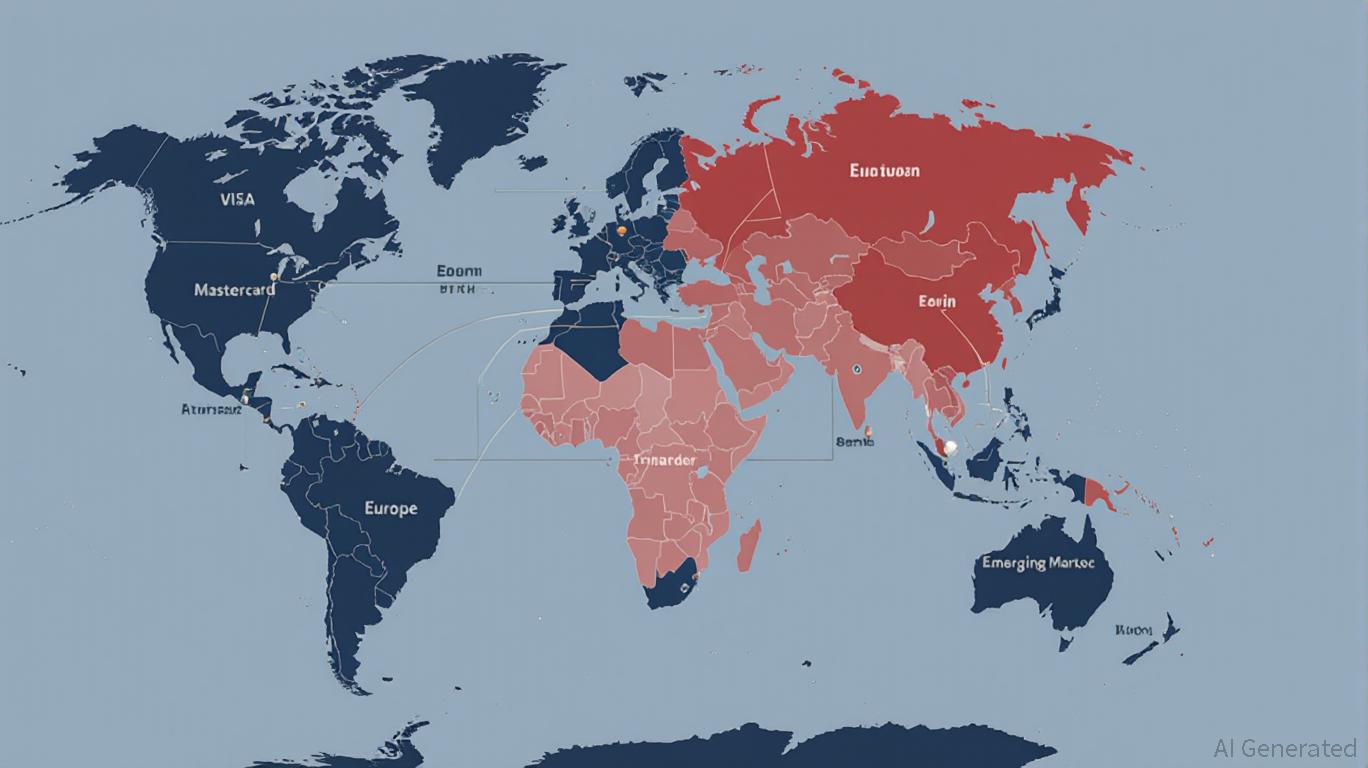

The U.S. open banking sector is undergoing a seismic shift as regulatory uncertainty and evolving business models force major players to recalibrate their strategies. Visa’s recent exit from the U.S. open-banking market—its first major retreat in this space—signals a broader reallocation of capital toward regions with more stable regulatory frameworks and scalable infrastructure. For investors, this pivot underscores the growing importance of firms with cross-border agility and adaptability to fragmented global rules.

Visa’s Exit: A Strategic Retreat Amid Regulatory Chaos

Visa’s decision to shut down its U.S. open-banking operations in 2025 was driven by two key factors: regulatory ambiguity and strategic misalignment. The Consumer Financial Protection Bureau (CFPB) is overhauling Rule 1033, which initially mandated free data access for third parties. Under the Trump administration, the revised rule now allows banks to charge fintechs for customer data—a move JPMorgan Chase has already embraced, potentially generating hundreds of millions in revenue. This shift threatens to upend the existing open-banking model, which relies on frictionless data sharing.

