Prop trading is attracting a new market segment: crypto. This week, Kraken acquired Breakout, a proprietary trading

firm that provides traders with access to capital for executing strategies. The acquisition marks Kraken as the first cryptocurrency

exchange to enter the proprietary trading space.

NEW: Kraken acquires Breakout to launch performance-based prop trading on Kraken Pro pic.twitter.com/bcyD8aMih6

— Blockworks (@Blockworks_) September 4, 2025

Unlike traditional prop trading firms, which offer funded accounts but no exchange platform, Kraken is combining its exchange

infrastructure with Breakout’s evaluation-based trading model.

RoboMarkets secures Dubai license

In the regulatory front, RoboMarkets, which recently exited the retail CFDs market in

Europe, obtained a license in Dubai.

The approval, classified as “Dealing in Securities,” allows

firms to operate as trading and clearing brokers, trading brokers in global

markets, brokers for non-exchange-traded derivatives and spot FX, on-market

trading brokers, and securities dealers.

AETOS closes offshore CFDs operation

However, not all brokers are expanding. AETOS, which

surrendered its United Kingdom license in June, closed its offshore operations under the Mauritius-licensed entity. The CFD broker also stopped onboarding new

clients through its offshore unit.

According to an AETOS spokesperson, the move is part of a

broader strategic review to exit certain offshore markets, including entities

regulated in Mauritius and Seychelles.

EC Markets’ profit up 15%

In numbers this week, EC Markets Group closed 2024 with stronger earnings as revenue nearly doubled year-on-year. The forex

Forex

Foreign exchange or forex is the act of converting one nation’s currency into another nation’s currency (that possesses a different currency); for example, the converting of British Pounds into US Dollars, and vice versa. The exchange of currencies can be done over a physical counter, such as at a Bureau de Change, or over the internet via broker platforms, where currency speculation takes place, known as forex trading.The foreign exchange market, by its very nature, is the world’s largest tradi

Foreign exchange or forex is the act of converting one nation’s currency into another nation’s currency (that possesses a different currency); for example, the converting of British Pounds into US Dollars, and vice versa. The exchange of currencies can be done over a physical counter, such as at a Bureau de Change, or over the internet via broker platforms, where currency speculation takes place, known as forex trading.The foreign exchange market, by its very nature, is the world’s largest tradi

Read this Term and CFD brokerage reported a turnover of $3.24 million, up from $1.71 million in 2023, alongside higher profits and an improved balance sheet despite rising costs.

Operating profit almost doubled to $614,622 from $315,933, while net profit rose 14% to $513,869 from $448,157. Administrative expenses climbed 58% to $1.64 million, but gross profit still increased to $2.26 million from $1.35 million, highlighting a year of growth for the firm.

Valutrades cuts 2024 loss

At the same time, UK-based Valutrades narrowed its annual loss in 2024 despite continued challenges from lower client activity and

revenue pressures.

For the year ended December 31, 2024, Valutrades

posted a net loss of £2.59 million, an improvement from the £3.82 million loss

recorded in 2023. Revenue rose 27% to £1.94 million from £1.52 million a year earlier.

eToro shares jump

In the fintech space, shares of eToro rose 5.25% on Tuesday to close at

$46.73, marking the trading platform’s strongest single-day gain since July 23

and one of its best sessions since its Wall Street debut in May.

eToro Key Performance Metrics Table

Metric

July-Aug 2024

July-Aug 2025

YoY Change

Assets Under Administration

$11.1B

$19.7B

+77%

Funded Accounts

3.20M

3.69M

+15%

Capital Markets Trades

85.4M

87.7M

+3%

Avg Capital Markets Trade Size

$264

$273

+4%

Crypto Trades

7.2M

10.7M

+49%

Avg Crypto Trade Size

$176

$345

+96%

Interest Earning Assets

$5.1B

$7.5B

+46%

Total Money Transfers

$1.2B

$1.8B

+50%

The surge followed eToro’s release of business metrics for July and

August, showing sharp momentum across core indicators. Assets under administration climbed to $19.7 billion

in August, up 77% from a year earlier, underscoring the platform’s rapid

expansion.

eToro also added support for USD Coin, a fiat-backed stablecoin issued

by Circle and Coinbase through the Centre Consortium, designed to maintain a

1:1 peg with the U.S. dollar.

