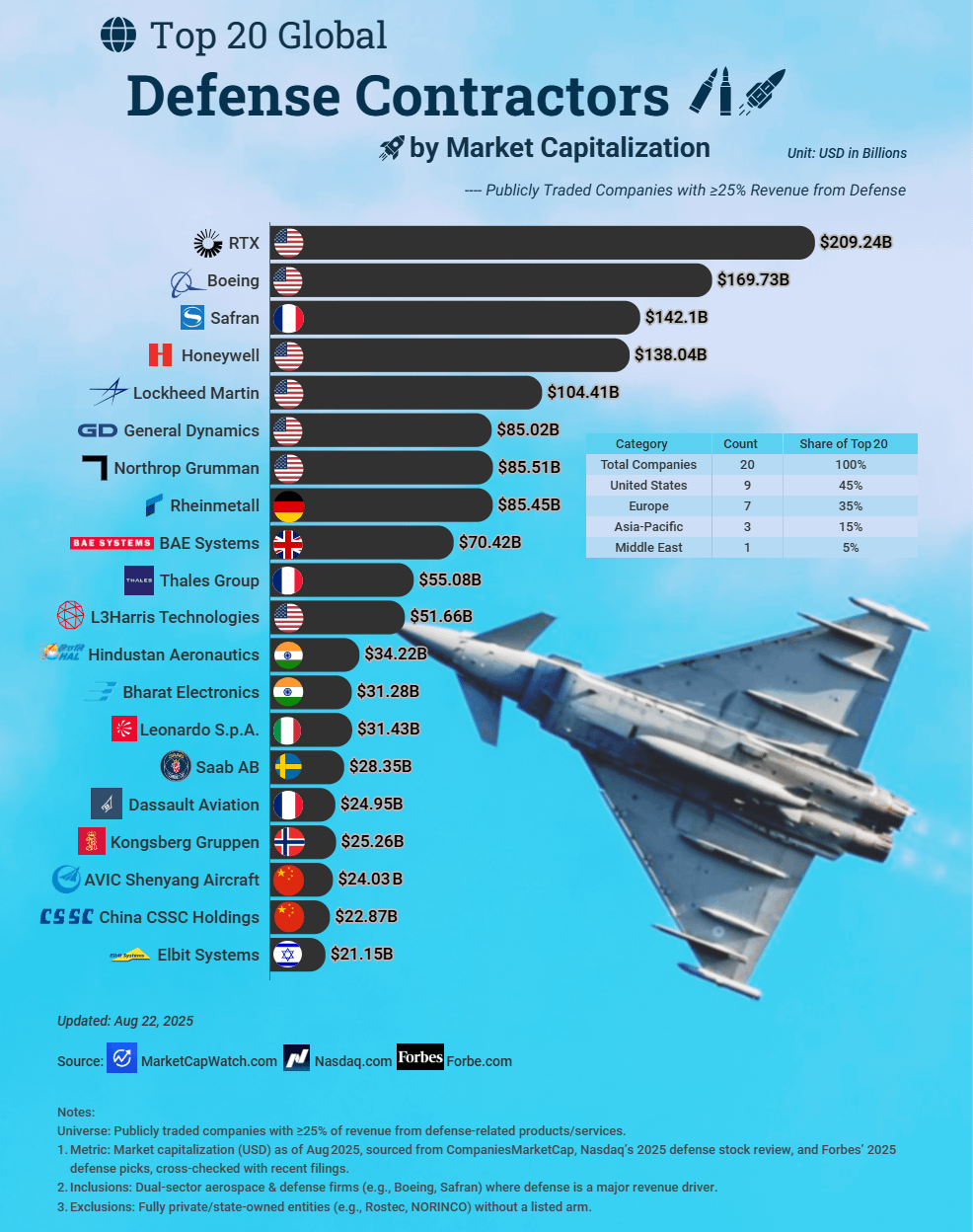

- Universe: Publicly traded companies with ≥25% of revenue from defense‑related products/services.

- Source: Market capitalization (USD) as of Aug 2025, sourced from MarketCapWatch, Nasdaq’s 2025 defense stock review, and Forbes’ 2025 defense picks, cross‑checked with recent filings.

- Inclusions: Dual‑sector aerospace & defense firms (e.g., Boeing, Safran) where defense is a major revenue driver.

- Exclusions: Fully private/state‑owned entities (e.g., Rostec, NORINCO) without a listed arm.

Posted by Proud-Discipline9902

![[OC]Top 20 Global Defense Contractors by Market Capitalization](https://www.europesays.com/wp-content/uploads/2025/08/ci2noceumpkf1-986x1024.png)

16 comments

I count 7 US, 8 European, and 4 Asia-Pacific companies in the chart.

Where is Dassault Aviation (market cap 25B).

How does before and after Trump compare?

I didn’t realize Saab was still an active company. I thought they were shuddered at decade or two ago. Today I see them on a top 20 defense contractor list.

America just throws everyone out of the water when it comes to defense. It’s just amazing how powerful the United States is compared to the combined strength of all the other countries in the world. Even Churchill knew WW2 was over when America entered the war. Total Badass.

PS I am not American and have no dog in this fight.

Edit : Changed Hitler to Churchill

Why the downvotes ??

There are a few mistakes here, Dassault should be behind Kongsberg and General Dynamics should be behind Rheinmettal and Northrop.

Another comment also pointed out the number of companies of each continent is false.

Honeywell? I thought they only made mediocre sensors and code readers…

That’s actually insane that RTX overmatches Boeing. Yes, they have major non military segments of the business, but that’s still crazy since it’s Boeing we’re talking about.

Eisenhower rolling over in his grave

As a French I would’ve thought that dassault would have the bigger market cap between them and Thales / Safran

Wow, Rheinmetall overtook BAE. I knew their share price was doing well, but I didn’t realise it was doing that well

This won’t stay like this for long at this pace.

Why would you include Safran but not Rolls-Royce? Rolls-Royce has a market capitalisation of $88B putting it ahead of General Dynamics, Rheinmetall and behind Lockheed Martin.

Rolls-Royce is the UK’s premier engine manufacturer and was the primary designer of the EJ200 engines in the Eurofighter and will also design the engines that’ll power the fighter that comes out of GCAP. They’re also the sole company responsible for designing the PWR reactors in British SSBNs and SSNs. Rolls-Royce are also the ones that provide most of the gas turbines in British warships. They have a pretty significant defence business.

But, in all honesty, defence consolidating into these massive companies is a terrible thing. We shouldn’t want such massive defence companies because there is now barely any actual competition between defence firms for contracts which is why defence acquisition costs in most Western countries has skyrocketed since the end of the Cold War.

Why would Lockheed Martin or Rheinmetall or BAE Systems bother being cost competitive when they know they’re too big to fail and the government will basically buy whatever they shit out? If not this contract then definitely some other contract because the government needs to give them some work regardless of its quality else they’ll go under and that’s a “national security risk”.

The 25% threshold leaves a big variance for how defense oriented companies are. Like I think Honeywell & Boeing are under 50% defense while others are much jogger defense.

Ohio’s GE Aerospace is also a major supplier of military aircraft engines with a market cap of $282 billion.

Canada should have been on this list! Bad choices over the years…

Comments are closed.