Last week, I began the of two dramatic Friday the 13th (of August) markets, the first being the time President Nixon gathered his Brain Trust in Camp David to devalue the and close the window.

The second dramatic Friday, August 13th, came in 1982 – after America suffered 140% in the 11 years after that gold-to-dollar devaluation. On Friday, August 13, 1982, a morbid market suddenly turned back up, in the strongest bull surge of the modern era, after a jackpot closing of 777 the day before.

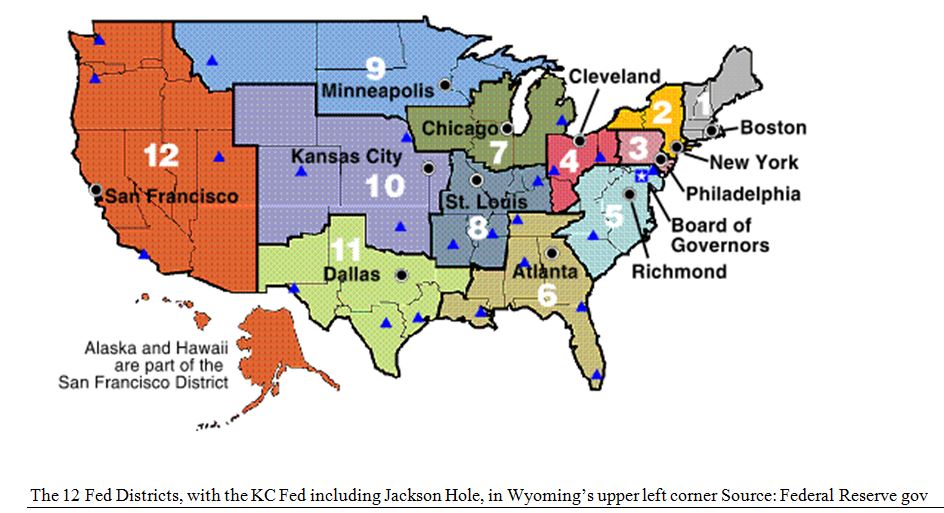

August 1982 also marked the first meeting of top Fed economists at , Wyoming, a tradition which continues this week (August 21-23), in another retreat for leading global central bankers in the furthest Western outpost of the Kansas City Fed’s district. The first (1978) KC Fed symposium met in Kansas City, followed by jaunts to Vail and Denver, Colorado, but in 1982, the event moved to Jackson Hole, mostly since then-Fed Chair Paul Volcker liked to indulge in some relaxing fly fishing in the area.

As it turns out, Missouri is the headquarters for two of the Fed’s 12 districts. The second is the great champion of monetary economics, the St. Louis Fed, which specializes in statistical studies and historical charts, using its FRED database. (The Kansas City district is more of a Midwest farm-oriented district.)

From the three years between his induction as Fed Chairman in August 1979 and the 1982 Jackson Hole meeting, the tall, commanding Fed Chair Paul Volcker conquered double-digit hyper-inflation by raising the Fed above 20%. By August of 1982, we faced deflation and a deep recession, so the KC Fed decided to lure Volcker to Jackson Hole by appealing to his love of fly fishing and stunning vistas.

Since 1982, there have been plenty of dramatic announcements in Jackson Hole, most notably the debut of Chairman Ben Bernanke’s seemingly endless declarations of more “quantitative easing” (QE), in each year of the 2010 to 2013 Jackson Hole meetings. Specifically, Bernanke announced QE1, QE2, QE3, and “tapering,” which caused a Taper Tantrum in 2013. Then came the introduction of Modern Monetary Theory (MMT) by ECB President Mario Draghi at the 2014 meeting. In that long span of monetary easing, the Fed also had a Zero Interest Rate Policy (ZIRP) with 0.25% rates from 2009 to 2015. It was like the Fed wanted President Obama to enjoy easy money “training wheels” during his full eight years.

The Fed Is So Powerful That It Can Kill Markets – And Then Resurrect Them

obviously impacts the markets – from the inflationary 1970s under Fed Chair Arthur Burns, then Volcker’s deflationary medicine and Bernanke’s QE mania, but Volcker made both positive and negative history in his eight-year run. First, he killed the market and economy, causing two deep back-to-back recessions, 1979-82. Then he resurrected the markets and the economy – quite a miracle-worker!

