Created on August 31, 2025

The clue that WTI Crude Oil went into this Labor Day weekend near the price it began last week at, and finished with what can be described as a sign of weakness may intrigue bearish traders. Looking for lower values in WTI Crude Oil within the 63.500 vicinity may feel wrong historically, but speculatively the price of commodity has shown the ability to move lower not so long ago. Traders have to remember that WTI Crude Oil will remain muted until Tuesday of this week.

Fair market value has to be considered by day traders. Historically the price of WTI Crude Oil has a long history of trading comfortably above 70.000 and even 80.000 USD. But there is also a track record under President Trump of rather serene prices within the current values being experienced. Supply remains strong, demand is there yes – but production levels are not about to decrease which likely means unless there is a huge increase in buying from manufacturing that the price of WTI Crude Oil is within an acceptable equilibrium.

It is unlikely that news from the media this weekend is going to suddenly shake the confidence of large WTI Crude Oil traders. Meaning that upon the return to trading this Tuesday the WTI Crude Oil Market is likely to be calm.

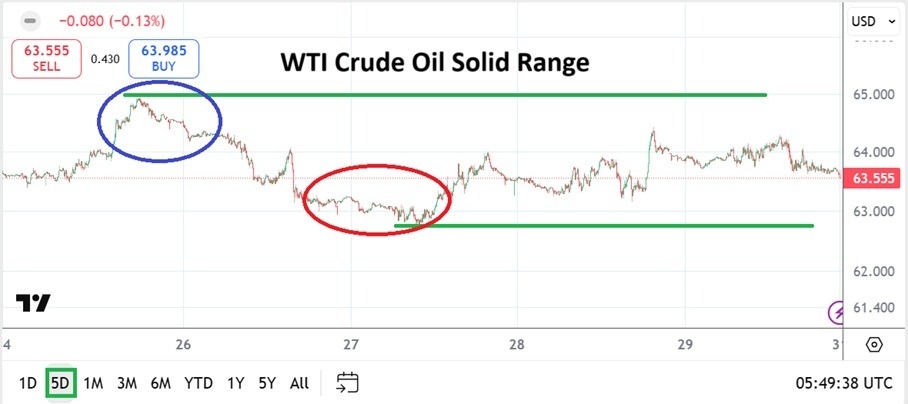

Lows from Tuesday until Thursday of last week saw a lot of trading below current levels.Perhaps conservative traders will want to wait on technical perceptions of resistance levels being tested while looking for lower values.Yes, the same can be said for those who believe that WTI Crude Oil is too low around the 63.000 level. But for the moment it feels unlikely that stronger sentiment in WTI Crude Oil going to create a massive burst higher.Meaning that moves higher that develop may be able to be wagered on speculatively with selling positions while looking for reversals lower.

The higher price elements of WTI Crude Oil proved rather awkward this past week. The commodity was not able to puncture the 65.000 mark. Prices above the 64.000 had a difficult time sustaining action after last Monday’s and early Tuesday’s speculative buying. WTI Crude Oil is certainly capable of trading higher, but looking for overly ambitious moves upwards seems illogical at this time.

The 65.000 to 66.000 price levels for WTI Crude Oil still look too high. Levels of 63.00 to 62.500 seem to be more realistic. Day traders should remain conservative and remember that early trading this week may see some volatility early as large players return to their desks following the long holiday weekend.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.