There’s a lot of attention on the Federal Reserve’s Board of Governors this week. There’s an ongoing legal dispute over President Trump’s attempt to remove Governor Lisa Cook from the board, and a confirmation hearing for Stephen Miran, Trump’s pick to replace a governor who resigned last month.

But there is more to the central bank than just the seven people who sit on the Board of Governors. Every time the Federal Open Market Committee meets — that’s the group that sets the interest rate the Fed controls — five of the 12 people voting are presidents of regional Federal Reserve banks. Those people, and the regional banks they run, are an important part of the Federal Reserve system and monetary policymaking in the United States.

History of the Federal Reserve’s regional banks

The 12 regional banks were created by the Federal Reserve Act of 1913. “At the time, lending was very localized,” said Haelim Anderson, a research economist formerly with the Bank Policy Institute. “It made sense that each region would have its own regional bank that could accommodate the economic conditions of that place.”

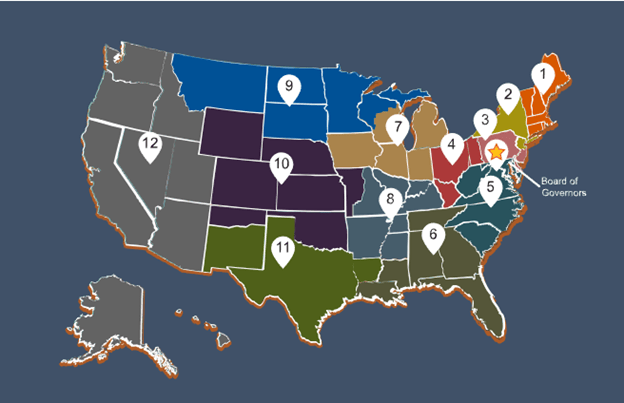

A map of the 12 Federal Reserve Districts of the United States published on the Federal Reserve’s website

Back then, and to a lesser extent now, there wasn’t just one U.S. economy — the economy of New York might look very different from the economy of St. Louis, or San Francisco, or Dallas. So, Congress created 12 regional banks that could set their own monetary policy.

That is, until the 1930s, when the Great Depression forced Congress to reevaluate central banking in the United States. “Policymakers thought ‘maybe we should make it more consistent across regions,’” said Anderson. “After that, the policy focus shifted to the Board of Governors, which is in DC.”

The regional Fed banks’ role today

Fast forward to today, regional bank presidents do still get to vote on interest rates — the New York Fed President votes at every meeting, and the rest of the regional Fed Presidents rotate in and out. But they do a lot of other stuff too.

Jeremy Piger, a professor of economics at the University of Oregon, has worked as an economist for both the Federal Reserve Board in Washington and the St. Louis Fed. “They were actually quite different positions,” he said.

Economists at the Board of Governors are there mostly to support the Chair and the 6 other governors. At the regional banks though, “there’s more time given to production of economic research that is meant to be published in scholarly journals,” said Piger.

The banks tend to carve out niches for themselves. The Philly Fed, for example, focuses on publishing consumer finance research. The Federal Reserve Bank of Cleveland makes daily inflation forecasts, and in San Francisco, “it’s cash services,” said Galina Hale, an economics professor at UC Santa Cruz who previously worked for the San Francisco Fed.

The research the regional banks put out helps contribute to the Fed’s overall understanding of the economy.

The regional banks also do a lot of the nuts and bolts running of this economy — such as facilitating payments between banks and supervisory field work as part of the Fed’s supervisory duties. “Some of those things really provide the foundation of an economy from which you can then think about the trade-offs between employment and inflation,” said Piger.

Regional banks and independence

Regional Fed Presidents, unlike Federal Reserve Governors who are appointed by the President and approved by Congress, are chosen by independent boards of directors at those banks and then sent to the Board of Governors in DC for approval.

“It’s just more layers away from DC and that allows a little bit more protection of independence,” said Hale. “There is this insulation, but it’s not impermeable.”

Speaking hypothetically here,” said Piger. “If you were to have a board of governors highly compromised in people’s assessment of their independence, then the Reserve Bank presidents become even more important in that, just the basic math of FOMC decisions, they can provide a counterbalance to the board of governors.”

That counterbalance, that insulation, is going to get tested in February, when all 12 of those Fed Presidents are up for reappointment by the Board of Governors — a Board of Governors which President Trump is currently trying to take control of.

Related Topics