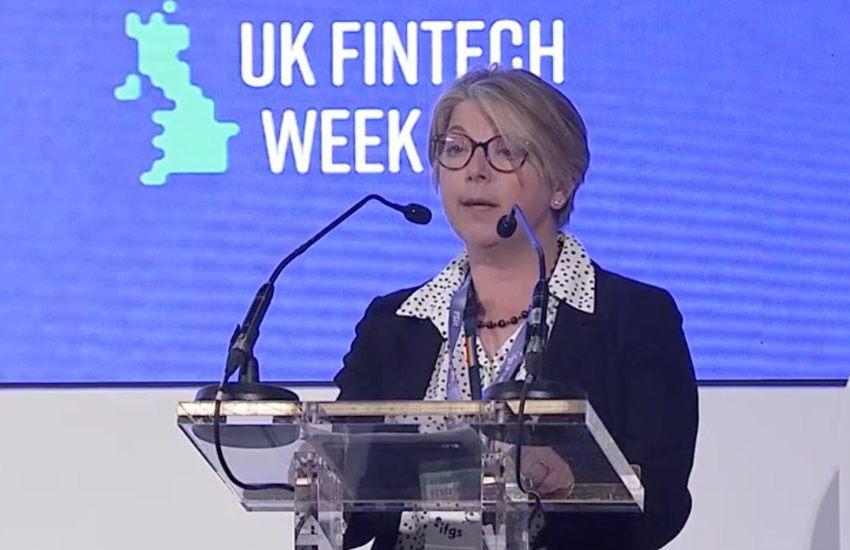

During a speech today, Bank of England Deputy Governor Sarah Breeden discussed stablecoins. When the central bank outlined plans for stablecoins in 2023, it made the framework rather unattractive for large or systemic stablecoin issuers. The good news was they would hold their reserves at the central bank, something most view as desirable. The bad news was they would earn no interest, undermining the main current business model.

Breeden has previously hinted at a softening of this stance, today clarifying that systemic stablecoin issuers would be able to hold “a portion” of their backing assets in high quality liquid assets such as short-dated government bonds.

She also noted that initial plans for stablecoins had focused on retail use cases, but times have moved on. Now both stablecoins and tokenized deposits will be used for the settlement of tokenized securities as part of the UK’s Digital Securities Sandbox. That is a relatively recent change, with stablecoins originally excluded from the sandbox.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: Innovate Finance