Aug 25, 2025

IndexBox has just published a new report: EU – Flat Cold-Rolled Steel in Coils – Market Analysis, Forecast, Size, Trends And Insights.

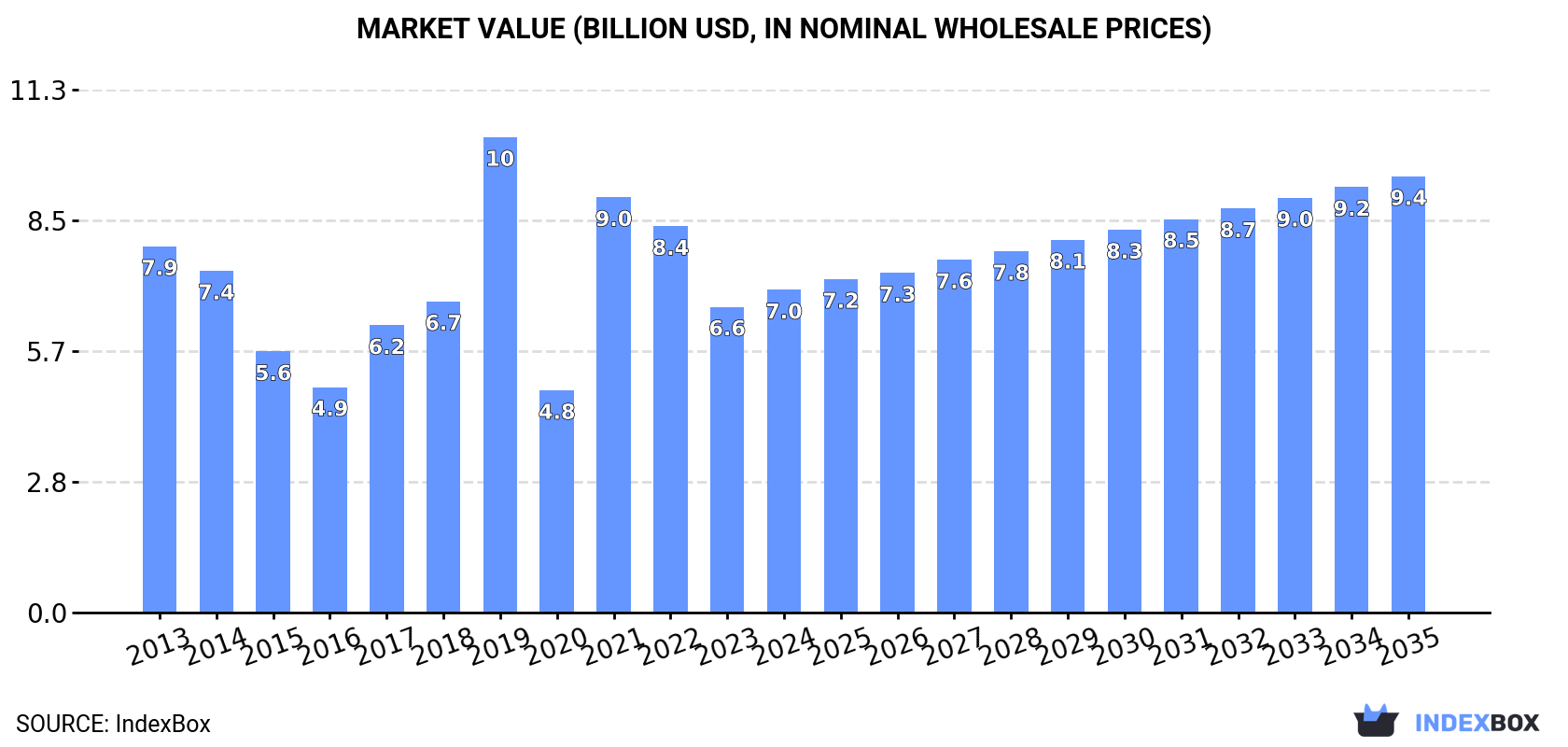

The article discusses the expected growth of the flat cold-rolled steel coils market in the European Union, with forecasts indicating a slight increase in performance. By 2035, the market volume is expected to reach 9.2 million tons, while the market value is projected to reach $9.4 billion.

