As the week progressed, the index extended its gains, testing levels around 25,150 on Thursday. However, it succumbed to sharp profit booking on Friday, erasing most of its intra-week gains.

On Friday, Nifty opened on a weak note and slipped further during the early to mid-session. Although there was an attempt to bounce back, it faltered midway. The index continued to weaken towards the close, ending the day lower. With a fall of 214 points, Nifty broke its six-session winning streak and closed at 24,870.

Despite Friday’s decline, the index managed to hold on to Monday’s gap-up levels and ended the week with a gain of just over 1%, finishing slightly above the 24,850 mark.

In an otherwise weak market on Friday, auto heavyweights such as M&M and Maruti, along with BEL, stood out among the top gainers in the Nifty pack. On the flip side, it was a tough session for stocks like Grasim, Asian Paints, and Adani Enterprises, which ended as the major losers.

Among sectoral indices, Nifty Media, Pharma, and Healthcare emerged as the top gainers. Conversely, Nifty Metals, PSU Banks, and FMCG sectors saw notable losses.

While the broader markets also witnessed profit booking, they managed to outperform the benchmark’s sharp fall. The Nifty Midcap 100 Index declined by just 0.14%, while the Nifty Smallcap Index lost 0.26%.

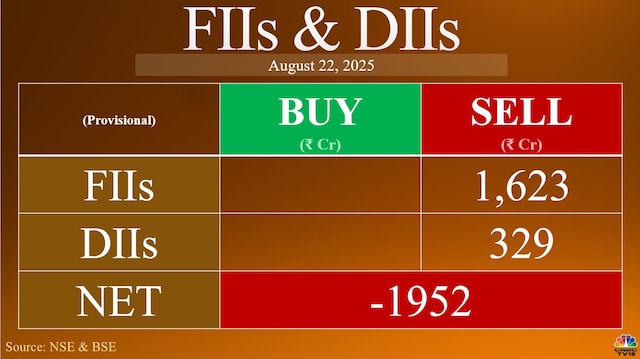

Both domestic and foreign investors were net sellers in the cash market on Friday.

Friday’s correction appears more like a retest of the bullish gap. In this context, the gap zone between 24,750 and 24,650 is expected to act as crucial support. A breach of this zone could invalidate the bullish structure, potentially opening the door for a retest of recent lows around 24,350. On the other hand, reclaiming the 25,000 mark and sustaining above 25,150 would be key for the bulls to regain control, said Rajesh Bhosale of Angel One.

According to Nagaraj Shetti of HDFC Securities, the short-term trend for Nifty is currently weak. He expects the index to find support in the gap area formed on August 18, around 24,800-24,700. A sustained move above 25,150, however, could revive bullish momentum.

Rupak De of LKP Securities said that after a steady rally, Nifty paused on Friday, indicating a brief consolidation phase before the next leg higher.

“The index continues to hold above the 50 EMA, which reinforces the short-term uptrend. On the downside, support lies at 24,800, staying above this level maintains the potential for an advance toward 25,000-25,250,” he added.

Nandish Shah of HDFC Securities said that Nifty has formed a bearish ‘Shooting Star’ candlestick pattern, which signals caution ahead. However, on the downside, the 50 DEMA at 24,841, along with the gap area between 24,673 and 24,852, could offer strong support. On the upside, resistance continues to be seen around 25,153.

Meanwhile, the Nifty Bank index ended the session at 55,149.40, down 1.09%. The recent swing low of 54,905 remains a critical support level. If breached, the next cushion lies at 54,500. Resistance is seen at 55,500, followed by 55,600, according to Om Mehra of SAMCO Securities.