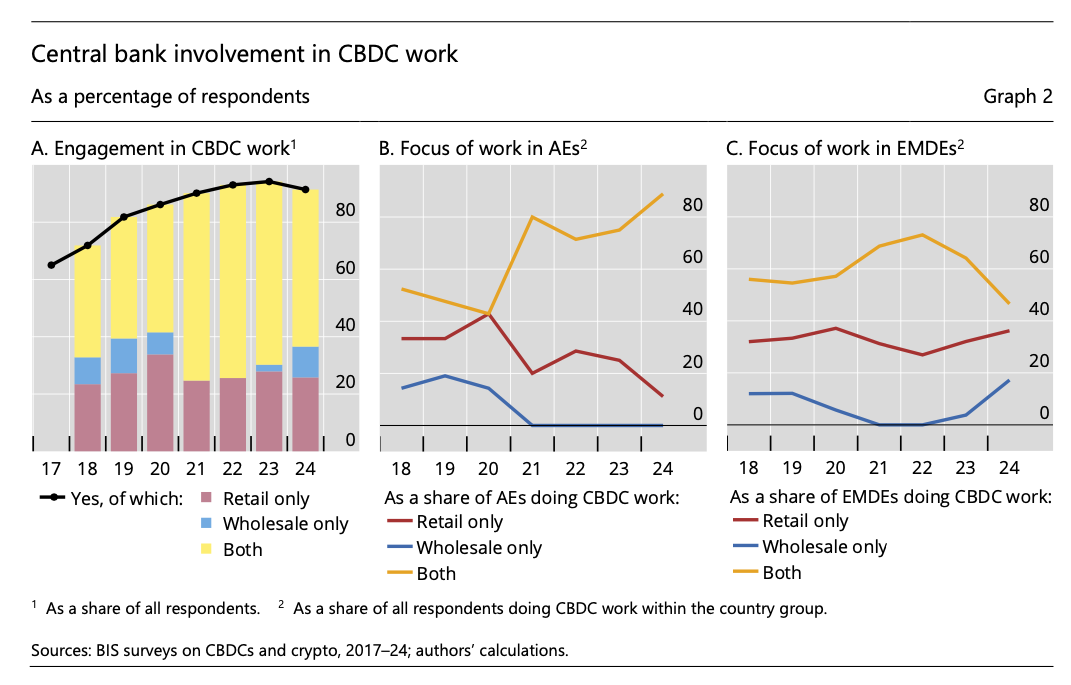

In the past few months the European Central Bank has frequently cited the expansive US approach to stablecoins as triggering urgency for a digital euro. It seems it is not alone. The 2024 central bank digital currency (CBDC) survey by the Bank for International Settlements (BIS) found that a third of central banks have intensified efforts on their CBDC work in response to developments with stablecoins and other cryptoassets. Overall work on CBDC has declined a little, from 94% of central banks in 2023 to 91% in 2024. However, the drop was more significant in emerging markets. The definition of ‘work’ includes research, pilots or working towards production initiatives.

The survey expanded its coverage from CBDC to include tokenization and briefly covers stablecoins and crypto. For stablecoins, most central banks reported trivial mainstream usage or use by niche groups, with around one fifth saying they are seeing some usage for domestic payments, remittances or cross border retail payments. However, a few emerging market central banks cited more significant usage, with cross border retail payments (2% of central banks) and remittances (4% of respondents) showing the highest responses.

Regarding legislation for stablecoins and crypto, 45% have already enacted legislation, with another 22% in the pipeline. Hence, soon two out of three economies will have rules of the road. Most jurisdictions – almost 80% – have adopted a bespoke approach, rather than relying on or repurposing existing legislation.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: BIS