We have been working on making financial data more intuitive and have created something I think you'll find interesting – a stock screener that uses physics simulations to show market dynamics in real-time.

The problem with traditional screeners

Most stock screeners are just boring tables of numbers. You set your filters and get a static list, but it's hard to see how different criteria interact or which companies are the real cream of the crop when multiple filters are applied.

Our solution: market forces as literal forces

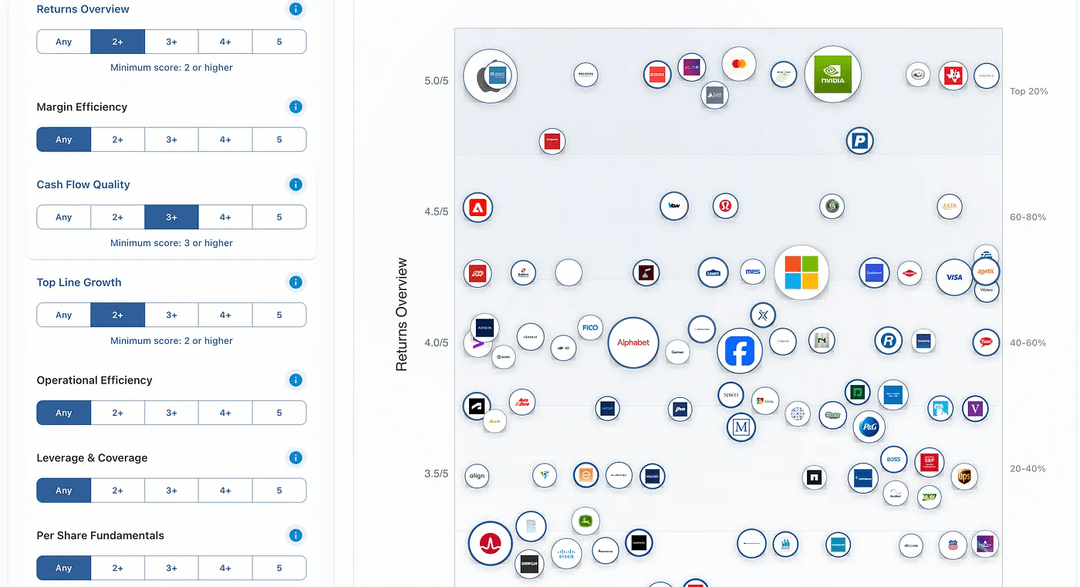

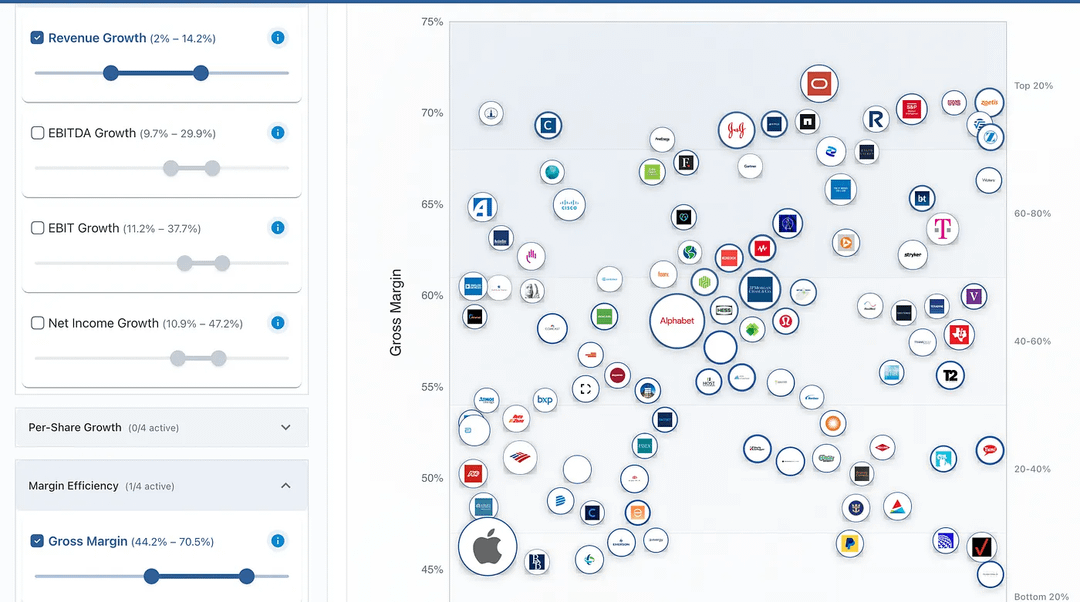

We built a screener where companies appear as bubbles on your screen (size = market cap), and as you adjust quality criteria, high-quality companies literally rise to the top while weaker performers sink down or disappear entirely.

Two screening modes

Simple Mode: Warren Buffett-style fundamental analysis with 10 business quality pillars (profitability, growth, financial health etc.) – just set minimum thresholds for what matters to your investment philosophy.

Advanced Mode: Granular control with 40+ financial ratios across 6 categories (margins, returns, liquidity, leverage, valuation, operational efficiency) for power users who want precise multi-criteria screens.

For "lower-is-better" metrics like P/E or debt-to-equity, it automatically flips so the best values are still at the top.

Also includes traditional table view for when you need that analytical precision.

It's currently in beta. Would love to get feedback from this community. Does anyone have thoughts on this approach to screening?

Posted by stockoscope

16 comments

Love it – is there any ability to go back in time or to run regressions? Like comparing FCF from FY-2 to Sales growth FY1 over a period of say 10 years to see what companies utilize free cash flow to drive sales growth and innovation

Very cool! Would love to play with it

Looks nice, don’t have a link yet ?

Very cool would love to try it out!

Looks good. Is there a way to test it?

It’s a neat idea. How do we try it out?

I like it. Can I try before I buy?

Can you post a link so we can test it and play with it?

Amazing any chance to try it?

Looks great, as a minor I would love to try it! 🙂

Looks really good. How can I join the Beta?

This is really cool! Would love to play around in it with specific market cap companies in the energy sector!

No idea if you’ve paid for bots but most of the comments are suspiciously similar and say nothing except amazing how do I try it …

I actually don’t think they are but they sure look it.

looks good. is there an intrinsic calculator filter/tool? that would be dope.

How many times will this be posted?

Looks fantastic, well done! Can you share a link?

Comments are closed.