South Korea, one of America’s top-10 trading partners, has become one of the most high-profile targets of Washington’s shifting tariff regime. After months of tug-of-war diplomacy, the United States imposed a 15% duty on Korean imports effective August 7 – less severe than the 25% levy initially floated but still painful for Asia’s fourth-largest economy. In exchange, Seoul agreed to ramp up investment in US projects and pledged to purchase $100 billion worth of American energy products, a deal that was meant to soften the blow. Seoul has already quantified the potential tariff impact, forecasting just 0.9% growth for 2025 (compared to 1.8% at the beginning of this year). This would mark the weakest pace of growth since the pandemic in 2020, underscoring how vulnerable the country’s export-led model is to tariff shocks.

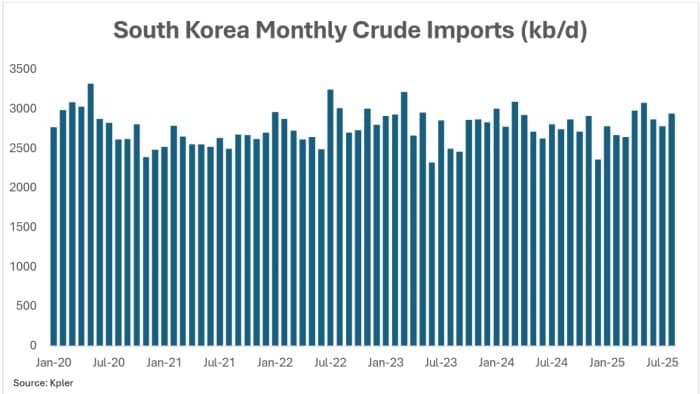

The energy pledge, however, looks harder to fulfil in practice than it is on paper. Washington expects South Korea to substantially increase imports of US crude, but refiners across the country have already been gradually shifting in that direction for years. According to Kpler data, imports of WTI Midland rose from 283,000 b/d in 2020 to 465,000 b/d in 2025, supported by favourable conditions under the bilateral free trade agreement and Korea’s freight rebate system that often makes WTI cheaper than Middle Eastern grades. Yet any incremental moves from here would be constrained. Total Korean crude imports have held steady in the 2.8 to 3 million b/d range for the past five years, and while American volumes have risen, Saudi Arabia, Iraq, and the UAE remain deeply entrenched in the supply mix. Saudi Arabia alone delivered 956,000 b/d to Korea in 2025 to date, nearly double the volumes from any other supplier, and though Russian flows dropped sharply after the start of Ukraine war, the gap was quickly filled by other Middle Eastern producers.

What keeps these flows in place is not just habit or geopolitics, but the underlying design of Korea’s refining system. WTI is a light crude, while South Korea’s highly complex refineries are configured to process heavier grades, predominantly Middle Eastern ones. Shifting too heavily toward US barrels (and subsequently, toward a lighter product yield) would leave parts of these facilities idle, eroding efficiency and profitability. Korea operates five refineries, and each illustrates why diversification is easier said than done. The largest, Ulsan, fully owned by SK Energy, already blends WTI with heavier grades from Iraq, Kuwait, and Saudi Arabia to run at capacity. Yeosu, half-owned by Chevron, follows a similar pattern, comingling rising volumes of WTI with heavier Iraqi barrels. Onsan and Daesan refineries, partially owned by Saudi Aramco with stakes of 63% and 17% respectively, lean overwhelmingly on Arab Light and Arab Medium, together making up about 80% of their crude slate. With Saudi interests directly embedded in their ownership structure, any push to substitute American crude faces resistance. Meanwhile, Incheon, the smallest refinery, struggles to operate even at 50% capacity and faces operational constraints that leave it in no position to absorb excess light oil.

Story Continues