During the first half of his tenure at the Fed, Volcker fueled three years of net negative growth. The Prime Rate hit 21.5%; unemployment reached 11.2%, and inflation topped 13% in 1980 – an expanded “Misery Index” of 45% – but inflation had fallen to under 4% by 1982, so in August 1982, the inflation-killing Fed Chair began easing the Discount Rate. His first cut was a giant step, down a full point, from 12% to 11%.

By 1985, the dollar had regained its mojo, requiring a special “Plaza Accord” to limit the dollar’s new punching power. Gold also retreated in the 1980s, along with inflation rates and our top interest rates.

In all, the Fed lowered the Discount Rate six times in the second half of 1982, from 12% down to 8.5%. Short-term (90-Day) T-bills declined from 13.3% to 7.8% in the third quarter of 1982, and banks lowered their Prime Rate from 21% to 13%.

Why such a dramatic drop? After Penn Square Bank in Oklahoma City failed in August 1982, along with many other banks, Paul Volcker’s Fed was determined to flood the market with new liquidity, because the August 1982 economic indicators were uniformly deflationary:

(1) Industrial production had fallen for 12 of the past 13 months as of August 1982.

(2) Raw material production was down for the 16th straight month.

(3) Durable goods orders were down 4%.

(4) The Mexican stock market fell 80% in U.S. dollar terms in the first nine months of 1982.

(5) Inflation rates were triple-digit in Argentina (130%), Israel (104%), and Brazil (100%).

America’s economic malaise seemed chronic at the time. After 200 years of growth, the U.S. seemed in decline. From 1973 to 1982, inflation doubled, spawning a new word: Stagflation: Stagnation + Inflation.

How did we avoid another 1930s depression? Simple: We remembered the 1930s and did the opposite. Instead of choking off the economy, as in the 1930s, the Fed turned on the spigots. Instead of cutting off world trade, we opened it up. We learned from history… but the doomsday crowd didn’t learn much.

In 1982, the Doomsday press predicted a repeat of the 1930s – the dreaded Kondratieff Wave. What they did not realize is that the exiled Soviet economist Nikolai Kondratieff was right – the parallels of 1929-32 were nearly perfect in 1979-82, but this time we made the right choices to avoid a deeper depression.

Consider these 50-year Kondratieff Wave parallels – accurate but misunderstood by the doomsday crowd:

The American economy contracted drastically from 1929 to 1932… and from 1979 to 1982.

The stock market more than tripled from 1932 to 1937 … and from 1982 to 1987.

There was another huge market crash in October 1937 … and in October 1987.

The market rally intensified after war broke out in 1941 … and in 1991 (the Gulf War).

So, Kondratieff was right – but his followers were wrong, because they ignored the details of his theory.

However, some in 1982 had the foresight:

(1) John Dessauer, editor and publisher of “Dessauer’s Journal” (later, “Investor’s World”), predicted a “buying panic” in late 1982. At the start of the year (January 6, 1982), he predicted “A new record high on the DOW…before the sun sets on 1982.” On August 4, 1982, a week before the turnaround, he wrote (in bold, all-caps, like this), “THE RISK AT THIS POINT IS A DRAMATIC UPTURN…. a sudden burst of optimism that carries stock prices higher without warning…. When the run comes, stock prices will move up fast.” The market rose 30% in the next two months, to set new all-time highs by year’s end.

(2) In a more general sense, in 1981 and 1982, Mark Skousen, editor of Forecasts & Strategies, went against the grain of the gold-oriented newsletter community, predicting “Reaganomics Will Work,” i.e., the supply-side implications of the Kemp-Roth tax bill would fuel a dramatic U.S. stock market rally.

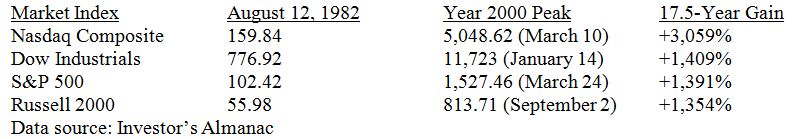

The result of the 1982 turnaround was a bull market for the ages, with the Dow and S&P rising 15-fold, and NASDAQ doubling those gains, up over 3,000% in 17.5 years – an average of +18% per year.

Why did most analysts miss the 1982 bottom? They were slaves to past trends and waves, ignoring one key aspect of human nature: “That which we most fear is least likely to happen.”