Regulators rein in CFDs

Meanwhile, institutional interest in contracts for

difference (CFDs) is on the rise as portfolio managers increasingly adopt themfor hedging purposes. This approach helps avoid the costs of closing and reopening positions,

as well as potential capital gains tax liabilities

For many funds, CFDs can serve as an efficient

tactical tool for short-term positioning, hedging or market access when

physical settlement is not required.

Crypto regulations ease in the US

In the crypto space, regulations are easing in the US.

The Securities and Exchange Commission and the Commodity Futures Trading

Commission said that exchanges registered with either regulator are not prohibited from facilitating trades in specific spot commodity products,

including some crypto assets.

🚨 The NYSE, Nasdaq, CBOE, CME, etc, will soon have spot trading for BTC, ETH, and more. https://t.co/qZo3YsYDQA

— matthew sigel, recovering CFA (@matthew_sigel) September 2, 2025

Still with matters of regulation, fraudsters are taking advantage of the UK’s upcoming

corporate transparency reform by sending phishing emails to company directors

about fake identity verification requirements. Companies House has issued a warning that the messages

are fraudulent and urged directors not to act on them

Top crypto firms eye crypto custody services

In contrast, the UK has taken a more restrictive

stance. Retail investors still face limits on access to spot crypto trading,

and no clear framework exists for mainstream exchange listings.

Several of the world’s largest banks are stepping up

their cryptocurrency custody strategies, including State Street and JPMorgan

Chase. The move comes as most stablecoin transactions

continue to occur outside the traditional banking system, even as these digital

assets edge closer to mainstream payments

Payments

One of the bases of mediums of exchange in the modern world, a payment constitutes the transfer of a legal currency or equivalent from one party in exchange for goods or services to another entity. The payments industry has become a fixture of modern commerce, though the players involved and means of exchange have dramatically shifted over time.In particular, a party making a payment is referred to as a payer, with the payee reflecting the individual or entity receiving the payment. Most commonl

One of the bases of mediums of exchange in the modern world, a payment constitutes the transfer of a legal currency or equivalent from one party in exchange for goods or services to another entity. The payments industry has become a fixture of modern commerce, though the players involved and means of exchange have dramatically shifted over time.In particular, a party making a payment is referred to as a payer, with the payee reflecting the individual or entity receiving the payment. Most commonl

Read this Term use.

Six RegTech firms merge

Six regulatory technology firms have combined to form

a new entity called ComplyMAP Group. The merger brings together Complyport, MAP

S.Platis, MAP FinTech, Quadprime, MAP RMS, and MAPiTek under a single brand.

As part of the consolidation, Quadprime, MAP RMS, and

MAPiTek have been integrated into Complyport. The newly formed group will

expand its services in operational resilience, cybersecurity, and prudential

regulation, with coverage extending across the UK, European Union, and the UAE.

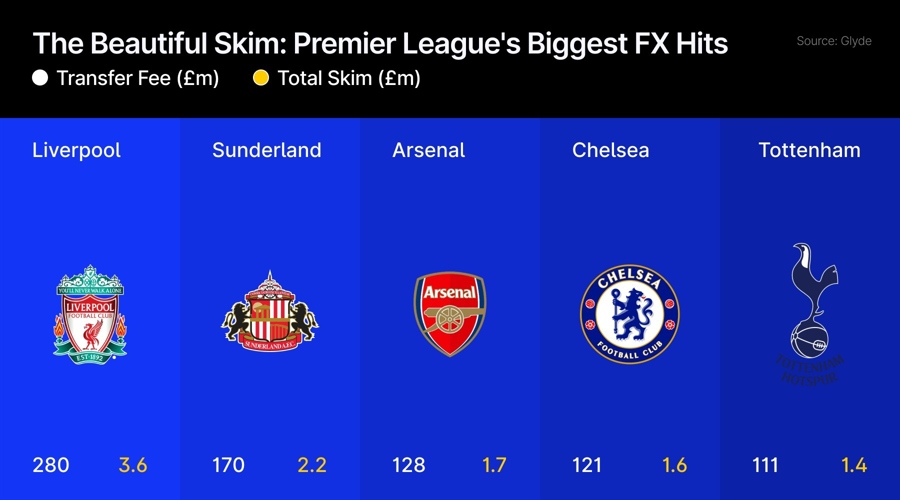

FX brokers skim £22m from Premier League clubs

Lastly, Premier League clubs paid over £22 million in

hidden foreign exchange (FX) fees during this summer’s transfer window,

according to new analysis.

