Despite an already strong run, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Limited (HKG:1938) shares have been powering on, with a gain of 32% in the last thirty days. The last month tops off a massive increase of 182% in the last year.

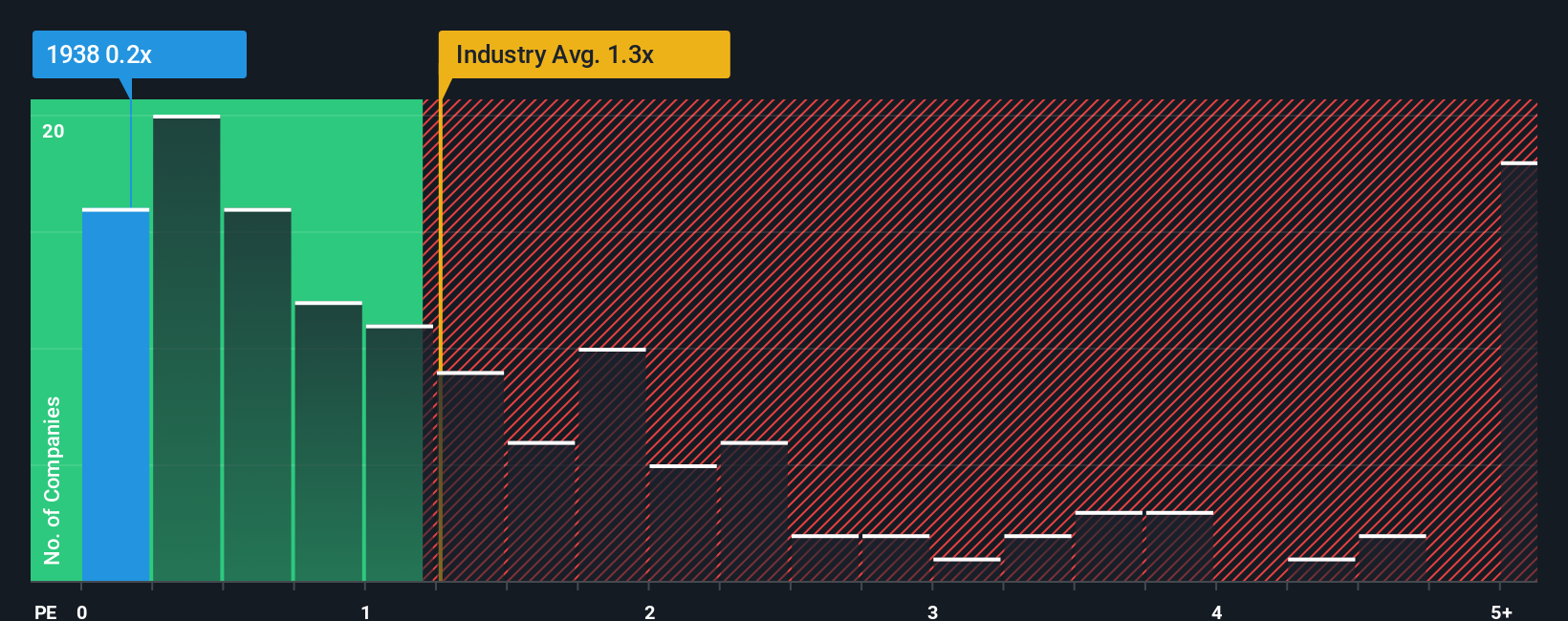

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Chu Kong Petroleum and Natural Gas Steel Pipe Holdings’ P/S ratio of 0.2x, since the median price-to-sales (or “P/S”) ratio for the Energy Services industry in Hong Kong is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Chu Kong Petroleum and Natural Gas Steel Pipe Holdings

SEHK:1938 Price to Sales Ratio vs Industry September 5th 2025 How Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Has Been Performing

SEHK:1938 Price to Sales Ratio vs Industry September 5th 2025 How Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Has Been Performing

For example, consider that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings’ financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you’d at least be hoping this is the case so that you could potentially pick up some stock while it’s not quite in favour.

Although there are no analyst estimates available for Chu Kong Petroleum and Natural Gas Steel Pipe Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow. Do Revenue Forecasts Match The P/S Ratio?

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings’ P/S ratio would be typical for a company that’s only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company’s revenues fell to the tune of 13%. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 10% over the next year, materially higher than the company’s recent medium-term annualised growth rates.

With this information, we find it interesting that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Chu Kong Petroleum and Natural Gas Steel Pipe Holdings’ P/S

Its shares have lifted substantially and now Chu Kong Petroleum and Natural Gas Steel Pipe Holdings’ P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn’t sensible, however it can be a practical guide to the company’s future prospects.

We’ve established that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings’ average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it’s hard to accept the current share price as fair value.

Don’t forget that there may be other risks. For instance, we’ve identified 4 warning signs for Chu Kong Petroleum and Natural Gas Steel Pipe Holdings (2 are a bit concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.