The US’ 50 per cent tariff measure on India took effect at 12:01 am EDT (9:31 am IST) today. The move comes after repeated warnings from US President Donald Trump, who linked the punitive measures to India’s continued imports of Russian crude. (File photo)

The biggest shock will be felt in the following sectors that have powered India’s export engine for years and together employ millions of workers, especially in small and medium enterprises (SMEs). (File photo)

Textiles and Apparel: The US is India’s largest buyer of textiles, with exports exceeding $10.8 billion a year. The sector, already under pressure from cheaper players like Bangladesh and Vietnam, is now faced with 63.9 per cent effective duties, wiping out any price advantage. (Image: AI-generated)

Gems and Jewellery: Exports worth $9.94 billion to the US, nearly one-third of the industry’s global trade, will now face 52.1 per cent total duties. Surat, which handles 80 per cent of India’s diamond processing, is already reporting order halts and layoffs. (File Photo)

Shrimp and Seafood: The US accounts for around 50 per cent of India’s shrimp exports, valued at $2.4 billion, or roughly Rs 20,000 crore. With the total duty now reaching 60 per cent, Indian exporters are warning that they will be priced out by Ecuador, whose shrimp face just 15 per cent duties. (File photo)

Carpets, Furniture, and Home Textiles: Carpet exports stood at $1.2 billion in FY25, and now face 52.9 per cent effective duties. Rising inflation in the US has already dampened demand, and the new tariff wall may push buyers toward Turkey or Vietnam. (File photo)

Leather and Footwear: Both leather goods and footwear are now subject to the full 50 per cent tariff, adding further strain to a sector already battling rising raw material and logistics costs. (File photo)

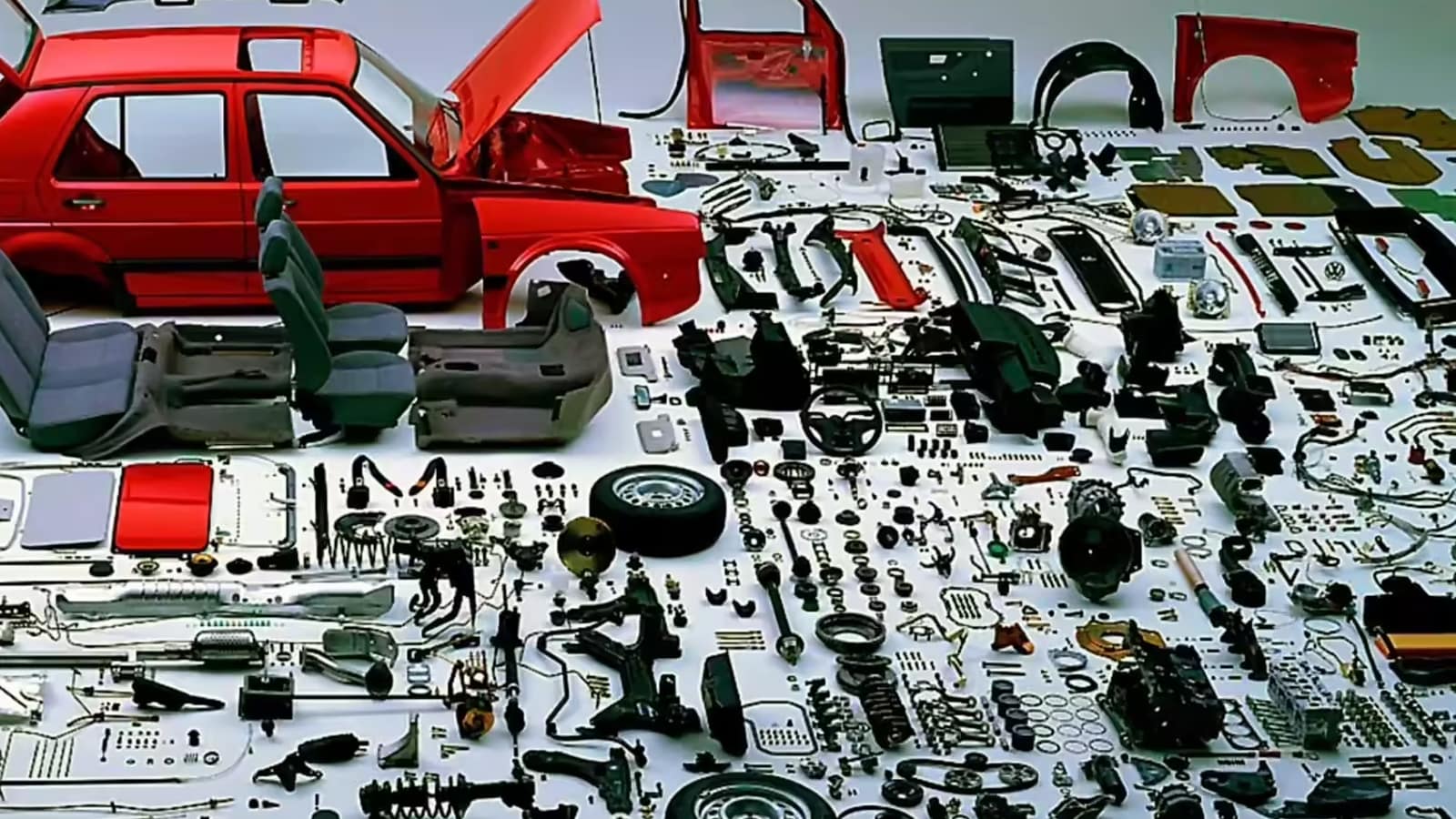

Auto Components: India’s auto component exports to the US stood at $6.6 billion in 2024. Of this, $3.4 billion, mainly parts for cars and small trucks, will face a 25 per cent tariff, while the rest will be subject to the full 50 per cent rate. Key segments like gearboxes and transmission systems, where India has a 40 per cent US market share, are likely to lose ground to suppliers in Mexico or Europe. (File pPhoto)

Chemicals and Organic Compounds: With $2.7 billion in annual exports and a 40 per cent SME share, India’s chemicals sector will face intensified competition from countries like Japan and South Korea, who enjoy preferential US tariff rates. Organic chemicals specifically will be subject to a 54 per cent effective tariff. (File photo)

Agricultural and Processed Foods: Indian exports of basmati rice, tea, spices, and other farm products worth $6 billion will now be subject to the full 50 per cent duty, placing them at a disadvantage against similar goods from Thailand and Pakistan. India is currently the world’s largest exporter of basmati rice, and any price hike in the US could see a major loss of market share. Processed foods too are in the high-duty category. (File photo)