The study, conducted by financial platform Glyde,

examined 71 permanent transfers between June 16 and September 1 involving

English clubs converting pounds into euros to sign players from leagues such as

the Bundesliga, La Liga, and Serie A.

Prop trading is attracting a new market segment: crypto. This week, Kraken acquired Breakout, a proprietary trading

firm that provides traders with access to capital for executing strategies. The acquisition marks Kraken as the first cryptocurrency

exchange to enter the proprietary trading space.

NEW: Kraken acquires Breakout to launch performance-based prop trading on Kraken Pro pic.twitter.com/bcyD8aMih6

— Blockworks (@Blockworks_) September 4, 2025

Unlike traditional prop trading firms, which offer funded accounts but no exchange platform, Kraken is combining its exchange

infrastructure with Breakout’s evaluation-based trading model.

RoboMarkets secures Dubai license

In the regulatory front, RoboMarkets, which recently exited the retail CFDs market in

Europe, obtained a license in Dubai.

The approval, classified as “Dealing in Securities,” allows

firms to operate as trading and clearing brokers, trading brokers in global

markets, brokers for non-exchange-traded derivatives and spot FX, on-market

trading brokers, and securities dealers.

AETOS closes offshore CFDs operation

However, not all brokers are expanding. AETOS, which

surrendered its United Kingdom license in June, closed its offshore operations under the Mauritius-licensed entity. The CFD broker also stopped onboarding new

clients through its offshore unit.

According to an AETOS spokesperson, the move is part of a

broader strategic review to exit certain offshore markets, including entities

regulated in Mauritius and Seychelles.

EC Markets’ profit up 15%

In numbers this week, EC Markets Group closed 2024 with stronger earnings as revenue nearly doubled year-on-year. The forex

Forex

Foreign exchange or forex is the act of converting one nation’s currency into another nation’s currency (that possesses a different currency); for example, the converting of British Pounds into US Dollars, and vice versa. The exchange of currencies can be done over a physical counter, such as at a Bureau de Change, or over the internet via broker platforms, where currency speculation takes place, known as forex trading.The foreign exchange market, by its very nature, is the world’s largest tradi

Foreign exchange or forex is the act of converting one nation’s currency into another nation’s currency (that possesses a different currency); for example, the converting of British Pounds into US Dollars, and vice versa. The exchange of currencies can be done over a physical counter, such as at a Bureau de Change, or over the internet via broker platforms, where currency speculation takes place, known as forex trading.The foreign exchange market, by its very nature, is the world’s largest tradi

Read this Term and CFD brokerage reported a turnover of $3.24 million, up from $1.71 million in 2023, alongside higher profits and an improved balance sheet despite rising costs.

Operating profit almost doubled to $614,622 from $315,933, while net profit rose 14% to $513,869 from $448,157. Administrative expenses climbed 58% to $1.64 million, but gross profit still increased to $2.26 million from $1.35 million, highlighting a year of growth for the firm.

Valutrades cuts 2024 loss

At the same time, UK-based Valutrades narrowed its annual loss in 2024 despite continued challenges from lower client activity and

revenue pressures.

