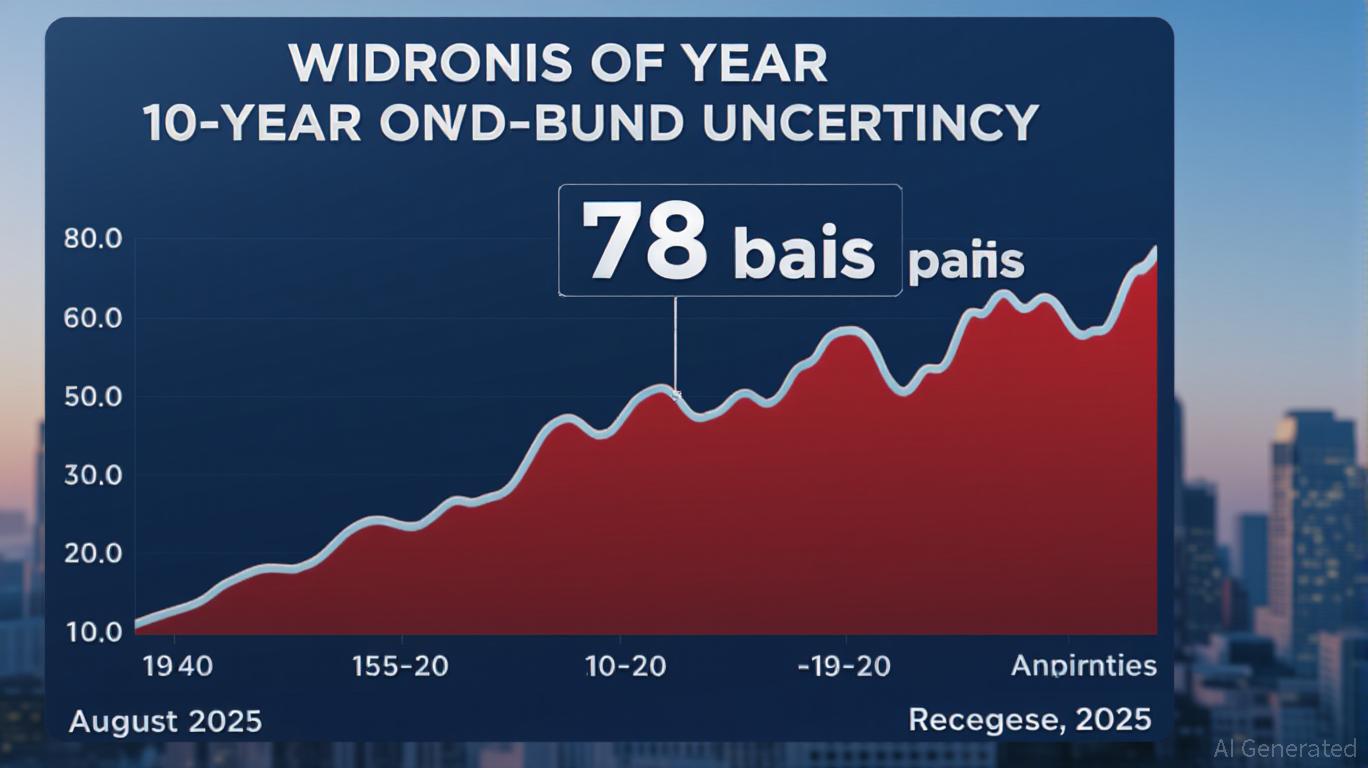

France’s political instability in 2025 has become a focal point for investors and policymakers across Europe, with its ripple effects distorting sovereign bond markets and amplifying risk premiums. The 10-year OAT-Bund spread—a key barometer of French fiscal credibility—has widened to 78 basis points as of late August 2025, driven by a no-confidence vote and the looming threat of a snap election [1]. This widening underscores a loss of investor confidence, with French government bond yields climbing to 3.5% amid fears of delayed fiscal consolidation and a projected 2025 deficit of 5.6% of GDP [2].

The risk premium embedded in French sovereign bonds now reflects not just economic concerns but a broader governance crisis. Credit rating agencies, while maintaining France’s AA- or Aa3 ratings, have assigned negative or stable outlooks, signaling vulnerability to downgrades if fiscal reforms stall [3]. This fiscal credibility gap has pushed investors to demand higher yields to compensate for the elevated risk of policy paralysis and potential credit rating deterioration.

The European Central Bank (ECB) remains a critical actor in containing market volatility through tools like the Transmission Protection Instrument (TPI). However, the political uncertainty in France has clouded the clarity of a reform path, limiting the effectiveness of such interventions [1]. The ECB’s ability to stabilize spreads hinges on whether Paris can deliver on fiscal discipline, a prospect that appears increasingly uncertain given the current political gridlock.

Investor concerns extend beyond France’s borders. The eurozone’s largest economy is a linchpin for European growth, and its fiscal slippage risks contagion in risk assets. The CAC 40’s underperformance and the euro’s depreciation against the dollar highlight the interconnectedness of political and financial markets [4]. If France’s political turmoil persists, it could trigger a reassessment of risk premiums across the bloc, particularly in peripheral economies already grappling with high debt levels.

For investors, the key question is whether the risk premium in French bonds is already fully priced in or if further deterioration looms. The current trajectory suggests that markets are pricing in a worst-case scenario: a prolonged period of fiscal inaction, potential rating downgrades, and a weaker euro. Yet, the ECB’s TPI and the EU’s fiscal frameworks remain as safeguards, albeit with diminishing credibility in the face of political dysfunction.

In the end, France’s political uncertainty is a microcosm of the broader challenges facing Europe. The interplay between governance and markets has never been more acute, and the coming months will test the resilience of both.

Source:

[1] French political storm: What it means for bonds and the euro [https://think.ing.com/articles/market-impact-of-french-political-turmoil/]

[2] French stocks, bonds tumble as government faces potential collapse [https://www.reuters.com/business/finance/french-stocks-bonds-tumble-government-faces-potential-collapse-2025-08-26/]

[3] French Political Instability and Rising Debt Premium [https://www.ainvest.com/news/french-political-instability-rising-debt-premium-era-risk-european-bonds-2508/]

[4] Does France’s political turmoil pose risks to Europe? [https://www.allianzgi.com/en/insights/outlook-and-commentary/does-frances-political-turmoil-pose-risks-to-europe]