Market Forecast

Driven by rising demand for flat cold-rolled steel coils in the European Union, the market is expected to start an upward consumption trend over the next decade. The performance of the market is forecast to increase slightly, with an anticipated CAGR of +1.3% for the period from 2024 to 2035, which is projected to bring the market volume to 9.2M tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +2.8% for the period from 2024 to 2035, which is projected to bring the market value to $9.4B (in nominal wholesale prices) by the end of 2035.

ConsumptionEuropean Union’s Consumption of Flat Cold-Rolled Steel in Coils

ConsumptionEuropean Union’s Consumption of Flat Cold-Rolled Steel in Coils

After two years of decline, consumption of flat cold-rolled steel in coils increased by 6.7% to 8M tons in 2024. Over the period under review, consumption, however, continues to indicate a noticeable decrease. Over the period under review, consumption attained the peak volume at 11M tons in 2013; however, from 2014 to 2024, consumption remained at a lower figure.

The revenue of the flat cold-rolled steel coils market in the European Union expanded remarkably to $7B in 2024, increasing by 5.5% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). Overall, consumption, however, saw a mild shrinkage. Over the period under review, the market hit record highs at $10.3B in 2019; however, from 2020 to 2024, consumption stood at a somewhat lower figure.

Consumption By Country

The countries with the highest volumes of consumption in 2024 were Italy (1.8M tons), Germany (1.2M tons) and Spain (1.1M tons), together comprising 52% of total consumption.

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the key consuming countries, was attained by Spain (with a CAGR of +2.5%), while consumption for the other leaders experienced mixed trends in the consumption figures.

In value terms, Italy ($1.8B), Germany ($1.1B) and Spain ($1B) appeared to be the countries with the highest levels of market value in 2024, with a combined 56% share of the total market.

In terms of the main consuming countries, Spain, with a CAGR of +4.3%, recorded the highest rates of growth with regard to market size over the period under review, while market for the other leaders experienced more modest paces of growth.

The countries with the highest levels of flat cold-rolled steel coils per capita consumption in 2024 were the Netherlands (34 kg per person), the Czech Republic (32 kg per person) and Belgium (31 kg per person).

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the main consuming countries, was attained by Spain (with a CAGR of +2.3%), while consumption for the other leaders experienced more modest paces of growth.

ProductionEuropean Union’s Production of Flat Cold-Rolled Steel in Coils

In 2024, production of flat cold-rolled steel in coils was finally on the rise to reach 5.4M tons after two years of decline. Overall, production, however, recorded a abrupt curtailment. The most prominent rate of growth was recorded in 2021 when the production volume increased by 10%. The volume of production peaked at 10M tons in 2013; however, from 2014 to 2024, production failed to regain momentum.

In value terms, flat cold-rolled steel coils production amounted to $5.3B in 2024 estimated in export price. In general, production, however, showed a pronounced descent. The most prominent rate of growth was recorded in 2021 when the production volume increased by 75%. Over the period under review, production reached the maximum level at $9.2B in 2019; however, from 2020 to 2024, production stood at a somewhat lower figure.

Production By Country

The countries with the highest volumes of production in 2024 were Germany (1.2M tons), Italy (1.1M tons) and the Netherlands (677K tons), together comprising 54% of total production. Belgium, Austria, Spain, Slovakia and Sweden lagged somewhat behind, together comprising a further 38%.

From 2013 to 2024, the biggest increases were recorded for Sweden (with a CAGR of +11.9%), while production for the other leaders experienced a decline in the production figures.

ImportsEuropean Union’s Imports of Flat Cold-Rolled Steel in Coils

In 2024, after two years of decline, there was growth in overseas purchases of flat cold-rolled steel in coils, when their volume increased by 4.8% to 6.7M tons. Over the period under review, imports saw a relatively flat trend pattern. The pace of growth appeared the most rapid in 2021 with an increase of 15%. As a result, imports reached the peak of 7.8M tons. From 2022 to 2024, the growth of imports failed to regain momentum.