For the year ended December 31, 2024, Valutrades

posted a net loss of £2.59 million, an improvement from the £3.82 million loss

recorded in 2023. Revenue rose 27% to £1.94 million from £1.52 million a year earlier.

eToro shares jump

In the fintech space, shares of eToro rose 5.25% on Tuesday to close at

$46.73, marking the trading platform’s strongest single-day gain since July 23

and one of its best sessions since its Wall Street debut in May.

eToro Key Performance Metrics Table

Metric

July-Aug 2024

July-Aug 2025

YoY Change

Assets Under Administration

$11.1B

$19.7B

+77%

Funded Accounts

3.20M

3.69M

+15%

Capital Markets Trades

85.4M

87.7M

+3%

Avg Capital Markets Trade Size

$264

$273

+4%

Crypto Trades

7.2M

10.7M

+49%

Avg Crypto Trade Size

$176

$345

+96%

Interest Earning Assets

$5.1B

$7.5B

+46%

Total Money Transfers

$1.2B

$1.8B

+50%

The surge followed eToro’s release of business metrics for July and

August, showing sharp momentum across core indicators. Assets under administration climbed to $19.7 billion

in August, up 77% from a year earlier, underscoring the platform’s rapid

expansion.

eToro also added support for USD Coin, a fiat-backed stablecoin issued

by Circle and Coinbase through the Centre Consortium, designed to maintain a

1:1 peg with the U.S. dollar.

Regulators rein in CFDs

Meanwhile, institutional interest in contracts for

difference (CFDs) is on the rise as portfolio managers increasingly adopt themfor hedging purposes. This approach helps avoid the costs of closing and reopening positions,

as well as potential capital gains tax liabilities

For many funds, CFDs can serve as an efficient

tactical tool for short-term positioning, hedging or market access when

physical settlement is not required.

Crypto regulations ease in the US

In the crypto space, regulations are easing in the US.

The Securities and Exchange Commission and the Commodity Futures Trading

Commission said that exchanges registered with either regulator are not prohibited from facilitating trades in specific spot commodity products,

including some crypto assets.

🚨 The NYSE, Nasdaq, CBOE, CME, etc, will soon have spot trading for BTC, ETH, and more. https://t.co/qZo3YsYDQA

— matthew sigel, recovering CFA (@matthew_sigel) September 2, 2025

Still with matters of regulation, fraudsters are taking advantage of the UK’s upcoming

corporate transparency reform by sending phishing emails to company directors

about fake identity verification requirements. Companies House has issued a warning that the messages

are fraudulent and urged directors not to act on them

Top crypto firms eye crypto custody services

In contrast, the UK has taken a more restrictive

stance. Retail investors still face limits on access to spot crypto trading,

and no clear framework exists for mainstream exchange listings.

Several of the world’s largest banks are stepping up

their cryptocurrency custody strategies, including State Street and JPMorgan

Chase. The move comes as most stablecoin transactions

continue to occur outside the traditional banking system, even as these digital

assets edge closer to mainstream payments

Payments

One of the bases of mediums of exchange in the modern world, a payment constitutes the transfer of a legal currency or equivalent from one party in exchange for goods or services to another entity. The payments industry has become a fixture of modern commerce, though the players involved and means of exchange have dramatically shifted over time.In particular, a party making a payment is referred to as a payer, with the payee reflecting the individual or entity receiving the payment. Most commonl

One of the bases of mediums of exchange in the modern world, a payment constitutes the transfer of a legal currency or equivalent from one party in exchange for goods or services to another entity. The payments industry has become a fixture of modern commerce, though the players involved and means of exchange have dramatically shifted over time.In particular, a party making a payment is referred to as a payer, with the payee reflecting the individual or entity receiving the payment. Most commonl

Read this Term use.

Six RegTech firms merge

Six regulatory technology firms have combined to form

a new entity called ComplyMAP Group. The merger brings together Complyport, MAP

S.Platis, MAP FinTech, Quadprime, MAP RMS, and MAPiTek under a single brand.

As part of the consolidation, Quadprime, MAP RMS, and

MAPiTek have been integrated into Complyport. The newly formed group will

expand its services in operational resilience, cybersecurity, and prudential

regulation, with coverage extending across the UK, European Union, and the UAE.

FX brokers skim £22m from Premier League clubs

Lastly, Premier League clubs paid over £22 million in

hidden foreign exchange (FX) fees during this summer’s transfer window,

according to new analysis.

The study, conducted by financial platform Glyde,

examined 71 permanent transfers between June 16 and September 1 involving

English clubs converting pounds into euros to sign players from leagues such as

the Bundesliga, La Liga, and Serie A.