Visa’s exit contrasts with its earlier $5.3 billion failed bid to acquire Plaid, a U.S. open-banking pioneer, and its 2022 acquisition of Tink, a Swedish open-banking platform. The latter move now makes strategic sense: Tink’s European footprint aligns with Visa’s focus on markets with clearer regulatory guardrails. Meanwhile, Mastercard remains committed to the U.S. market, betting on its ability to navigate the evolving landscape.

Europe’s Resilient Open-Banking Ecosystem

Europe’s open-banking infrastructure, anchored by the Payment Services Directive (PSD2) and evolving toward PSD3 and the Financial Data Access (FIDA) regulation, offers a stark contrast to the U.S. The EU’s regulatory clarity has fostered a thriving ecosystem of fintechs, banks, and infrastructure providers. Key players like Yapily and Tink are leveraging standardized APIs and cross-border interoperability to connect nearly 2,000 European banks, enabling seamless data flows and payments.

The ECB’s push to interlink fast payment systems—such as TARGET Instant Payment Settlement (TIPS) with India’s UPI and Western Balkan systems—further highlights Europe’s role as a global hub for cross-border innovation. These initiatives reduce transaction costs and settlement times, creating a fertile ground for fintechs to scale. For example, Nordea Bank has integrated open-banking data into its Carbon Tracker tool, demonstrating how regulatory frameworks can drive both financial and environmental innovation.

Emerging Markets: The New Frontier for Fintech Capital

Emerging markets are becoming critical battlegrounds for cross-border fintech infrastructure. Companies like Rapyd, Airwallex, and Ebury are capitalizing on fragmented payment systems and high remittance costs to offer scalable solutions. Rapyd’s $15 billion valuation (as of 2022) reflects its ability to process 1,200 payment methods across 100 countries, while Airwallex’s 70% YoY growth in 2025 underscores demand for multi-currency platforms.

In Latin America, JPMorgan’s partnerships with real-time payment systems are accelerating digital adoption in cash-dependent economies like Mexico. Similarly, India’s UPI, processing 500 million daily transactions, is a blueprint for low-cost, high-volume cross-border systems. These markets offer not only growth but also regulatory sandboxes that allow fintechs to test innovations without overreaching compliance risks.

Investment Thesis: Prioritize Cross-Border Agility and Regulatory Resilience

For investors, the key takeaway is to target firms with cross-border infrastructure and regulatory agility. Here’s how to allocate capital:

European Fintechs with Global Reach: Yapily (UK): A leader in cross-border API integration, connecting 2,000+ banks across 19 European countries. Tink (Sweden): Visa’s strategic acquisition, now a cornerstone of Europe’s open-banking infrastructure.

Checkout.com (UK): Processes payments in 150+ currencies, leveraging AI for fraud detection and compliance.

Emerging Market Innovators:

Rapyd (UK): A fintech-as-a-service platform enabling global businesses to integrate payments, compliance, and treasury tools. Airwallex (Singapore): Offers multi-currency accounts and embedded finance solutions, serving 100,000+ businesses.

Ebury (UK): Specializes in SME-focused foreign exchange and cross-border payments, with a 70% YoY growth rate.

Regulatory Sandboxes and CBDCs:

Invest in firms participating in EU or emerging market regulatory sandboxes, which reduce compliance risks while enabling rapid innovation. Monitor central bank digital currency (CBDC) developments, such as the ECB’s digital euro, which could redefine cross-border settlements. Conclusion: Navigating the New Open-Banking Landscape

Visa’s exit from the U.S. open-banking market is a harbinger of deeper structural shifts. As regulatory uncertainty persists in the U.S., capital is flowing toward regions where infrastructure and policy align to support scalable, cross-border solutions. Investors who prioritize firms with global data infrastructure, regulatory agility, and partnerships in emerging markets will be well-positioned to capitalize on this reallocation. The future of open banking lies not in isolated markets but in interconnected ecosystems that transcend borders—and the winners will be those who build bridges, not walls.