In value terms, flat cold-rolled steel coils imports shrank slightly to $6B in 2024. Total imports indicated slight growth from 2013 to 2024: its value increased at an average annual rate of +1.6% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, imports decreased by -20.5% against 2021 indices. The most prominent rate of growth was recorded in 2021 with an increase of 85% against the previous year. As a result, imports reached the peak of $7.6B. From 2022 to 2024, the growth of imports remained at a somewhat lower figure.

Imports By Country

In 2024, Belgium (1,112K tons), Germany (887K tons), Italy (880K tons), Poland (787K tons), Spain (758K tons), France (590K tons), the Netherlands (411K tons) and the Czech Republic (341K tons) was the main importer of flat cold-rolled steel in coils in the European Union, committing 87% of total import.

From 2013 to 2024, the biggest increases were recorded for Belgium (with a CAGR of +4.8%), while purchases for the other leaders experienced more modest paces of growth.

In value terms, Belgium ($941M), Germany ($815M) and Poland ($756M) appeared to be the countries with the highest levels of imports in 2024, with a combined 42% share of total imports.

Belgium, with a CAGR of +6.4%, saw the highest rates of growth with regard to the value of imports, among the main importing countries over the period under review, while purchases for the other leaders experienced more modest paces of growth.

Imports By Type

Iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm (3.1M tons) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 0.5mm or more but not exceeding 1mm (2.9M tons) prevails in imports structure, together mixing up 91% of total imports. It was distantly followed by iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of less than 0.5mm (366K tons), making up a 5.5% share of total imports. Iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more (261K tons) held a relatively small share of total imports.

From 2013 to 2024, the biggest increases were recorded for iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more (with a CAGR of +1.2%), while purchases for the other products experienced mixed trends in the imports figures.

In value terms, iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm ($2.8B), iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 0.5mm or more but not exceeding 1mm ($2.6B) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of less than 0.5mm ($314M) constituted the products with the highest levels of imports in 2024, with a combined 95% share of total imports. These products were followed by iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more, which accounted for a further 5%.

In terms of the main imported products, iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more, with a CAGR of +3.1%, recorded the highest growth rate of the value of imports, over the period under review, while purchases for the other products experienced more modest paces of growth.

Import Prices By Type

The import price in the European Union stood at $905 per ton in 2024, with a decrease of -4.8% against the previous year. Import price indicated a slight expansion from 2013 to 2024: its price increased at an average annual rate of +1.5% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, flat cold-rolled steel coils import price decreased by -19.6% against 2022 indices. The most prominent rate of growth was recorded in 2021 when the import price increased by 61% against the previous year. Over the period under review, import prices reached the maximum at $1,126 per ton in 2022; however, from 2023 to 2024, import prices remained at a lower figure.

Average prices varied somewhat amongst the major imported products. In 2024, major imported products recorded the following prices: in iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more ($1,151 per ton) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm ($904 per ton), while the price for iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of less than 0.5mm ($858 per ton) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 0.5mm or more but not exceeding 1mm ($890 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more (+1.9%), while the other products experienced more modest paces of growth.

Import Prices By Country

The import price in the European Union stood at $905 per ton in 2024, which is down by -4.8% against the previous year. Import price indicated a mild increase from 2013 to 2024: its price increased at an average annual rate of +1.5% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, flat cold-rolled steel coils import price decreased by -19.6% against 2022 indices. The pace of growth was the most pronounced in 2021 an increase of 61%. Over the period under review, import prices reached the maximum at $1,126 per ton in 2022; however, from 2023 to 2024, import prices stood at a somewhat lower figure.

Average prices varied somewhat amongst the major importing countries. In 2024, major importing countries recorded the following prices: in the Czech Republic ($1,036 per ton) and Poland ($960 per ton), while Italy ($823 per ton) and Spain ($838 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by the Czech Republic (+2.4%), while the other leaders experienced more modest paces of growth.

ExportsEuropean Union’s Exports of Flat Cold-Rolled Steel in Coils

Flat cold-rolled steel coils exports contracted to 4.1M tons in 2024, waning by -2.8% against the previous year’s figure. Overall, exports saw a perceptible decrease. The pace of growth was the most pronounced in 2021 when exports increased by 8.5% against the previous year. Over the period under review, the exports attained the peak figure at 5.9M tons in 2013; however, from 2014 to 2024, the exports stood at a somewhat lower figure.

