September 3, 2025

Economic activity in the Southeast declined slightly over the past several weeks, according to the new Beige Book report from the Federal Reserve Bank of Atlanta.

Contacts from several sectors reported that business had slowed during mid-July through August: consumer spending softened, leisure travel was down, and demand for both transportation and manufacturing activity fell. Five previous Atlanta Fed Beige Books this year described an economy that either grew modestly or exhibited little change. This report is the first in 2025 to characterize overall activity as slowing a bit.

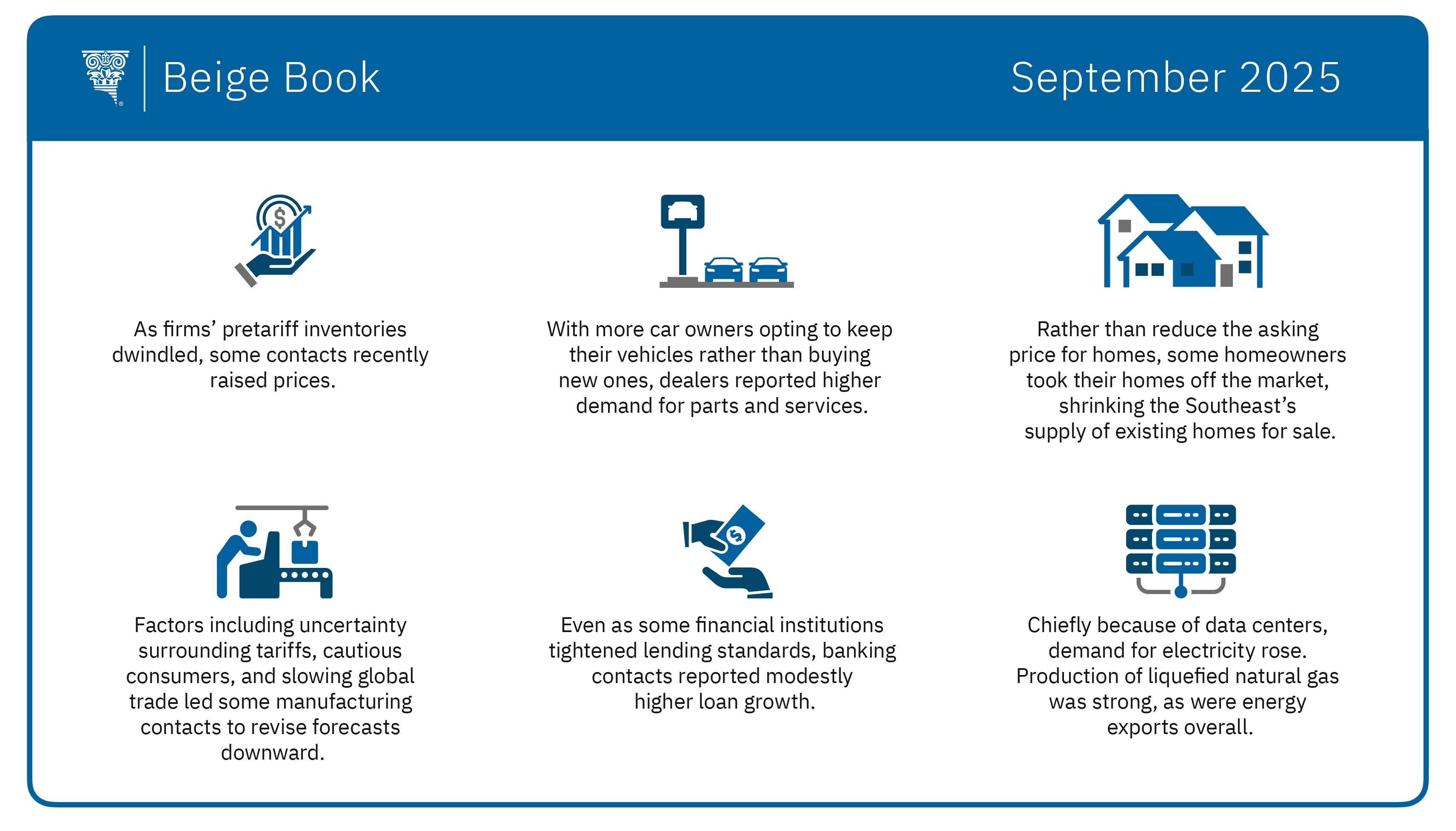

At the same time, prices rose moderately. Some contacts said they have recently raised prices as they depleted inventories they had accumulated before the onset of tariffs. Smaller businesses had a harder time passing through cost increases to final prices, contacts reported, compelling many proprietors to cut expenses, including changing their product offerings and reducing workers’ hours. Many contacts expect tariffs to create inflationary impacts through the rest of this year and into 2026, including companies that face little or no direct pressure from tariffs.

The Federal Reserve has a dual mandate from the US Congress to pursue price stability and maximum employment. On the employment front, labor markets in the Atlanta Fed’s Sixth District remained unchanged compared to the previous Beige Book reporting period. Economic uncertainty and softening demand continued to constrain hiring, and some contacts continued to allow attrition in their workforce.

Most business contacts indicated they plan to maintain current staffing levels through the rest of 2025. And although some firms continued to note challenges hiring for technical roles, most contacts reported abundant applicants for most jobs. Meanwhile, some firms paused hiring plans because of cuts in federal spending.

In other sectors:

The Community Perspectives segment of the Beige Book reports that workforce agencies described ongoing signs of a weakening labor market. The workforce intermediaries said that they received fewer requests for workers from employers, and that smaller employers were increasingly opting to hire contract workers instead of full-time staff.

Automobile dealers reported higher demand for parts and services as customers chose to keep their vehicles rather than buying new ones. New car sales were flat to down.

Home sales prices in Florida dropped. Across the District, the supply of existing homes for sale shrank as some homeowners chose to pull houses off the market rather than reduce asking prices.

Transportation contacts expect a soft peak shipping season this year amid tariff uncertainty and the potential for a slowing economy.

In manufacturing, the outlook worsened as contacts reported downward revisions to forecasts in the face of rising input costs, tariff uncertainty, cautious consumers, and slowing global trade.

Banking contacts reported modestly higher loan growth even as some said they tightened lending standards.

Energy activity grew modestly. Liquefied natural gas production and exports remained strong, and electricity demand grew, largely because of data centers.

The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve districts. The Fed System and regional reserve banks publish the Beige Book eight times a year, before each meeting of the Federal Open Market Committee. The reports from each District characterize regional economic conditions based on a variety of mostly qualitative information, gathered directly from District sources, including interviews and online questionnaires completed by businesses, community organizations, economists, market experts, and other sources. The Committee next meets September 16 and 17.