In value terms, flat cold-rolled steel coils exports declined to $3.8B in 2024. Over the period under review, exports continue to indicate a slight reduction. The pace of growth appeared the most rapid in 2021 when exports increased by 70% against the previous year. As a result, the exports reached the peak of $5B. From 2022 to 2024, the growth of the exports remained at a somewhat lower figure.

Exports By Country

In 2024, Belgium (1.3M tons), distantly followed by Germany (813K tons), the Netherlands (497K tons), Austria (350K tons) and Sweden (269K tons) were the largest exporters of flat cold-rolled steel in coils, together mixing up 80% of total exports. Italy (179K tons), France (170K tons), Slovakia (164K tons), Spain (102K tons) and Poland (72K tons) held a little share of total exports.

From 2013 to 2024, the biggest increases were recorded for Poland (with a CAGR of +5.5%), while shipments for the other leaders experienced mixed trends in the exports figures.

In value terms, the largest flat cold-rolled steel coils supplying countries in the European Union were Belgium ($1.2B), Germany ($726M) and the Netherlands ($461M), with a combined 62% share of total exports. Austria, Sweden, Italy, Slovakia, France, Spain and Poland lagged somewhat behind, together accounting for a further 35%.

Among the main exporting countries, Poland, with a CAGR of +6.6%, recorded the highest rates of growth with regard to the value of exports, over the period under review, while shipments for the other leaders experienced more modest paces of growth.

Exports By Type

Iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm (1.9M tons) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 0.5mm or more but not exceeding 1mm (1.8M tons) dominates exports structure, together comprising 91% of total exports. It was distantly followed by iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of less than 0.5mm (262K tons), generating a 6.4% share of total exports. Iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more (99K tons) followed a long way behind the leaders.

From 2013 to 2024, the biggest increases were recorded for iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm (with a CAGR of -2.0%), while shipments for the other products experienced a decline in the exports figures.

In value terms, iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm ($1.7B), iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 0.5mm or more but not exceeding 1mm ($1.7B) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of less than 0.5mm ($250M) were the products with the highest levels of exports in 2024, with a combined 96% share of total exports.

Iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm, with a CAGR of -0.4%, saw the highest rates of growth with regard to the value of exports, in terms of the main exported products over the period under review, while shipments for the other products experienced a decline in the exports figures.

Export Prices By Type

In 2024, the export price in the European Union amounted to $928 per ton, waning by -4.8% against the previous year. Export price indicated a notable increase from 2013 to 2024: its price increased at an average annual rate of +2.0% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, flat cold-rolled steel coils export price decreased by -18.5% against 2022 indices. The most prominent rate of growth was recorded in 2021 when the export price increased by 57%. Over the period under review, the export prices attained the peak figure at $1,138 per ton in 2022; however, from 2023 to 2024, the export prices stood at a somewhat lower figure.

Average prices varied somewhat amongst the major exported products. In 2024, major exported products recorded the following prices: in iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 3mm or more ($1,339 per ton) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of less than 0.5mm ($955 per ton), while the average price for exports of iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness exceeding 1mm but less than 3mm ($903 per ton) and iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of 0.5mm or more but not exceeding 1mm ($929 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by iron or non-alloy steel, in coils, flat-rolled, width 600mm or more, cold-rolled, of a thickness of less than 0.5mm (+3.0%), while the other products experienced more modest paces of growth.

Export Prices By Country

The export price in the European Union stood at $928 per ton in 2024, which is down by -4.8% against the previous year. Export price indicated a pronounced expansion from 2013 to 2024: its price increased at an average annual rate of +2.0% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, flat cold-rolled steel coils export price decreased by -18.5% against 2022 indices. The pace of growth appeared the most rapid in 2021 when the export price increased by 57% against the previous year. The level of export peaked at $1,138 per ton in 2022; however, from 2023 to 2024, the export prices remained at a lower figure.

Average prices varied somewhat amongst the major exporting countries. In 2024, major exporting countries recorded the following prices: in Sweden ($1,140 per ton) and Italy ($1,137 per ton), while Belgium ($871 per ton) and Germany ($893 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Italy (+2.9%), while the other leaders experienced more modest paces of growth.